NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring extreme range and volume. Price was balanced overnight. First the market worked up through the Tuesday high then it marked time above it. As we approach cash open, price is hovering somewhere below Monday’s midpoint and above Tuesday’s high.

On the economic calendar today we have industrial production at 9:15am, crude oil inventories at 10:30am and Fed Beige Book at 2pm.

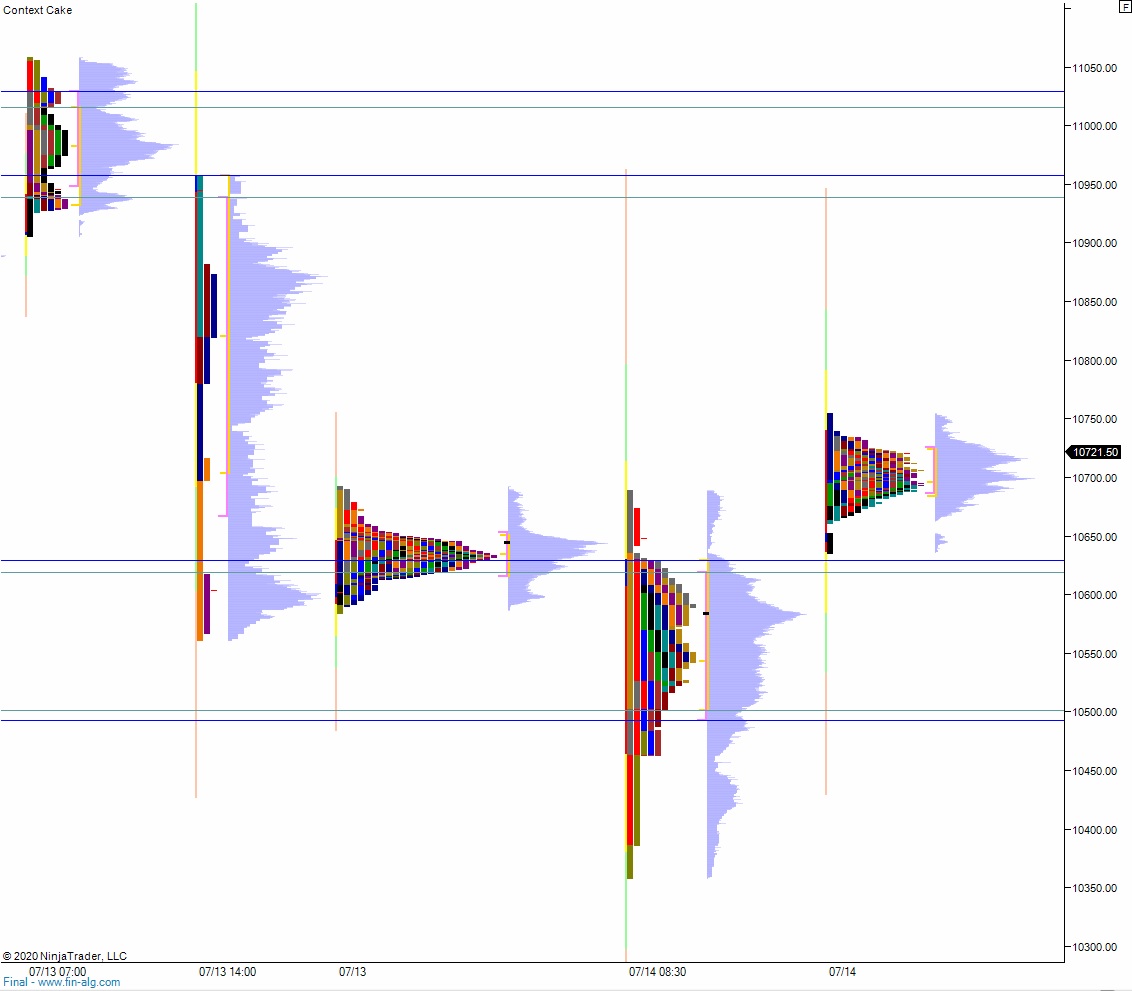

Yesterday we printed normal variation up. The day began with a gap down outside of Monday’s range. Buyers drove higher off the open, rapidly filing the overnight gap before finding strong sellers who asserted enough pressure to reverse the open drive and press to lower lows on the morning. Before 10:30am however, we discovered a strong responsive bid. Said buyers stepped in just a point above the July 4th open gap. Buyers had control of the tap from then onward, steadily campaigning price up through the midpoint then eventually to range extension up. We ended the day on the high, trading back up into Monday’s range.

Really choppy and fast week so far.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 10,755. Look for sellers up at 10792.75 and two way trade to ensue.

Hypo 2 sellers work into the overnight inventory and close the gap down to 10,648.25. Look for buyers down at 10,629.25 and two way trade to ensue.

Hypo 3 stronger buyers sustain trade above 10,800 setting up a run to 10,900.

Levels:

Volume profiles, gaps and measured moves: