How we trade relative to the following sign posts will give me information regarding who is in control of the tape. Continuing to trade within this range signals consolidation/indecision, which is still a postive environment for individual setups.

Comments »There’s Always Tuesday

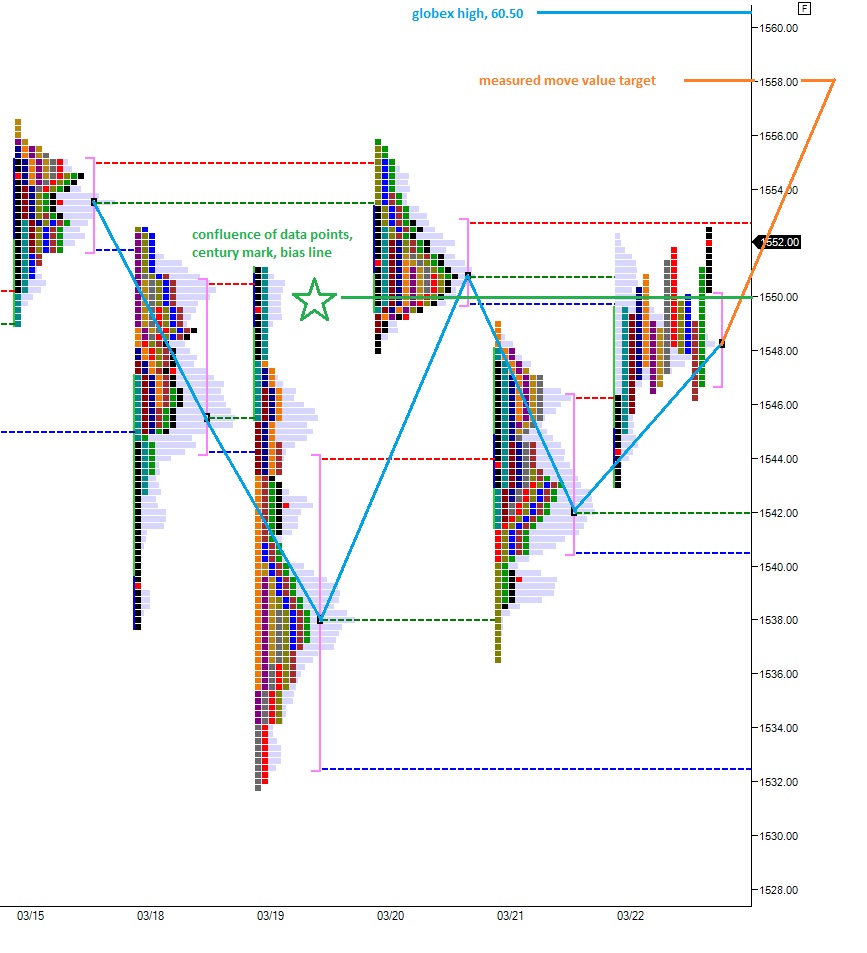

Price clawed its way back to value before closing out the cash session. There’s certainly indecision present. Here’s more shorthand on what happened:

Major new highs overnight

Large opening swing

Sellers assert tape dominance

Price craters through the entire Friday range

Intraday shorts start working

Shorts get faded

Price pushes back up to value

Value settles lower than Friday

Big outside bar is formed

There was no clear winner, but I don’t like this Yen strength. If it continues, we’re operating in a different environment than we’ve seen thus far this year. Lots of charts are extended, like today’s winner AWAY.

Don’t chase risk. Our job as traders, especially at this juncture, is to take as little risk as possible. Tighten up that risk. Get it tight, get it right.

Warm Regards,

Comments »Testing Strategy and Raising Cash

I’ve been busy this morning with the market. I began running my first algorithm live this morning. It seeks to define high probability entries for scaling the E-mini S&P contract. So far so good, it has triggered shorts only all morning. I’m turning it off now to dig into the data a build macros to chomp away at it.

I got a bit larger than I should have with LEDS into the bell Friday. The stock stalled out while I was trying to day trade it and I sailed into the weekend with a 10% position. Good lord. I spent the majority of the morning liquidating the position down to around a 3% position. I was able to earn an average sale price of $1.23. Suffice to say, target one achieved, and I have a runner on should the stock gods offer me some crème.

Then the market continued to deteriorate so I bought more ZNGA. Try to figure out that logic. It needs to firm up before the bell for me to have optimism in the name.

Finally, I sold out of YCS, AWAY, and DNKN. Loser, winner, loser.

Now I’m building a sizeable long in patience as they say. This is such a corny saying, but I see traders take pride in being patient while others are risking coin, so I’ll consider myself amongst good people.

Comments »Morning Profile Analysis

Some Mine(o)r Chart Chomppery

So…Back To Gold Buggery?

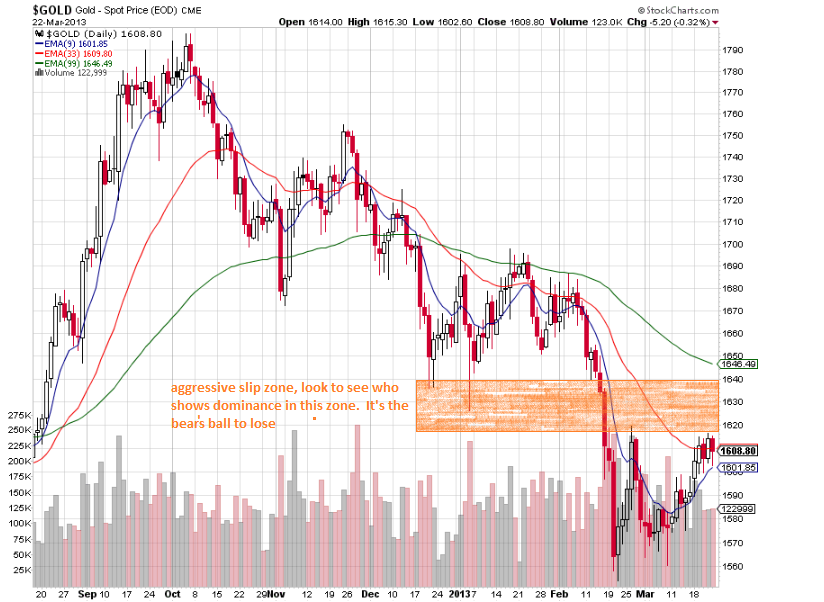

After hearing the news that Cyprus depositors of the six figure variety are each getting a leg chopped off and tossed into the pig trough, and puking a little bit, my immediate thought was ‘people will run to their gold and guns on this news.’

Rather than blast the interweb waves with subjectivity on this peaceful Sunday morning, I thought instead we could revisit my piece on February performance in the metal and miner space, look at how they’ve performed since then (during March) and later this evening I’ll chomp some charts.

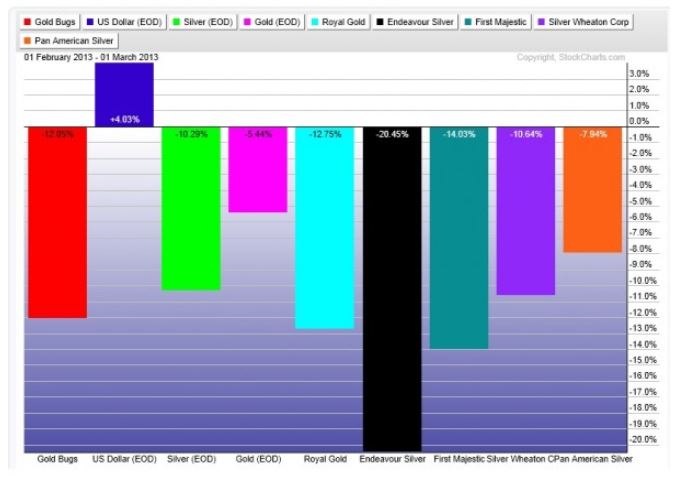

Exhibit the first, via my February blog, courtesy of stockcharts.com:

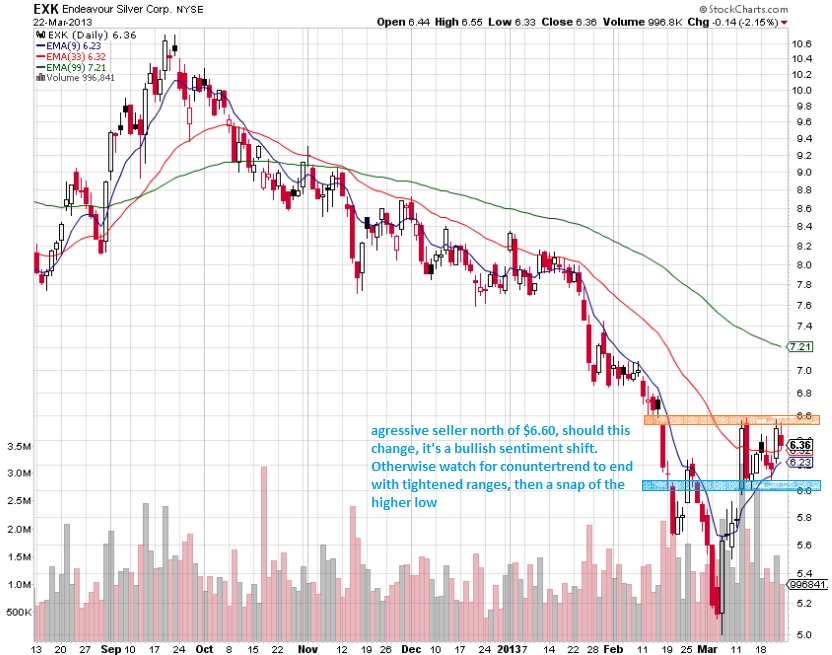

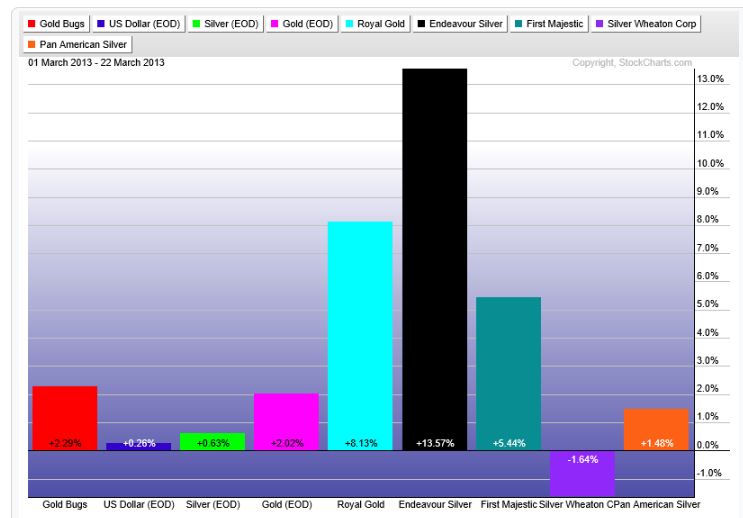

Exhibit two, performance since:

The March-to-date performance would suggest money flows are finding their way into the miners at a rate greater than would be counteracted by sell flow.

Are leprechauns invading the market, chasing rainbows in a completely non homo fashion?

Has Jakegint received a massive bonus from his feverous work last year, and cemented the market with a heavy bid?

Will you need three guns or more to protect your metal stash and family from the zombie banker apocalypse?

Tune in this evening.

Comments »Your Trash Is My Treasure

When you’re bouncing around at the frothy peaks of a thrust higher, you want to be on the lookout for the trashiest of the stocks which are setting up nicely on the charts.

This type of trading is downright degeneracy, let me forewarn. If you choose to partake in this lottery, be sure you define your risk, and don’t be a little baby when you lose. Close that loser with confidence. Being a confident loser is cool, guy.

I’m scraping the gutter with this one, after flaming the name for being a downright loser. I took LEDS long. This is pure price gambling, the company itself is a fantastic loser. But check out this daily chart, belissima:

Comments »Key Levels into Friday’s Trade

I’m looking for buyers to take a more active role in today’s tape. They’ve been getting tossed about quite a bit this week by some rather large sell flow. But overall we seem to be in some rough, choppy waters.

I’m hesitant to give the bears an edge here, although I do give an edge to volatility.

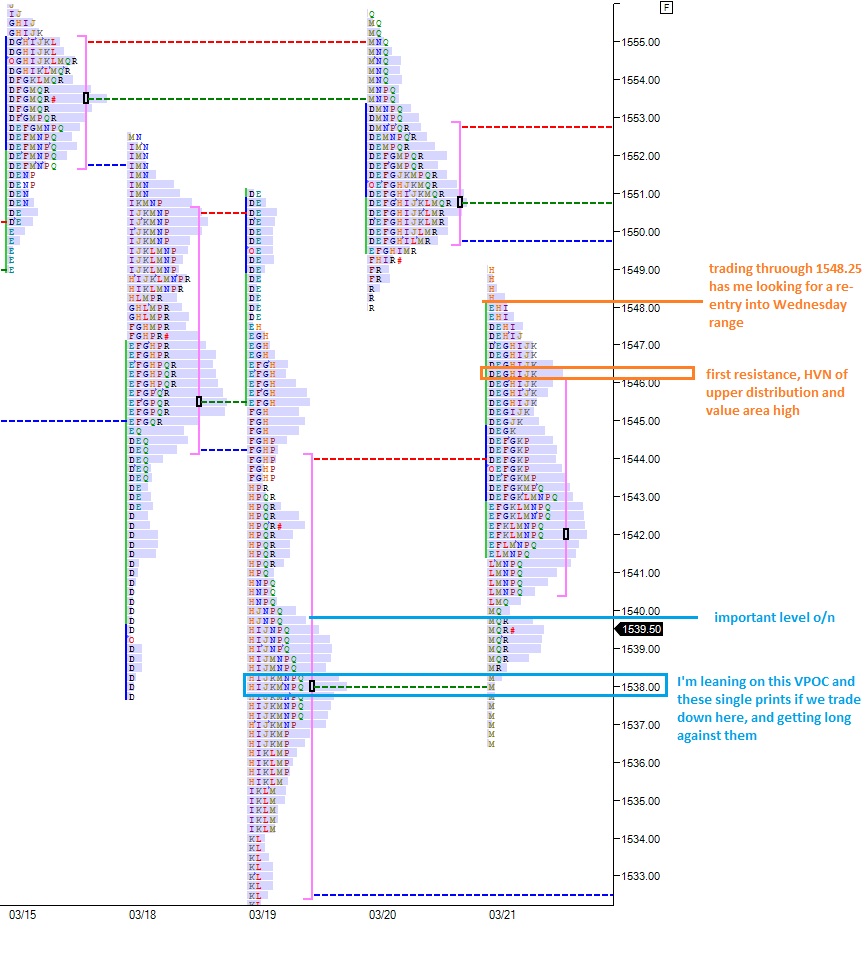

Early on we’re up 3.5 handles from the close yesterday. I’m looking for sellers to enter and try and close the gap back down to 1539.50. If buyers don’t show up then a critical test of 1538 will result. This level saw large reactionary buying that was able to stop the sellers in their tracks yesterday. I plan to lean on these levels and try some longs. However, if it is lost, and trade sustained below, I will raise cash into the weekend.

Comments »The General Goings

This week has been a comedy of sorts for the book of Raul. I’m churning my book around quite a bit, sloshing around in the choppy waters of this shallow dip.

At times I want to be all cash, other times beta neutral, and now today I’m about 55 percent exposed. My exposure is long equity 50 percent and short yen 5 percent via YCS which is an ultra-short, meaning I get about double exposure. It’s very grand and nice.

I’ve cut some of my big winners free, as a sacrifice of sorts to the stock gods. As such, they’ve granted me AWAY, which is propelling my book higher today. I took a modest 1/3 scale already, after the stock appreciated 5 percent overnight. I don’t always scale at 5 percent profit, but it’s a nice fixed target if you’re back testing a strategy (you’re welcome new coders, I hate you).

I cut TIF after it went 2 percent against me, I was quick to cut HUN and and HOV on Monday too. I’m not giving longs a ton of room to run against me, as any one of them could be a jack-in-the-box scrotum punch.

CREE won’t quit. Will it ever?

I miss my Zillow and Tempur-Pedic already.

Is Ford gay, or do they want to win?

Heckmann (HEK) looks pissed and ready to rip, more than any other stock.

The above snippets are major themes in my ongoing internal dialogue.

Finally, fellow blogger network gent @capitaloverlook aka YoungGun put out an interesting tidbit on online gambling today. You should read it. It’s a nice piece of anecdotal evidence behind the Zynga play.

Comments »Keep Moving

http://youtu.be/292-GQ3xgZ8

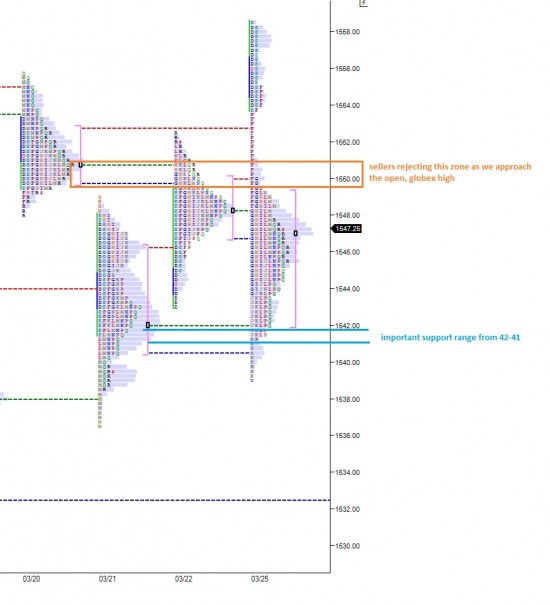

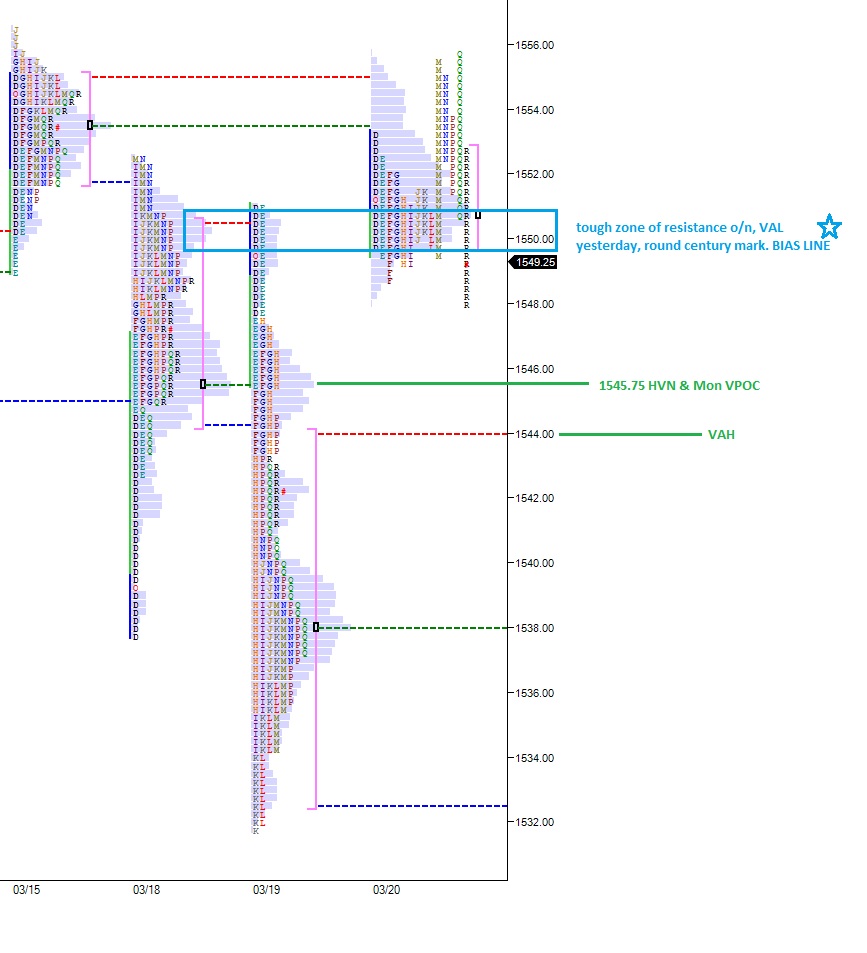

Yesterday’s tight range managed to auction the value area from last Friday (annual high water mark) and successfully find sellers who were willing to send price tumbling back down to value. The overnight session has been quiet and as we approach 8:30am the markets are unchanged.

Early on my expectation is for sellers to reenter the market and probe lower for buyers. I’ll be looking for signs of a buyer reaction first at the high volume node from Tuesday’s upper distribution then at the value area high. Should the sellers press through the value area high, I’m expecting them to press down to 1538.

To the upside, any sustainable trade above the 1550 zone highlighted above could be considered constructive for the bull camp, especially on a closing basis. There were several traders on Twitter yesterday suggesting a possible island reversal on the SPY, trading up to these levels would firmly negate that price theory.

Should price sustain above 1550, I will measure bullish conviction by the size of their rotations and the price levels they’re able to accomplish, especially a clean break of the highs set last week.

Comments »