A few years back I gave up stock picking. The days of the gun slinging stock picker are numbered. All the fund money is being poured into agriculture hedge funds and quant portfolios. If an advisor has a role in the grande scheme of finance, it is simply a third party to hold people accountable for their retirements.

Like someone that encourages you to be responsible, and when you instead blow all your money on avocado toast and burning man, they aren’t mad–just a little disappointed. But they empathize and understand and hopefully keep you on track with your retirement goals, whatever that means.

I have zero intention of retiring. Every business/process I design can be operated automatically or by an 85-year-old decrepit. You will never pry my salty, crocodile ass away from work. My bones are made of steel,my blood a high viscosity lithium, and my brain a low-voltage computer fortified by philosophy.

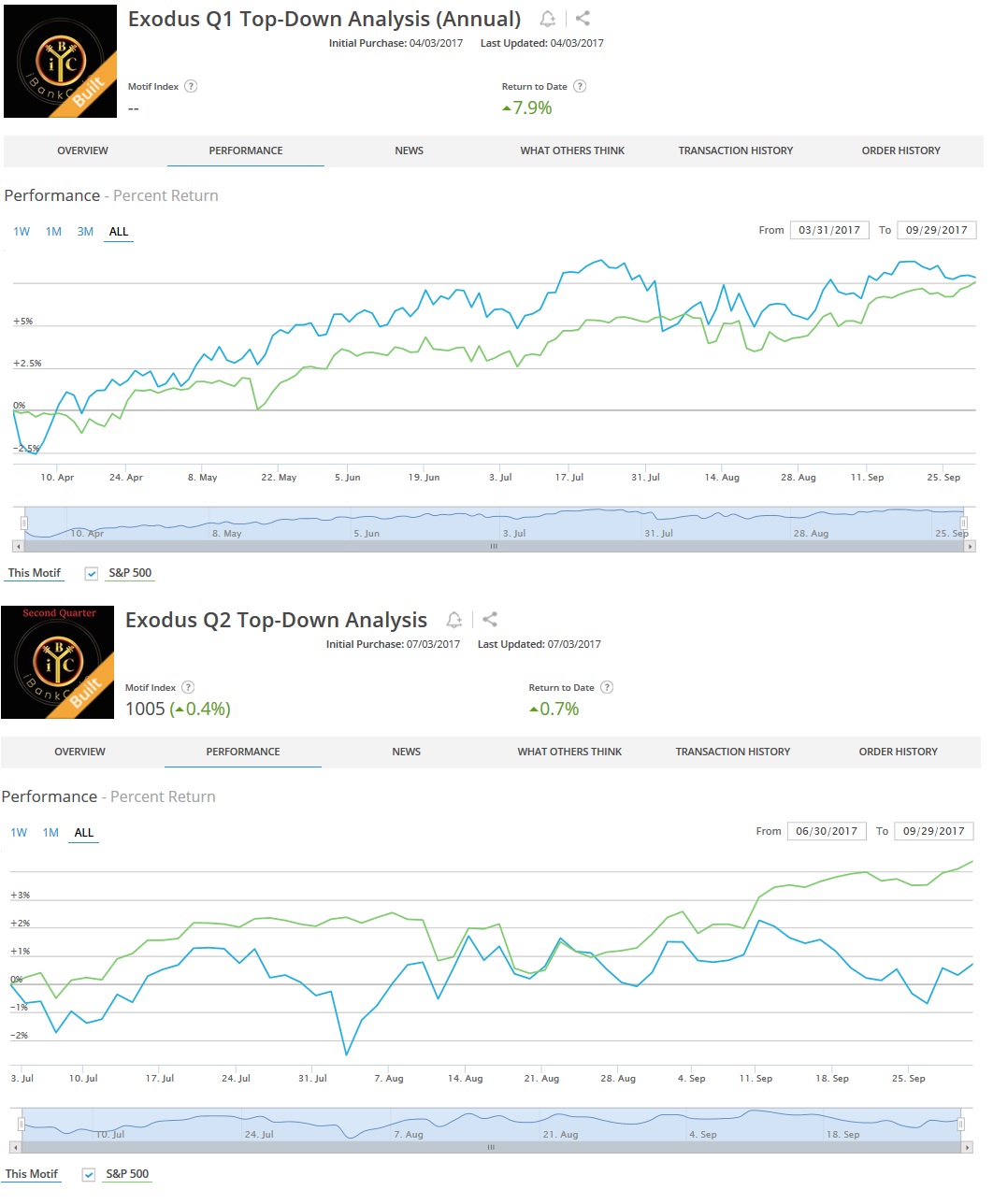

Anyhow, my lazy man’s approach to portfolio building is doing an okay job. When you net together the performance of the first two installments of the quarterly portfolio, it is not outperforming the S&P 500. I know, very sad.

This is mostly due to the lousy performance of the 6-month look back portfolio which was built at the end of June. It has sucked wind. Below are the performance of the 3-month and 6-month look back portfolios:

Over the weekend I will build the third portfolio which will look back over the last 9-months and use the information to select 10-18 stocks.

Recap: At the end of every quarter, a quick, top-down style analysis is performed using Exodus. We start at the sector level—seeing which performed the best—then drill down to specific stocks within the best performing sectors that we will then hold for a 12 month period.

While I will build the 3rd installment Sunday and purchase it Monday, I will hold off on making a Youtube live video of the process until Tuesday afternoon. That is because I will be doing the portfolio building demonstration live with the Detroit StockTwits investor conference this time, and I figure we will kill two proverbial birds with one stone. Here are links to the first two quant building videos:

I will not abandon this process just because it saw some under performance last quarter. Instead I will press onward, for at least three years, at which time I will have a more interesting data set from which to draw conclusions.

Unlike most of the gurus and pickers and tipsters floating around the internet talking stocks, I intend to be in this game for an extremely long time. Like 70 more years, realistically. There are advancements in biotechnology and DNA editing and neuroscience that make it reasonable to expect high human function well beyond 100 years.

And unlike most of these tip tweeting, pump fiends, I will not tell you the stock market is a get rich quick scheme. It is a grind, a hustle, just like anything else. You can work hard at it and see zero results. You can be on cruise control and suddenly see a massive improvement in your bottom line, and vice versa. The key is consistency.

Most matters of life, and economics, and business are cyclical. Feast and famine. This is why I adhere to the school of thought that says diversify your income streams. That way, when one is in famine, another is in feast mode. Of course, it all looks good on paper until a perfect storm of famine hits. And it will. This is when you will be thankful you keep a low burn-rate.

When you keep life expenses low you can be patient. You can fast. You can let opportunity reemerge. The crocodile is the longest living species on earth. Study its actions. The way it saves energy. The speed and ferocity it attacks with, but only when the best opportunities emerge.

Such is the life of an opportunist. And all of these traits bode well with speculation and business risk.

These automated portfolios are doing an okay job of storing value without taxing my precious brain resources. This allows me to commit more emotional capital to trading NASDAQ futures are other industrious pursuits. It is my belief that we are entering a period of economic prosperity the likes of which no living human has ever seen.

The roaring ’20s of the new millennium will put the last century’s era to shame. The mental and physical work we do today will pay massive dividends over the next 3 years. As long as you are ready to fast. And wait. Then attack quickly. All at once.

If you enjoy the content at iBankCoin, please follow us on Twitter

Your approach is focused on looking backward 9 months to pick stocks. Since the market is forward looking, I find it hard to see how you will outperform. You’ve got to increase the active risk and thus the tracking error enough to deviate from your benchmark. You can do that by using non-correlated assets, stock picking or market timing. Since you’ve given up on stock picking, that leaves you with non-correlation or market timing. Good luck.

3- 6- 9+ and 12-month look backs. Isn’t that kind of wild? 4 different portfolios together forming one. Sometimes the picks overlap like ATHM

It’s an interesting approach. I’ll be interested in seeing how you do.