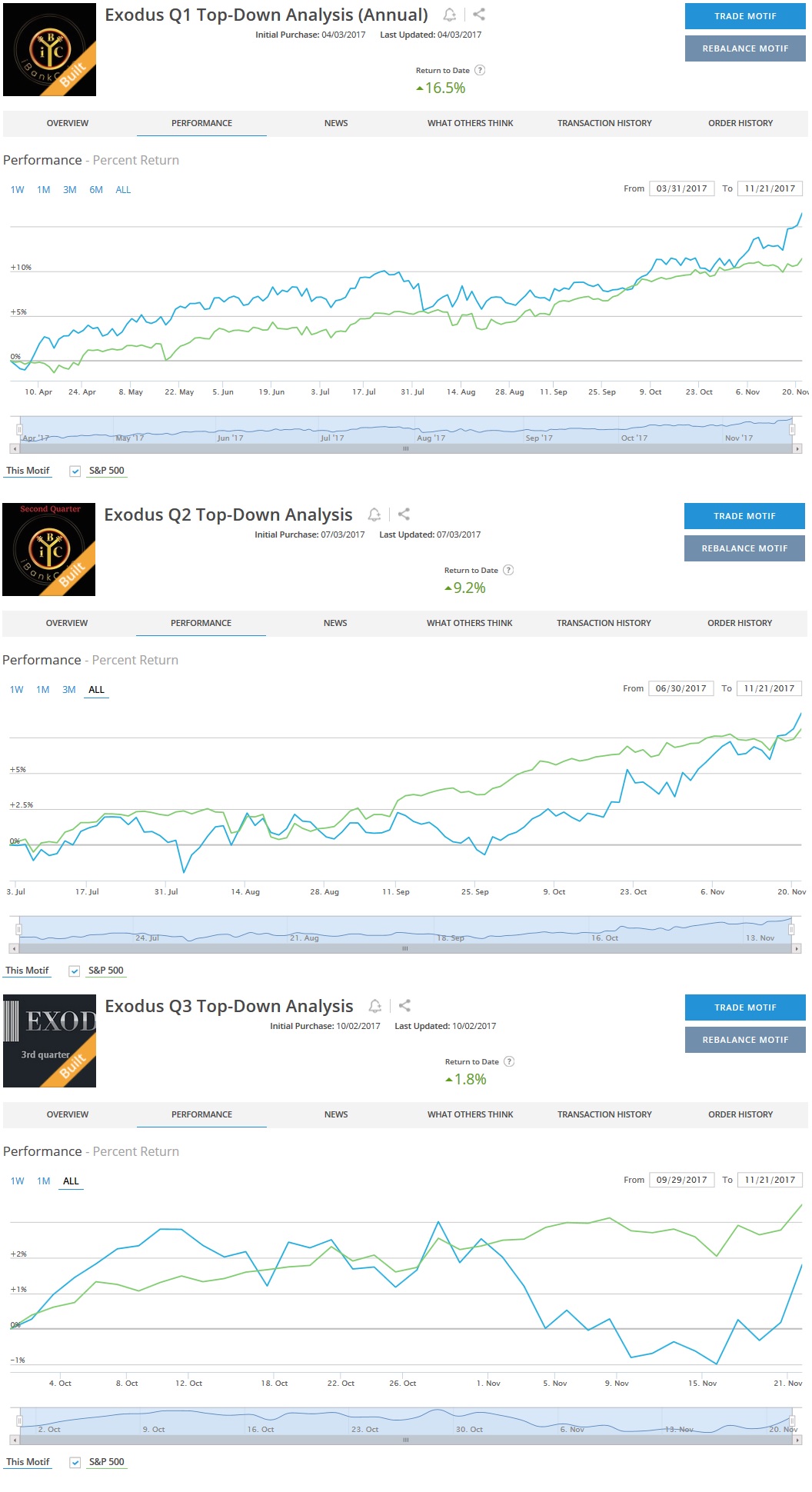

It has been one hell of a year. 12 out of 12 months saw the benchmark S&P 500 index higher. That has never happened before. Ever. 12 wins for America.

Tesla performed exceptional in 2017, returning about 46% on the year. The company is pressing hard into the third ring of production hell and amassing more haters than ever. Despite leading a car revolution, they are criticized for their cash flows. It is like people expect it to be a quick accomplishment, pressing into an industry heavily insulated against new competitors or change.

The company, which is mankind’s last hope at reversing the destructive path humans have taken, is expected to announce its fourth-quarter delivery and production figures next week. Right at the beginning of 2018. We are likely to see another miss for the Model 3. Which is fine. Investors will grant them immunity for these next few quarters. What other choice do they have? Invest in some other world changing ideology?

The options are scarce.

There is bitcoin. If you do not hold all the bitcoins (core, cash, gold) some etherium and litecoin, then you are not participating in the liberation of society from the caprices of our central banking cartel. Unlike fiat currency, these crypto dollars cannot simply be printed on a whim to pay off any old fiat debts. Bitcoin is a libertarian dream. As such, you need to come correct. And if bandits steal your coin stash, well bitch, you have no government regulator to go running to, crying poo poo. You are a free man now. For better or worse.

Which touches upon my final topic–freedom. What I fight for on this blog and in the real world is “liberte de l’homme”. There are so many forces conspiring against a free mind. Societal pressures against free will. For years I operated from complete anonymity online. Not because I had to to avoid the SEC or some other regulator, but because back in 2006 when I started, it seemed like we were operating on meritocracy. It did not matter what family you came from or who educated you. If you were right, and kind, then good on you.

It has limits. Scaling the reach of your voice without showing your face is cumbersome, especially if you are not talking politics. In 2017 I stepped out of the shadows. I hope to do more of this in 2018. And I will continue to discuss the tactics and practices that have allowed me to escape a life of corporate fiefdom.

I have been watching the way bitcoin is auctioning on the CME, and I am starting to see something. It is behaving like an auction. Sometimes it is a maniacal auction, but it is an auction nonetheless. I may take up active trade of the instrument next year. This is, like most of my pursuits, #developing.

There will also be much travel. The more time I spend in the mountains, the more I realize I am better suited for nature. I am strong and love the cold. Out in the wild, my mind and body are much more synchronized. It is a much more pure existence.

What I need to figure out is how to extract more passive income. This means delving into more quantitative strategies. I still love the competition of active futures trading. It is another pure place for me. But the call of the wild has been increasing. I will never give up NASDAQ futures trading, especially given I have the best trading levels in the game.

I would like to wish you all a happy and prosperous 2018. I hope you achieve whatever it is you set out to do next year, and I hope you have your health and happiness and a sense of free spiritedness and an ease of being.

Raul Santos, December 29th, 2018

Comments »