NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. price worked lower overnight, steadily campaigning lower in a methodical manner. At 8:30am jobless claims, Philadelphia Fed and retail sales data all came out. Data was mixed. As we approach cash open, price is hovering in the lower quadrant of Wednesday’s range.

Also on the economic calendar today we have business inventories and housing market index at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

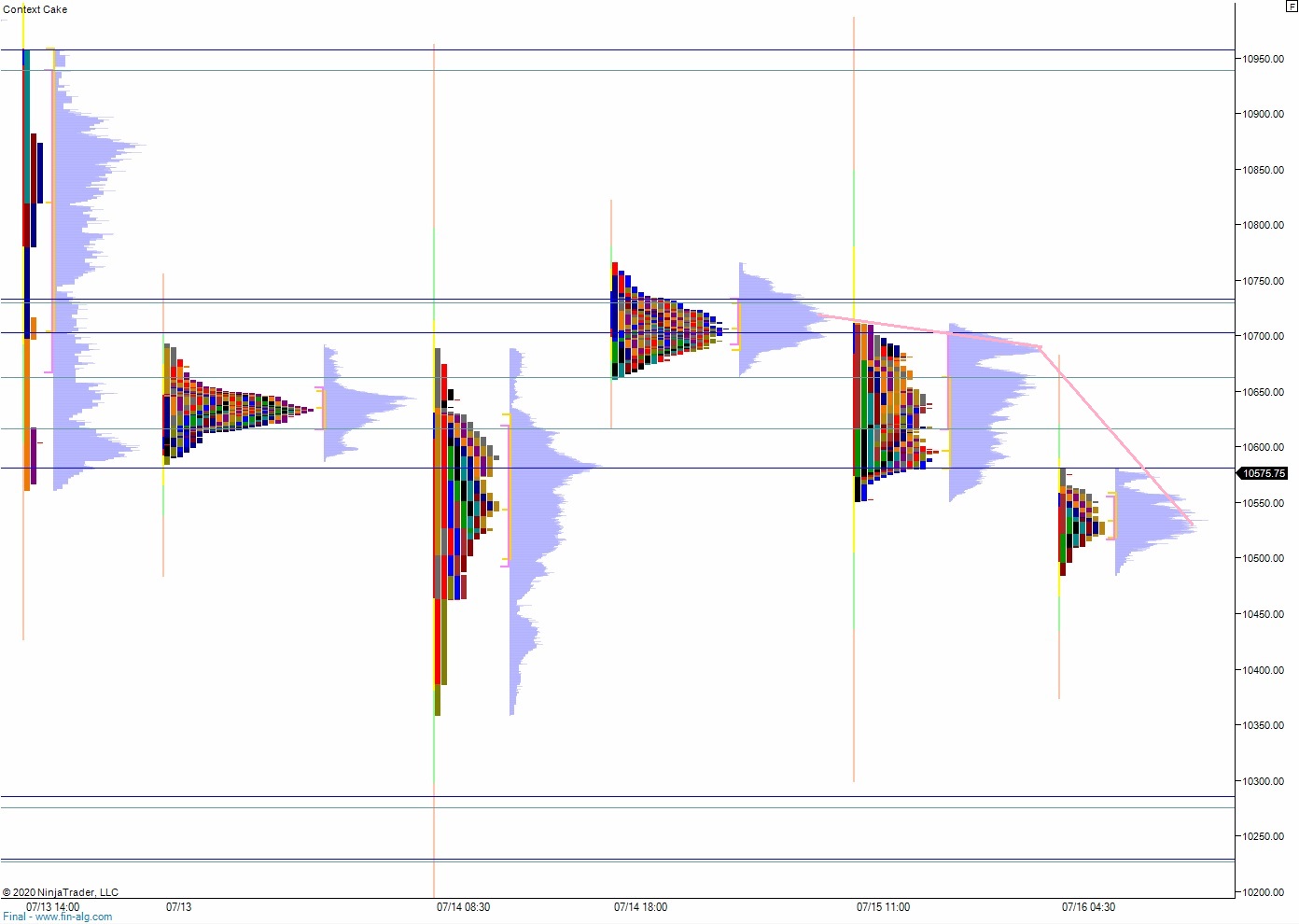

Yesterday we printed a normal variation down. The day began with a gap up and open auction outside range. Sellers eventually stepped in and close the overnight gap, but not before buyers drove up through overnight high. The selling continued down past Tuesday’s naked volume point of control before discovering a responsive bid around lunchtime New York. The rest of the day was spent campaigning higher, with a brief pause at the midpoint before chopping along it and closing above it.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 10,684.50. From here we continue higher, up through ovenrigh high 10,698.25. Sellers defend 11,000 and two way trade ensues.

Hypo 2 sellers defend their overnight selling, putting up a wall at 10,617. Sellers press down through overnight low 10,485 setting up a move down to 10,450 before two way trade ensues.

Hypo 3 stronger sellers trigger a liquidation down to 10,400. Stretch targets to the downside are 10,300 then 10,285.50.

Levels:

Volume profiles, gaps and measured moves: