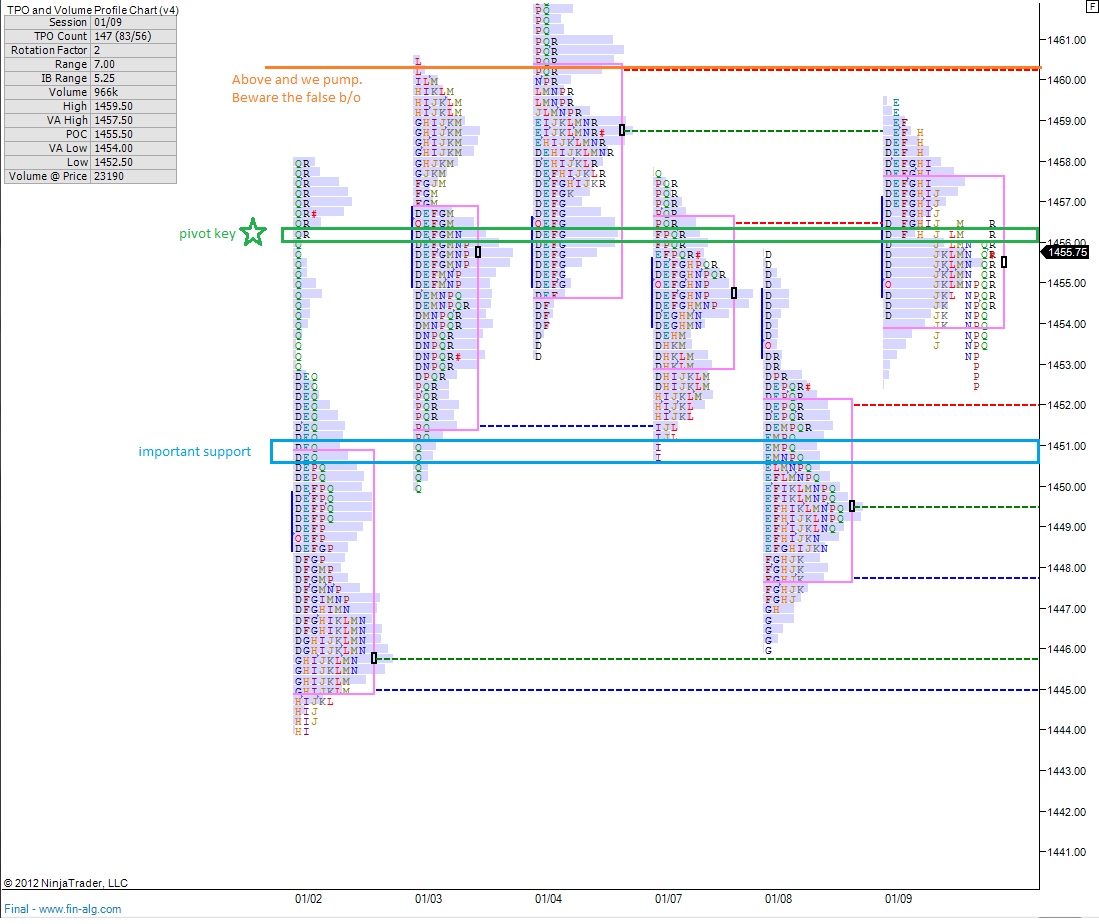

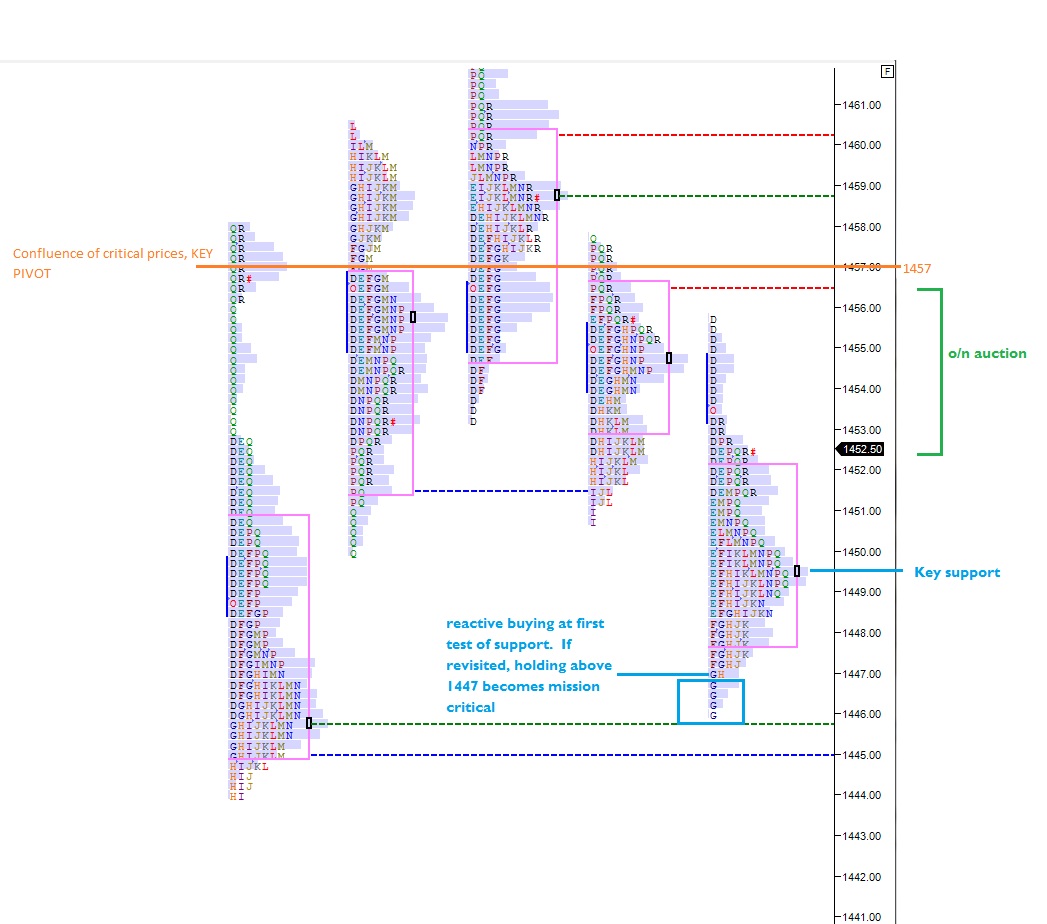

This morning I defined a price level where I wanted to position for the pump. That way, even if I get pulled into a meeting to talk IRS bullshit or jerked around by my favorite underlings I can always pick up my chart and see where we’re trading and whether I should act. It turned out to be a busy day.

When it comes time to buy into a rally, I want to buy. I bought SE early on, thinking the market would hold my pivot at 1460 on the S&P March contract. When the level broke, I cut TIVO. For all I know, TiVo could rip tomorrow. But when it was weak in a strong market and the market began giving back its early gap, I cut.

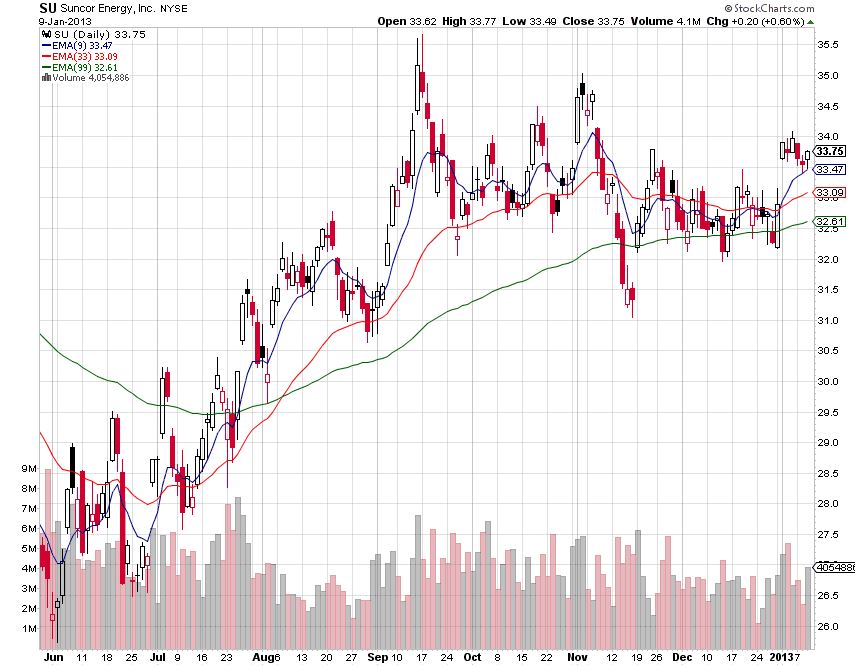

Next my eyes turned to Zale Corp to see how it was behaving after TIF missed on revenues. They dropped some hot same-store data too, double pumparoo. ZLC loved the news. People who can no longer afford Tiffany but still need to get iced out can shop at Zale’s. Shares ripped hard off their 200 day moving average and I hunted a dip to buy in. I barely caught a riskier secondary entry after the primary entry vanished as soon as I loaded up the chart. When I bought the stock it was already up almost 10% so it felt sketchy. Thus I only purchased a 1/3 position. The position was in question all day. My swing setups are all based on how the stock closes. Obviously I had no clue where the stock would close at 11am, but given the strength of the market and the strength in the name I gave it the benefit of the doubt. It closed strong. Nice.

Just before lunch I took a small ¼ scale in FB. I usually scale in thirds, but the stock has been far too beast. I’ll ride peak-to-trough if needed to see higher prices. However, it’s always prudent to take gains when you’re at prior levels where price has demonstrated curious behavior. I also purchased BGMD near the highs of the day only to sell the degenerate stock near the LOD.

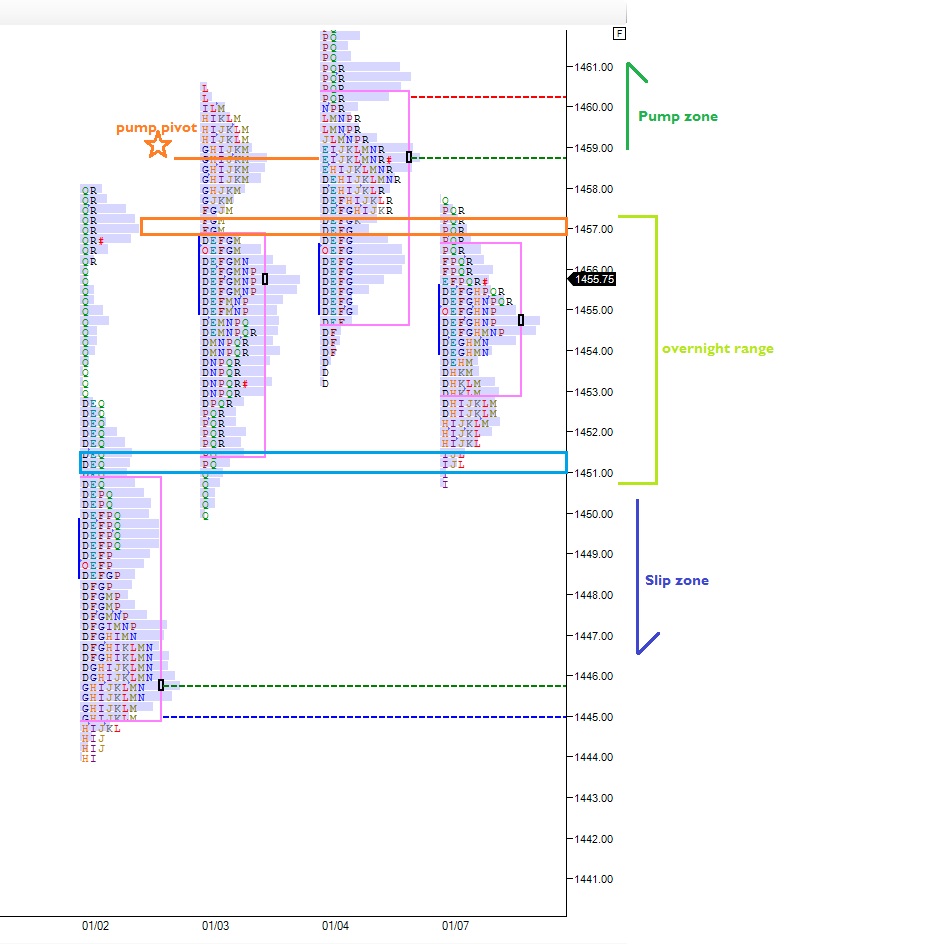

Coming into the closing hour of the day it became apparent the market was accepting higher prices. All I wanted to do was get longer. I bought GOOG to bring my cash levels down. Then I bought APP. I know, busy day.

Finally, I scaled off 1/3 of my full size SINA position. It seemed a proper sacrifice to the stock gods.

All this action and I still have 35% cash in case the hanging man candle forming on the index wants downside follow-through. It was the only warning indicator flashing to my eyes, but it could signal buyer exhaustion.

I have to go swim now I have far too much energy. Take care and get out of that chair friends.

RA RA WITH THAT SINA:

Comments »