NASDASQ futures are coming into Friday with a strong gap up, at record highs, after an overnight session featuring normal range and volume. Price worked higher, unabashed, all night and morning long as investors looked forward to industries having free reign to do what they please with the world’s resources.

The model used by the team at iBankCoin labs issued a bearish outlook on Sunday, for the holiday shortened week, and was acted upon. Tuesday the good scientists sold a long-held position in $T and went long $SQQQ as a hedge. Both actions has been deemed not only wrong, but insolent by the final arbiter—natural market forces.

It is worth noting, however, that the short bias served us well intra-day. there were sustained periods of selling pressure, and a long battle controlled by sellers at the daily mid Wednesday, that allowed us to capitalize on our bearishness.

Overall, however, the week is being dominated by bulls.

The economic calendar is light into week’s end. We had Non-farm payroll data at 8:30am and it was mixed:

USA Unemployment Rate for May 4.30% vs 4.40% Est; Prior 4.40%

USA Nonfarm Payrolls for May 138.0K vs 185.0K Est; Prior 211.0K

The Baker Hughes rig count comes out at 1pm and is likely a non-event.

Yesterday we printed a normal variation up, but it resembled a neutral extreme up. This is when you knew the short bias was in serious jeopardy. Sellers were active in the morning but vanished before the first hour of trade concluded. The rest of the day was spent pressing higher slowly, then all at once after our authoritarian leader withdrew from the Paris accord.

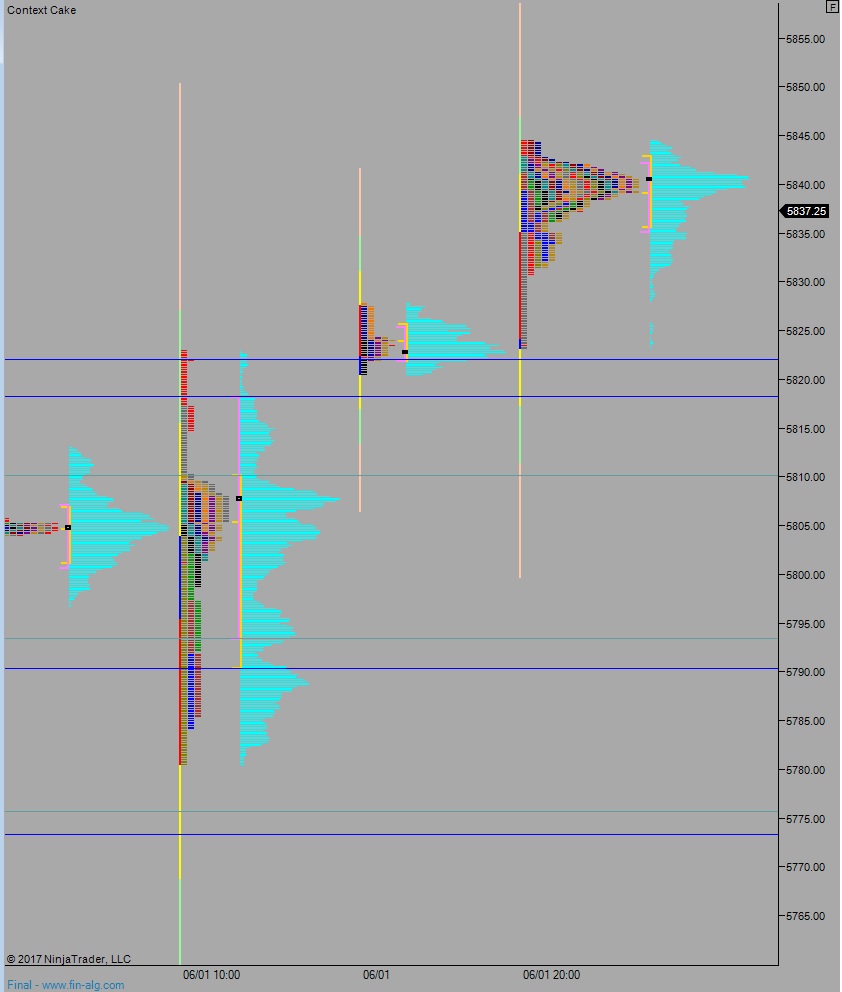

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the gap down to 5822 then continue lower, down through overnight low 5820.50. Look for buyers down at 5818.25 and two way trade to ensue.

Hypo 2 stronger sellers press down to 5810 before two way trade ensues.

Hypo 3 buyers work up through overnight high 5844.50 and continue exploring higher prices.

I will reserve taking any action to update my swing hedge (sell or add to $SQQQ) and aside from trading my very actionable hypothesis and market profile levels, will sit put until end-of-day. If at end of day the bulls continue to dominate the tape, it will be time to eat crow and adjust my book slightly.

Developing…

Levels:

Volume profiles, gaps, and measured move:

zombie buyers

3rd reaction analysis on jobs report looks like a sell?

lol, learn to read a chart if you want to keep your fly from getting swatted.

Should wait til post OPEX week to short. Last 10 years think like only 1 was up.

opex happens every month.

I assume u mean the quad witching?