We mostly talk stocks in this surreal environment and occasionally the halls are overrun by bullshit politics. You’ll toss off to hours of politics instead of spending your time with your children or contributing to society. And this is perfectly fine. It’s simply another time-waster that will result in me finding the next innovation b3fore the distracted masses.

Some people enter these halls with the proper intentions of managing real money and watching others manage real money live. I believe enterprising up and comers should work diligently to develop multiple residual income sources. We have no pensions. Some of our best are rotting in corporate mediocrity or studying their asses off for a higher earning slave shift. But others have thrown up a big middle finger to monotony. If you’ve taken this route and intend to stay on it you must build businesses. Businesses, so when one goes stale another one flows ensuring your continued freedom.

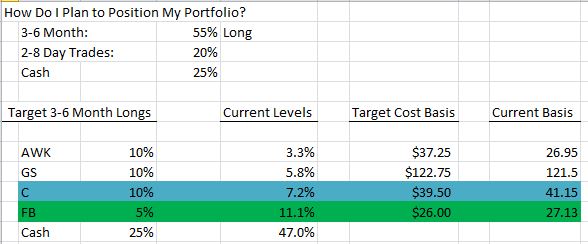

As a trader, you can create several businesses. Maybe you call them strategies. Mostly we manually trade stocks. Even when following systematic trades like trading a particular ETF based on PPT scores, we enter the trade manually and follow a set of rules to set (again manually) our profits and stop losses. We analyze indices but mostly to gauge the context we’re trading in.

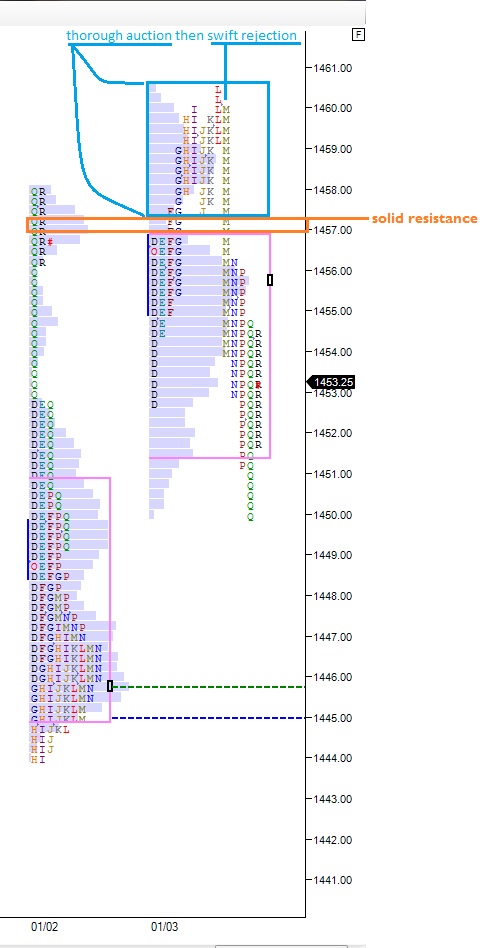

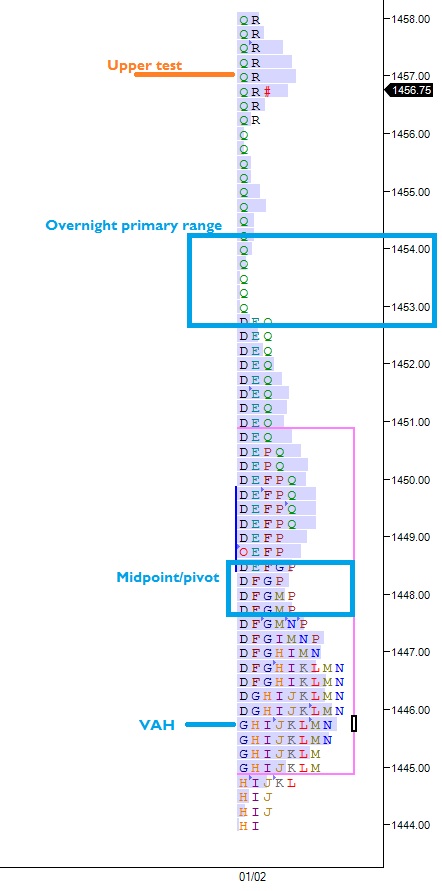

Perhaps you haven’t been reading the market profile work I’ve been doing daily and I couldn’t care less if you’ve decided it isn’t suited for you.

“But won’t The Fly cast your charred caucus in the dumpster come March?”

Yes, that’s the deal I’ve made with Le Fly and blogging is a business. But I’m telling you as sure as 2013 is my busting out year, that thrusting my game onto the interwebs have sharpened it. To me the biggest disgrace would be to sully these halls with lackluster advice. We’re here to bank coin. The profile work is putting coin in my purse. And soon it’s going to be putting much more.

Enter Hybrid Trading:

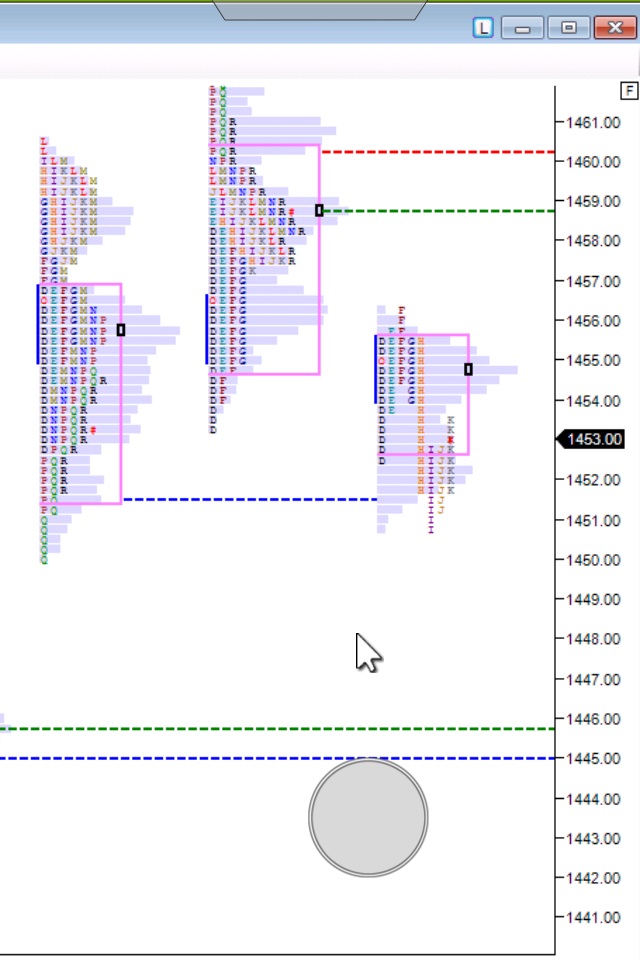

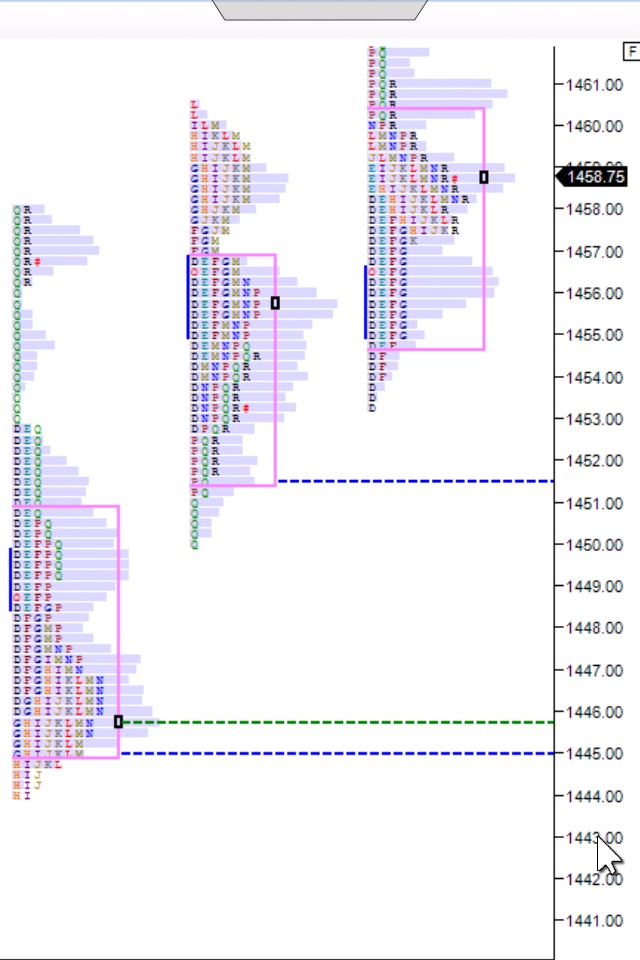

My biggest problem with day trading is the idle time staring at the computer waiting for my high probability setup to emerge. The best setups vanish so fucking fast and most days only have three or four dips from the well to grab a drink. But what if you could assess context, key off of critical levels, then turn on a robot to diligently hunt out an entry with a high probability of reaching your first scale point? This dramatically reduces the time eyes must be glued to a chart. Once your context presents itself you simply turn on your robot and continue your business until a fresh trade is fed to you. Then you manage the trade manually. Voila! Hybrid trading.

And that’s exactly what I intend to build this year. A new business. If you’ve ever built such a mechanism and care to chime in sage bits of advice please comment. I’ll always trade and talk stocks. Swinging for yachts, if you will.

Comments »