Impressive rally so far on this Tuesday before Thanksgiving. Breadth supports it. According to Exodus over 68% of the equity complex is higher. Net issues on the NASDAQ 100 concur. Net Issues are reading 67.

I do not want to assume all readers know that there are 100 stocks in the NASDAQ 100, especially since we have commentors with special needs like sacrilige.

But yes, there are 100, and if net issues are at 67 that means about 67% of the underlying components that make up the index are higher.

Moving on.

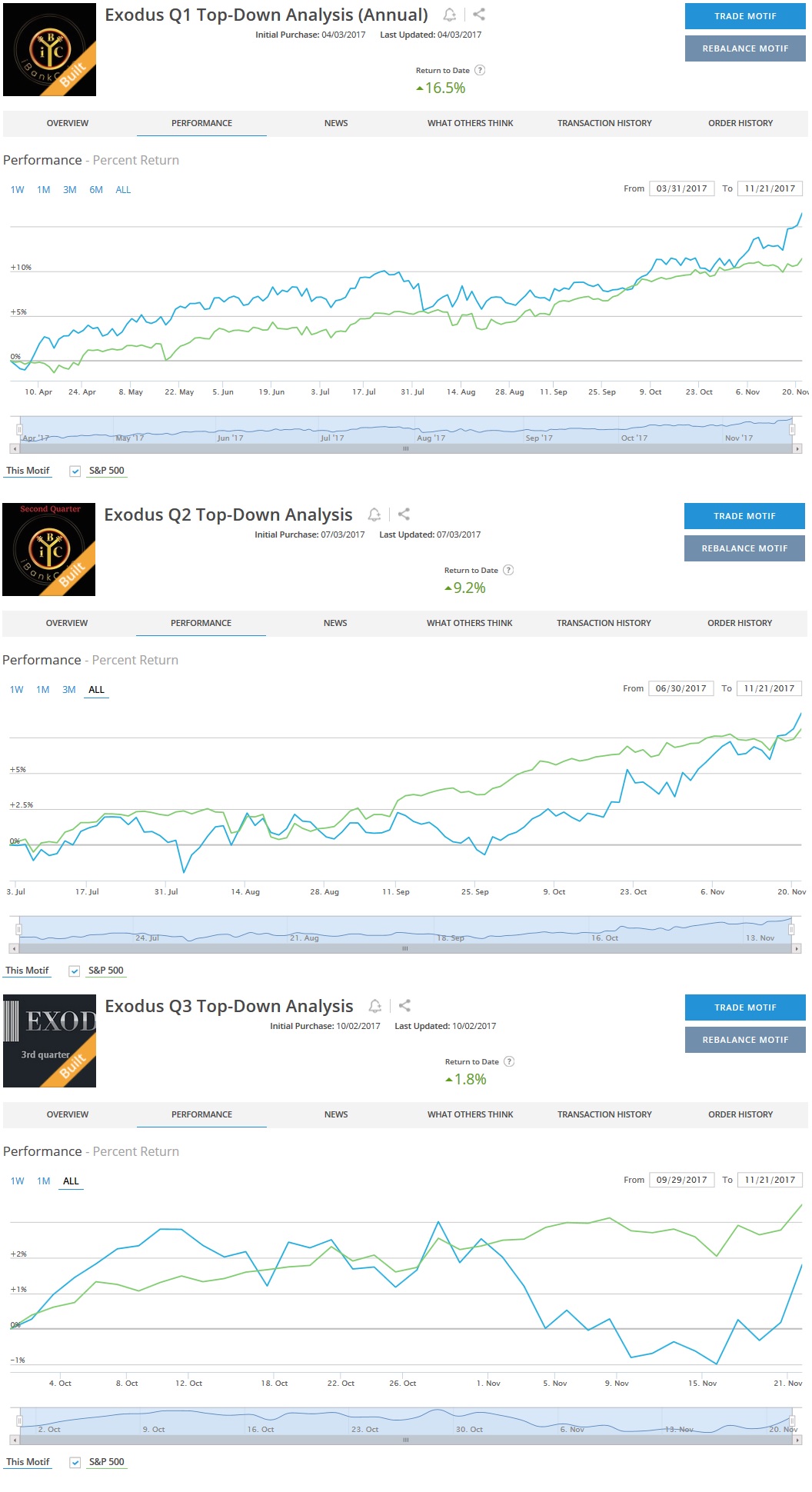

Since the end of Q1 I have been using our analytics platform to quantitatively build baskets of stocks. There is a new one built every quarter. You can read a long-form recap of the process here.

They are performing well, and by removing myself from the stock picking equation, I am liberated to focus on more important matters. Stock picking is not a task suitable for 90% of humans. The 10% can separate their ego from the process of stock picking and form a clear-headed method of choosing companies to own.

It takes a ton of work. And maybe these investors are like some kind of apex predators who spend most of their life in solitude, stalking and hunting and eating. But I prefer to take a beta position and submit to the robots. They have no ego therefore they are better suited for the task.

So far it is paying off. The Q1-through-Q3 accounts are up 16%, 9%, and 1.8% respectively. See below:

Below is a picture of my assistant showing these charts to sacrilige:

It is important to note that none of these accounts have been put to the real test of a market correction because there simply has not been one since the accounts went live. What needs to happen, ideally, before the next correction, is for the accounts to build up an out performance buffer verse the S&P 500.

For when the time comes for markets to correct, it will inevitably affect these portfolios. To what degree, I am uncertain.

Overall, being freed from the need to babysit the 30-40 public companies that comprise my equity exposure has been extremely valuable. Sure this task could be outsourced to a licensed wealth manager, and maybe it is my Midwestern mentality, but I like to handle my own business.

Like if a pipe breaks, I have to give my Italian genetics a chance to fix the problem before I call a plumber. If my ancestors could build the aqueducts using brawn and muscle and stone, then I can probably cut and glue some PVC.

I am grateful Hardeep Walia and his team of engineers over at Motif created a platform that allows me to execute these quant strategies without blowing all my money on commissions. There is no incentive for me to plug them, they just made a brokerage that works.

The final leg of this strategy will be built on the first trading day of next year, which I believe is January 2nd which is a Tuesday. If I am not already chasing snow out in the Rockies, I will pop on YouTube and build the basket live.

Until then,

Raul Santos, November 21st, 2017

If you enjoy the content at iBankCoin, please follow us on Twitter

If you’re out at keystone or A-basin this winter, holler at me. Maybe we can grab a beer at 11000 feet

I will be floating around the rockies pretty much all February and will be in Jackson hole this Sunday, Dec 3rd