NASDAQ futures are coming into Thursday essentially flat after an overnight session featuring normal range and volume. Price was balanced overnight, balancing along the lower quadrant of Wednesday’s range. At 8:30am jobless claims data came out in-line withe expectations and as we approach cash open price is hovering in the lower half of Wednesday range.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 30-year note auction at 1pm.

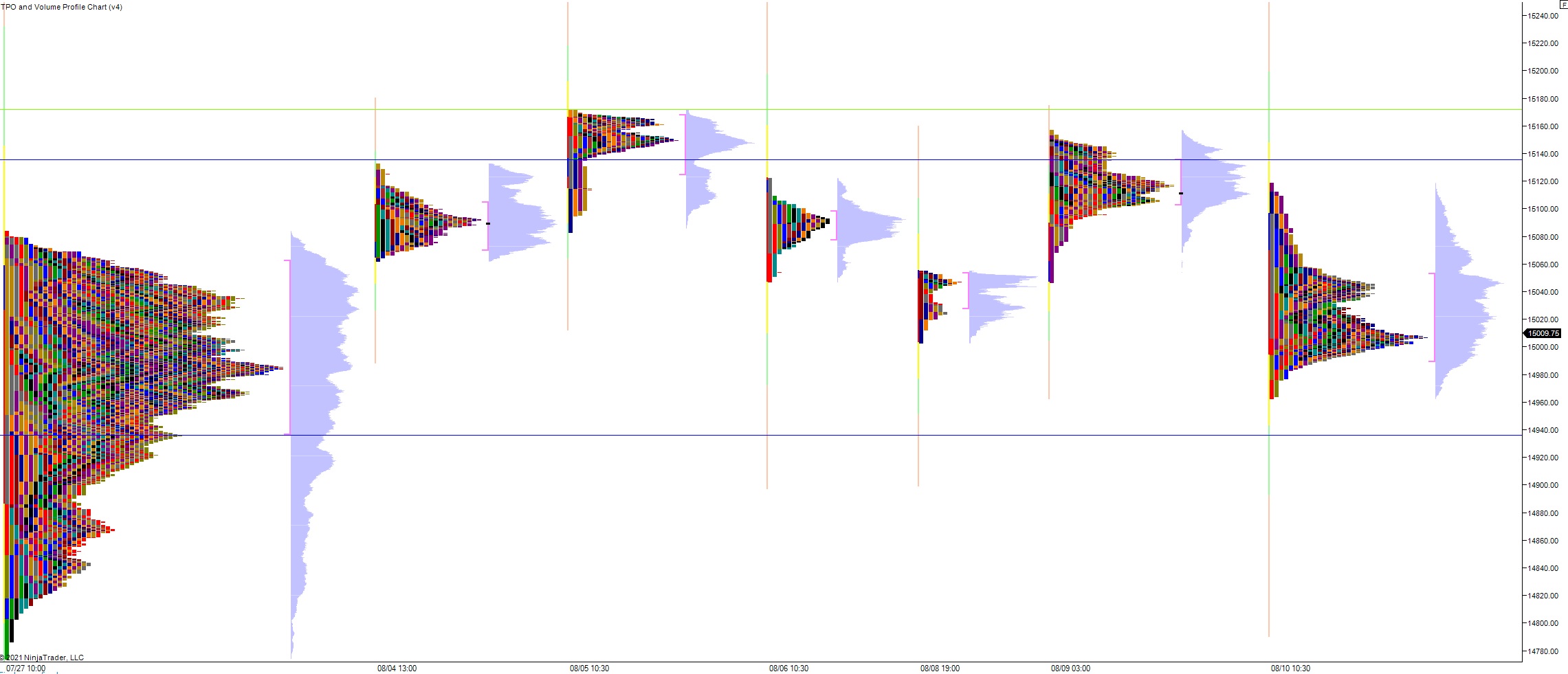

Yesterday we printed a normal variation down. Price action was fast early on. Before the bell CPI data put a strong spike into the market and by the the opening bell rolled around there was a gap up in range. After a brief two-way auction sellers drove down into the gap and made short work of closing it. There was a brief battle at the UNCHANGED line before sellers resumed their campaign, effectively taking out the Tuesday low. We chopped along the lows for a bit, making an early range extension low before responsive buyers bid price back up into Wedneday range. We spent the rest of the session sort of chopping along the lower half of the days range, never revisiting the midpoint.

Heading into today my primary expectation is for buyers to work price up through overnight high 15035. Look for sellers up at 15,060 and for two way trade to ensue.

Hypo 2 stronger buyers trade up to 15,100 before two way trade ensues.

Hypo 3 sellers press down through overnight low 14,983 then continue lower, taking out Wednesday low 14,963. Look for buyers down at 14,936 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: