Greetings lads,

It is a thin thread that holds our society together. Hard winds pressed through the north and challenged that reality over the weekend. At times gusting up to 60+ miles-per-hour, wind and wind alone took out electricity in most of the mitten’s thumb.

winds up to 60mph I've opened all hatches to the mothership we're runnin' wide open the volume of air coming through is incredible pic.twitter.com/ZLF40ukCix

— RAUL (@IndexModel) May 4, 2018

Saturday morning I woke up to a pleasant silence. Mothership maintained a comfortable 74 degrees through the night and a gentle breeze was blowing through the rear port. It was so quiet that morning that after rolling around, soaking in the gentle wake up call from busy birds, I began to worry that perhaps power had gone out. Then, as if on cue, my dish washing robot kicked on and began thrashing Friday night’s plates and pans with boiling hot water. Mothership was operational.

Last fall, in keeping with our current political climate, I began building a wall. The east side of Detroit is plagued with corrupt politicians and a variety of wild dogs, and I wanted to create a small libertarian oasis where I could walk around in the nude, tending to my grapes and fruit trees. This has been a dream since I spied the old German couple across the street as a boy. Elder RAUL always speculated that the “old krauts” were Nazis on the run, and this skepticism always made me curious of them. One day I caught a glimpse of their shriveled-old bodies picking fruit off trees in their yard, fully nude, and I thought they had it all figured out.

I know most Americans don’t have a stomach for nudity due to their Regan-era morality and general fear of sexuality (Free The Nipple!). So I set out to build a wall. It is, of course, going to be the most beautiful wall anyone has ever seen. Phase II of wall building is underway, and you will be happy to know the wall was unfazed by mother nature’s wind lashing:

I received a distress call from elder RAUL around 9am Saturday. He was without power and several of the robotic systems I had built to augment his up north lifetsyle were still and lifeless. He seemed to be calm, but also so calm I worried he was harboring a great deal of anxiety. I loaded the tactical deployment vessel with a generator, ample fuel, and several contractor-grade extension cords. Then I pushed north.

About a third of the way up the main corridor, the gravity of the situation began to set in. There were many electric poles snapped in half like dried up twigs:

There aren’t many street lights along the way but they were all out. Black from top-to-bottom, red-to-green. I passed a set of hoop houses that appeared shredded. I stopped in to see if I could help. I walked up to the nursery owner, Theresa, having light conversation with her team. She told me it was a pretty wild situation Friday, and at one point she opted to close up the house, have a whisky, and go to bed.

Her morning was less pleasant than mine, but she gracefully handled the wreckage. She gave me a barefoot tour of the facility, offering advice along the way for growing plums in Michigan. What seemed like major damage to my eyes turned out to be relatively small. The inventory was a little beat up, but she had taken out an insurance policy last season and appears to be coming out of the wind relatively unscathed.

I love chaos. When I tell people this they often think it is because I love destruction. That is not the case. It is because chaos creates opportunity, both professionally and introspectively. A natural disaster brings out the real character of people and provides us the chance to see what we are made of. Sometimes those challenges reveal something about ourselves that may be unsettling. Which is fine. It means we have found a path to growth and improvement.

By the way the cows were in good spirits and it appears none of them blew away:

None of the pinwheels in the distance showed any sign of damage. During the last major windstorm a pinwheel destroyed itself after the brakes failed. It was rumored to travel more than two miles, spinning like a ninja star across the planes, leaving four foot deep gouges along the way like the footprints of a marching Pink Floyd hammer.

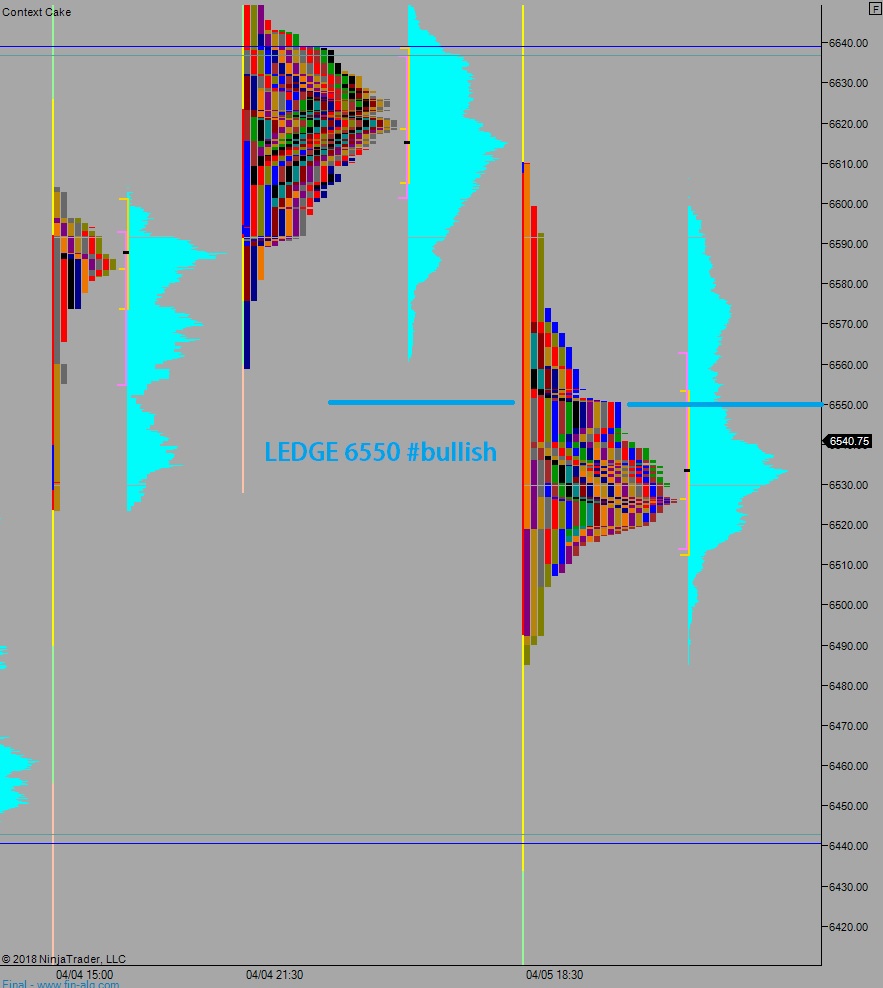

If you’ve made it this far, you may be wondering what any of this has to do with NVIDIA earnings? Electricity, my noble reader, is what runs through the semiconductors and brings them to life. Exodus has put out many rare readings over the last month that whispered of bearish times. The relevance of those readings expires at close of business Thursday. At the same time, NVIDIA will be reporting earnings.

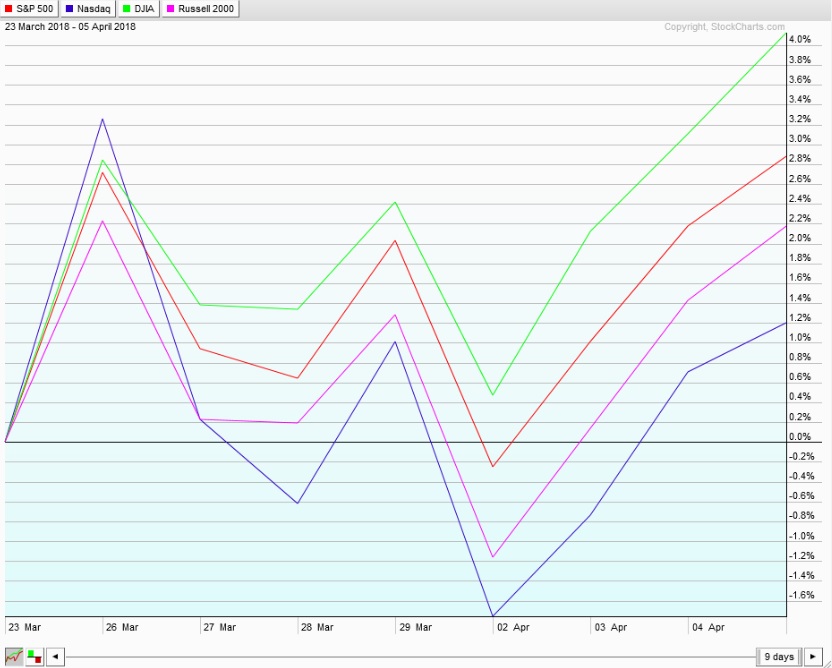

Back in early February, there were even more rare readings, but these were from IndexModel. They spoke of a correction that could play out one of two ways. The second way was a drawn-out, time-based correction. Here is the specific note from our February 4th Strategy Session:

After the 9/11/2016 reading a bid was established the very next day, but the next three months were spent churning sideways in what appears in retrospect to be a time-based correction.

Three months. And here we are lads.

The bears have FOUR MORE DAYS to present themselves and keep this correction going. Otherwise, come Friday, all bearish bets are off and we are going balls-to-the-wall long into summer, in a full DGAF manner.

So NVIDIA is the final arbiter.

So it is written, so it shall be.

Trade accordingly.

As for me, I am going to be spending the first few days of the week in nature. I need to further assess the effect these winds had on the local watershed and bird populations. #developing

Exodus members, the 181st edition of Strategy Session is live. Check out what is going on with the PHLX Semiconductor index, and how we can observe it going forward to make better life decision.

RAUL SANTOS, May 6th, 2018

Comments »