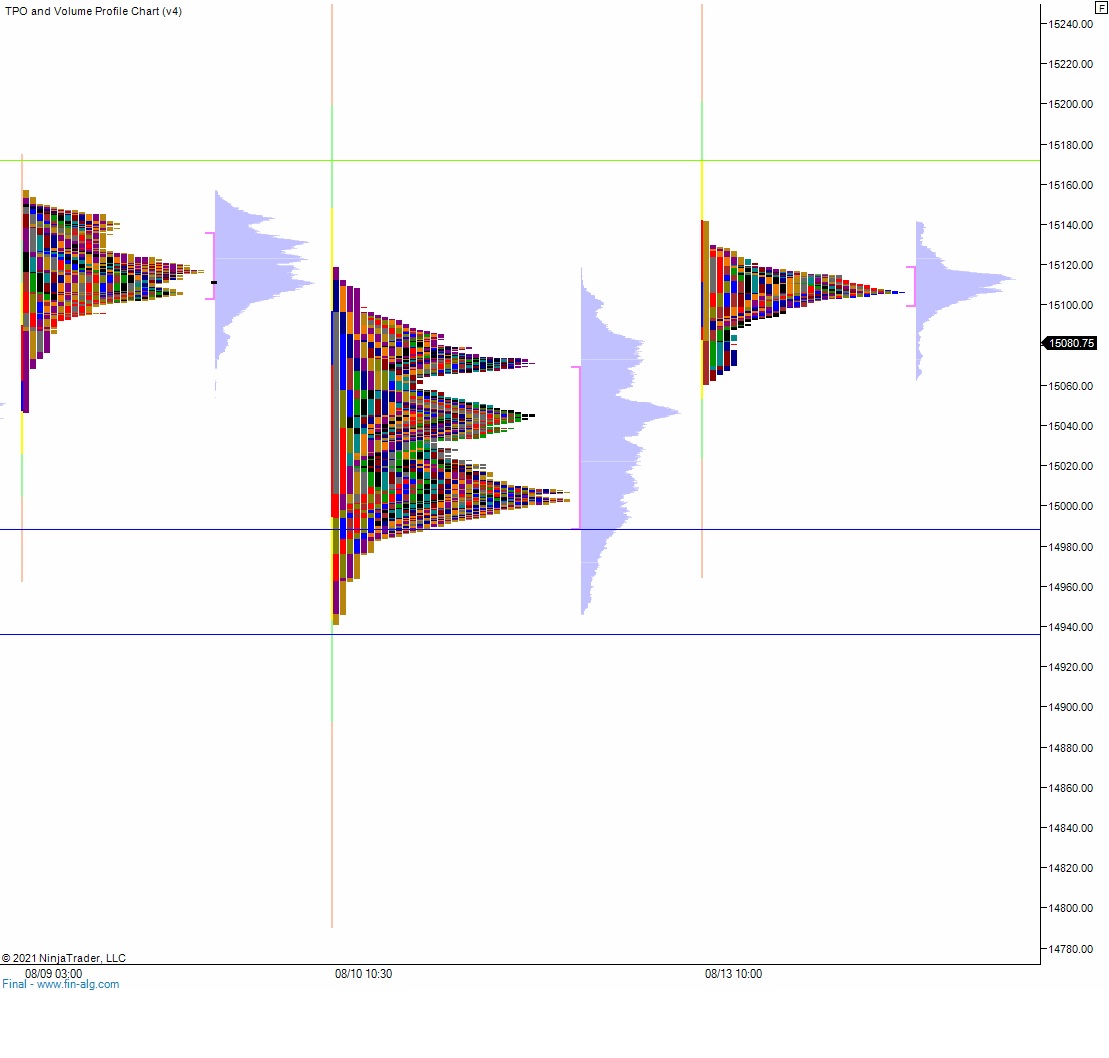

NASDAQ futures are coming into third week of August gap down after an overnight session featuring elevated range and volume. Price was balanced overnight, balancing along the lower half of Friday’s range. As we approach cash open price is hovering inside the Friday range, down near the lows.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

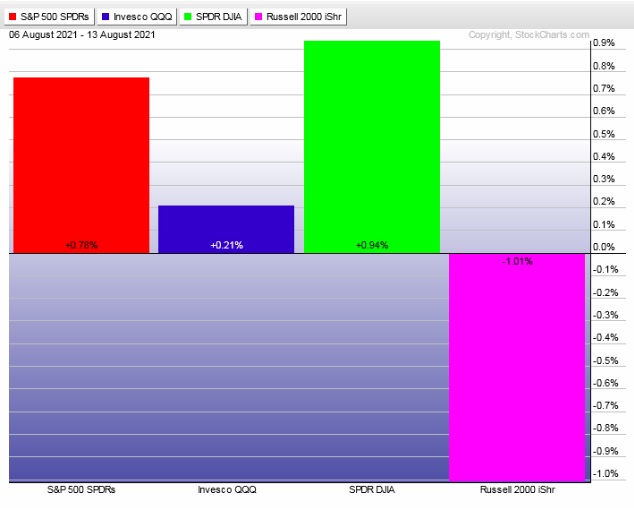

Last week we saw a steady, week-long rally in the Dow and S&P while the NASDAQ and Russell marked time. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal day which is anything but. Happening a bit less than 20% of the time. The day began with a gap up inside range. Sellers quickly resolved the gap after a brief open two way auction. By 9:45 the daily low was in and price began to campaign higher rallying up near the weekly high but never exceeding it. Instead an excess high would form within the first hour of trade before the rest of the session was spent chopping the mid.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 15,125.25. Buyers continue higher from here to take out overnight high 15,130 before two way trade ensues.

Hypo 2 sellers press down through overnight low setting up a quick tag of 15,046.

Hypo 3 stronger sellers trade down to 14,988.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: