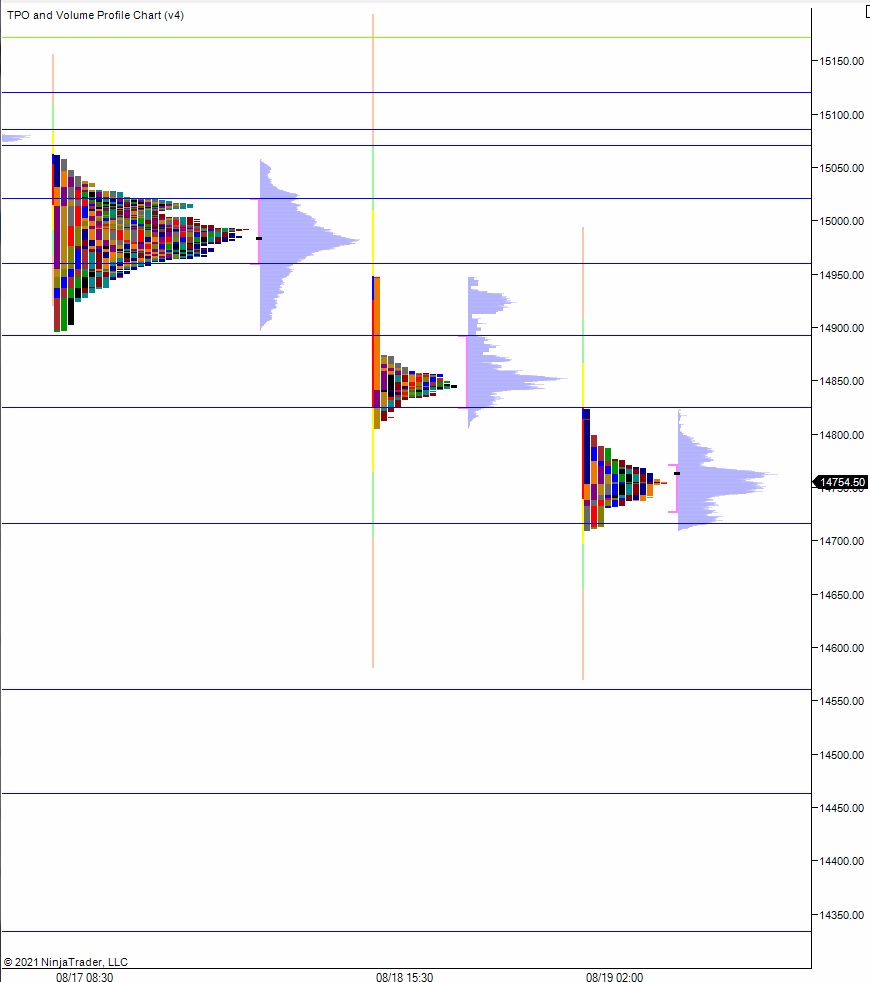

NASDAQ futures are coming into the Thursday before option expiration down -100 after an overnight session featuring extreme range and volume. Price was balanced overnight until about 2am New York when sellers stepped in and drive price lower. The selling campaign took price down to levels unseen since mid July. At 8:30am jobless claims data came out better than expected and as we approach cash open price is trading down near the lows of July 21st.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by 30-year TIPS auction at 1pm.

Yesterday we printed a normal variation down. The day began with a slight gap down. After a brief open two way auction buyers resolved the open gap and continued higher to briefly probe above the overnight high. Just before buyers could go range extension up, around 10:27am the poked above the daily high and the auction failed. This sent price traversing the entire daily range and into an early neutral print. Price sort of walked over the mid once more before sellers made a new daily low. There was one more check back to the mid around 2:45pm before sellers began their final selling campaign which would continue right up into the closing bell, closing on the lows.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 14,851.75 before two way trade ensues.

Hypo 2 stronger buyers tag 14,892.50 before two way trade ensues.

Hypo 3 full on liquidation down through overnight low 14,710.50 early on setting up a move down to 14,600.

Levels:

Volume profiles, gaps and measured moves: