What first catches my eye when viewing yesterday’s profile is its shape. It nearly resembles a lowercase letter b. The shape of the profile indicates sellers overwhelming the tape early in the session only to find interested buyers down below. It’s often referred to as long liquidation which is the opposite of a short squeeze. Once the temporary excess of supply from top tickers and chasers ends the market stabilizes. Often times the occurrence of a long liquidation can mark the low of a trough. However, I’ve noted a bias line where I want to see trade sustained above to be constructive on long positions. The level also acted as resistance during the overnight session on three occurrences also before we blasted through it around 7am. Watch trade in and around 1415:

Comments »Don’t Act Brand New

We’re getting our first solid snow and by the looks of it winter is off to a healthy start. Last winter featured mild temperatures and practically no accumulation of snow. Jeff Daniels and I can attest to the importance of snow and ice for our iconic lakes. I mostly enjoy the ripe conditions for Tokyo drift driving.

The funny thing about the first significant snow is how everyone acts brand new. Even the well studied librarians insisted it was imminent that the roads would become impossible to trek. Oh the horror! I performed my inaugural double-doughnut parking lot warm up before advancing to some chicane action near the obviously empty golf course. You must always consider your risks when performing advanced driving maneuvers and perform every slide in a kickass manner–Ludacris on bump.

I’m almost giddy to shovel all the snow in the morning. It’s the light and fluffy, good for making you feel boss strong and getting the blood flowing into your rosy cheeks (no butt).

Back to drifting, how do so many people resist the urge to slide their car around like they’re James Bond being chased through Stalingrad by a bunch commies? Are people so caught up in the mundane that they completely overlook a practically free and amusing activity? Then I thought perhaps they don’t have a method for learning the technique. Then I thought about trading.

One thing you will notice about consistent traders is their methodical approach. I look back at the worse trades of my year and they were all deviations from my plan. I tend to throw money at an idea quick, trial-by-fire. Take for example my entry today shorting Macy’s.

One overarching thesis going into the New Year is weakness in high-ish end retail stores. Today the early holiday sales data comes out and we get a bid sell the news reaction. I practically sold the lows on M. I’ve already deviated from my method of trading. My method is simple, it’s momentum and order flow boiled down to two simple steps:

Define the trend (or lack of)

Trade pullbacks in the direction of the trend

I love this method because it has a margin for error. I also know much sooner if I’m wrong. Fortunately I started very small in my M short. But even that is a deviation. Nowhere in my plan does it say, “Toss a feeler on and add when the sauce starts to thicken” or whatever. It says trade the pullbacks. Now I may have to ride peak-to-trough before I can even assess the downward momentum.

I acted brand new. And we should all learn from it. 2013 is about trading the PLAN only. As for drift driving, you can call me Steve McQueen.

http://youtu.be/5cPN6EsE6cc

Comments »Not Much Action

Today the market’s weakness resulted in an early flush in a few names, especially retail as we cut through the key support level highlighted in my premarket profile work. Many retail and department store names were sold off early morning when data came out suggesting a ho-hum holiday of selling. The data points are lining up in favor of my department store thesis. Unfortunately, AMZN took a hit too, and I sold the name for a scratch after being up in the position.

Other than selling my shares in AMZN I started small shorts in Macy’s (M) and Saks (SKS). Also I sold my degenerate OTB guy position in BGMD at a 5% loss. I suppose I should have booked that dog as soon as it was a winner.

MOS had a solid first day in my possession, and shares of POT and MON behaved well also. All the companies have earnings right around the corner in early January. After the earnings are out of the way I plan to build into the names for Q1. Unless they start sucking wind, then I’ll abandon the entire idea.

Comments »Merge For a Clearer Picture

Sometimes when a session like Monday occurs with very little movement in price and trade entirely contained within the prior session’s range, I will merge the profiles into one, to get a better sense of the overall trading range and relevant guideposts it can present.

By merging Friday and Monday sessions together, we get the below profile. Interesting note, the volume price of control at 1423 (also Monday high) has been tested three times overnight. Going into the open we’re priced to open right on the level. For all these reasons, I consider the range from 1422 to 1423 my pivot line.

Above resistance is the confluence of the profiles value area high and last Tuesday’s session low at 1425. The next interesting area above is last Friday’s high. Trading above 1428.50 would demonstrate buyer strength.

Very important support below is the confluence of last Monday’s VPOC and the profiles value area low from 1418.50 to 1419.

Comments »Santa Ben Is Coming

You better be good, Santa Ben is coming to town. Everybody have an excellent holiday. Remember, the holidays are all about forgiveness. Don’t forget to forgive yourself too.

http://youtu.be/2e5TYdNqJ8M

Comments »Lets See Who Shows Up For Work Today

The early AM has seen prices in the S&P gently levitate after gapping down Sunday evening. After finding support near Friday’s low near 1418 the market has lifted over five handles and as of 9:15 AM is pricing an open within yesterday’s value area.

Key levels from Friday’s balance are the volume price of control at 1422.75 and the value area high and low at 1426.75 and 1416.25 respectively. Below Friday’s low the next key area is last Monday’s value area low at 1415.75 and below there we want to see bulls holding last Monday’s low, otherwise they risk a quick blow to their confidence on this shortened trading day. Taking out Monday’s lows, the lows of last week could set the tone for the week.

Keep an eye on the key levels from Friday for a cue on who make their way to market this Christmas eve:

Comments »The Upper Middle Class Is Fucked

My second major theme for 2013 is that department stores all face serious headwinds, and are the most vulnerable industry. Here’s a link to my first theme going into 2013. Anyone who loves the stock market and has been dragged out shopping during the holiday season should love this piece.

First off, I never shop in department stores unless I’ve been dragged there by my girl. What that means is when I’m there she’s shopping, I’m a pack mule for carrying cargo. Mentally I’m completely removed from the shopping experience, instead diverting my mental capacity to investigation. I look at the racks, what people are shopping for, ask for a manager and see how long it takes, and talking to employees about their sales goals. This is old school channel checks, it’s incredibly subjective, and perhaps only a defense mechanism for my otherwise disdain for being dragged around town. BUT, this year, I’m telling you as objective as I possibly can, volumes are down.

CASE IN POINT: Sephora. This is one store where I can get concrete information. Their store at The Somerset Collection, our best shopping center, and a top 10 grossing store nationally for the company, is missing their sales targets by nearly 10%. They’re also over on their labor budget. I consider the products they carry especially sensitive. Ladies from the upper-middle class need makeup because, as Chuck Bennet so eloquently stated, without it they’ll “get no handbags.” Women don’t bend the budget knee and give up their beauty products without a fight. It’s the first in three years they haven’t blown their sales forecasts out. Red flag.

The second force, the big chipper, the internet. Yes of course I know department stores have a huge online presence, but they also have huge physical shops–full of expensive sales reps, nice warm air, shined floors, and well you get the picture–overhead. Smart phones are more prevalent than last year and shopping on the go (read: at work) easier. Out on the internet the competition is leaner, have better developers, and way more budget flexibility to advertise. Department stores a losing online.

Finally, we’re going over the fiscal cliff. Whatever, WHATEVER the fuck that means. Rest assured either by simply being more cognizant of the risk or the high likelihood of it’s occurrence, the upper-class expect higher taxes. And they’re bitter in general. They watch way too much news. Cliff imagery. Domestic Terrorists. Doom’s day preppers. NRA. Careless citizens snapping pics of people moments before death by train. Increased hurricane damage. It’s all enough to BUY A GUN, at the least. Suddenly, blowing money on RL over at M seems less important. Why not go on EBAY and get a ten pack of polo shirts from Izod or APP?

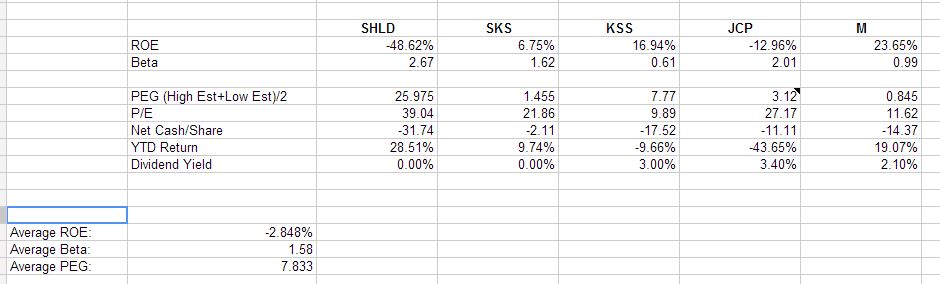

With all this in mind, I took to the almighty PPT. I was happy to receive thesis support instantly, Department Stores are the lowest ranked industry in the service sector. Their January seasonality is 50/50 with an abysmal average return less than 1%. Things perk up slightly in February, and March is downright bullish, seasonality speaking. Here’s a very brief fundamental comparison:

According to these few fundamental comparisons, Sears obviously is getting their ass kicked. Shorting shares of SHLD has been a well publicized trade, it has been a loser . The stocks up nearly 30% this year. Shorts could get their redemption this year. But I see more vulnerability in the slightly higher end (but not too nice, remember upper-middle class). Which makes me not want to short KSS, except investors may be ready to dump the shares after watching their modest annual gains gap into the red earlier this month, POOF! JCP already crushed their shareholders this year, down big. It’s more vulnerable to a squeeze higher on its inevitable march to zero.

Mostly I’m interested in Macy’s (M) and Saks (SKS). I suppose a head-to-head comparison is in order. After all, either of these stocks aligns well with my overarching thesis. For now I’ll leave you with my short-term chart annotations for all the highlighted stocks:

Comments »Are Farmers Investing For A Bumper Crop?

The agriculture chemical sector grabbed my interest this week. The sector saw a modest improvement in its hybrid scoring last week and the charts are set up well. Also, I’m looking to build a few themes going into 2013, and I like the story in farming. We had quite the scare last summer with farmers across the breadbasket reporting low yields. The media ran the story hard, possibly because they saw it as a piece to advance their global warming agenda, possibly because it created buzz and sold advertisements. There’s no question it pumped up (artificially?) corn and wheat prices. I’m sure you remember, but check out the respective corn and wheat price charts, via finviz:

If farmers had even average yields, and didn’t hedge down their profits too much, they were able to take their products to market at higher prices, and could be sitting on cash piles. Irrigation systems are a possible investment, but an easier investment for a farmer is a beefed up nutrient and genetic regiment.

With that story in mind, I also like the sectors seasonality, which according to The PPT, has better than a 60% chance of increased prices in both January and February. If I’m building a theme going into the New Year, I want something that will hit the ground running.

Before taking to the charts, I wanted to compare a few key fundamental statistics:

My takeaway from the above data is that Monsanto (MON) appear to be you innovator. They’re the only company pumping a serious R&D budget. Potash Corporation (POT) although having the lowest beta, is the highest risk stock with the worse cash position. They need demand to come in, or they could be in trouble. However, POT has the highest ROE, and although I didn’t do any risk adjustments, any such adjustments would only solidify their ROE out performance considering their beta.

I didn’t put the dividend yield stats on my chart, but POT currently has the highest yield. I see the yield as a risk. With their low cash position, they may be pressed to reduce the dividend. This could affect share price.

Year-to-date, it appears much of the negative news could be baked into the share price of POT, they’re had an abysmal performance this year. There could certainly be an element of “catch-up” built into the name.

Taking to my precious, the charts, we can see big time innovator MON flirting with annual highs, threatening another big breakout. Also, both MOS and POT are sitting on key support levels. Should we see strength in these names, both names have room for us to scale some profits well before swing highs, allowing us to book some gains which would reduce our cost basis should we choose to swing the names for multiple months:

Comments »Down But Never Out

Strong bounce thus far this morning in the S&P, pumping hard off of a key support level. Financials continue to behave very bullish although the session is still early. We’re into the back-and-fill range I highlighted this morning after getting a telegraphed bounce off of Monday’s value area high:

Although I’m down over 1.5% today and counting, I used this morning’s pop to clean out all the degenerate positions from my portfolio. All except one, BGMD. I can’t let this position go unless it gets seriously weak. It flagged hybrid oversold yesterday with an impressive dataset and look at this chart:

Comments »

Finally Some Snow

I woke up this morning to the first sight of snow on the ground. It’s just a light dusting, mind you, but even the slightest glimpse has me in a better mood than last night. Let it snow, let it snow, let it snow.

I got all bulled up yesterday afternoon after seeing the S&P thoroughly auction the EXACT price range I had laid out in the morning yesterday and then break higher. Typically, this is a very bullish event. It says to me, the buyers and the sellers came to the town square, exchanged their paper while wearing top hats, the sellers were quite pleased with the amount they had sold and went home for the day, but more buyers were left around in the afternoon, possibly drunk on eggnog, and they were still interested in buying. Only the sellers were gone so their teased them back into the square by throwing snow balls at their windows.

Little did they know the world was ending today, and they would wake a giant laser beam armed algo who would melt all the snow and leave only a bottomless pit where the buyers once stood.

And here we are today, still alive after the attack. Take a look at where we’re set to open, around 1422, not as bad as it looks on the freaky overnight tape:

We’re set to open right around Monday’s value area high, an area we snapped through and never looked back. Well here we are, throwing back to the scene of the crime where this week’s breakout started. Chess mentioned in his special fiscal cliff video last night that even though it appears we could see extreme volatility today given the overnight action, the busy news headlines, and option expiration it’s quite possible to be a quiet day given the light holiday trading action.

A mild session favors the bulls going into next week, and if they can hold the key levels of support I’ve outlined in the above profile, I we can stay constructive on the market. Keep your head on the open.

Update: Futures took another cliff jump down to 1418 as soon as I published. Be prepared for anyting, including a flush. Key off of the support levels highlighted.

Comments »