I got back from my beach excursion — where we cavorting for a short while on the sands until the lifeguards quite literally flew the black and declared the beach a “dangerous hazard” warning all to leave immediately due to “lightening storms being 6 miles away.”

What does one do when one hears such a thing? Do we wing it and simply enjoy more sand and sun — risking getting struck down by Zeus? OR, do we make a beeline for the car and depart? The lifeguards all left post haste — leaving their fucking black flags flying above their little huts.

After some debate, we decided to leave early and of course it never rained and no one got electrocuted. Those fucking cunts.

We then ventured off to the most “awesome and amazing” Viet-Thai restaurant in Wilmington, NC — which sounded insane to me. Viet-Thai food isn’t even that good. I’d rank the very best Thai food in the world like 10th best world cuisine overall. We went, we ate — it was mid.

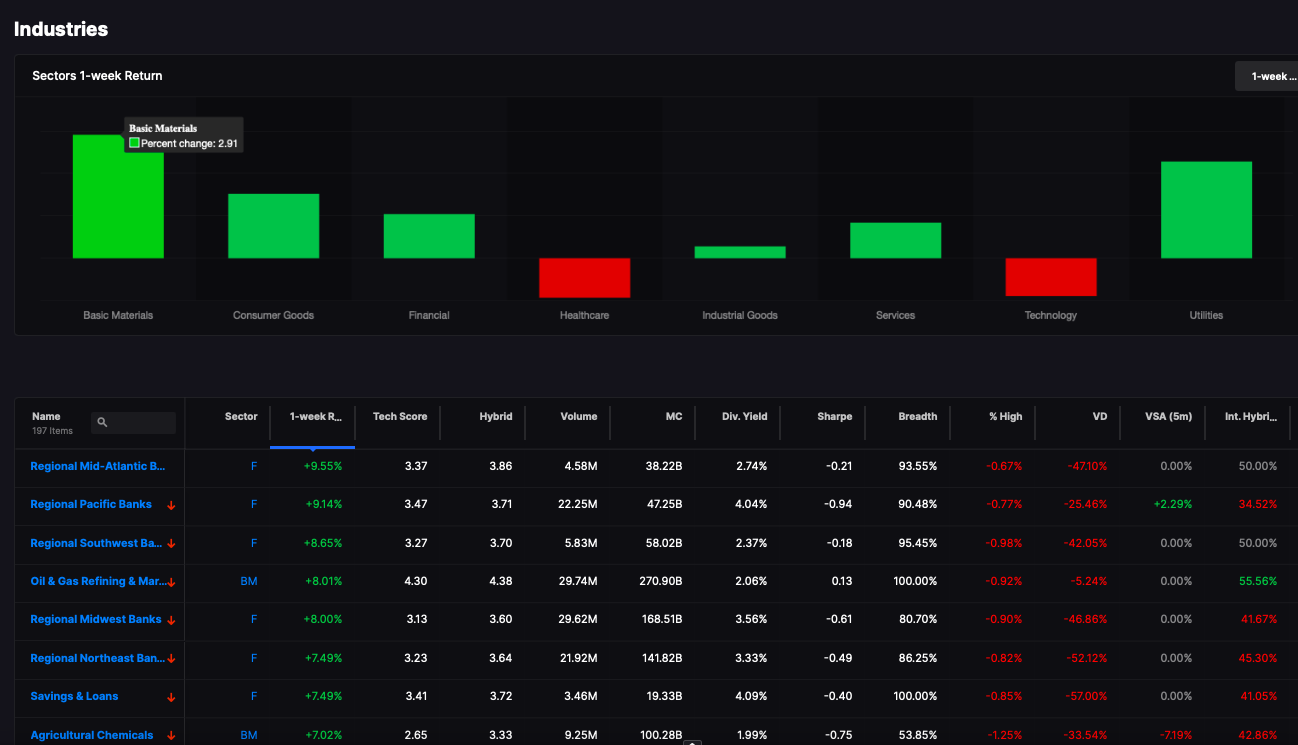

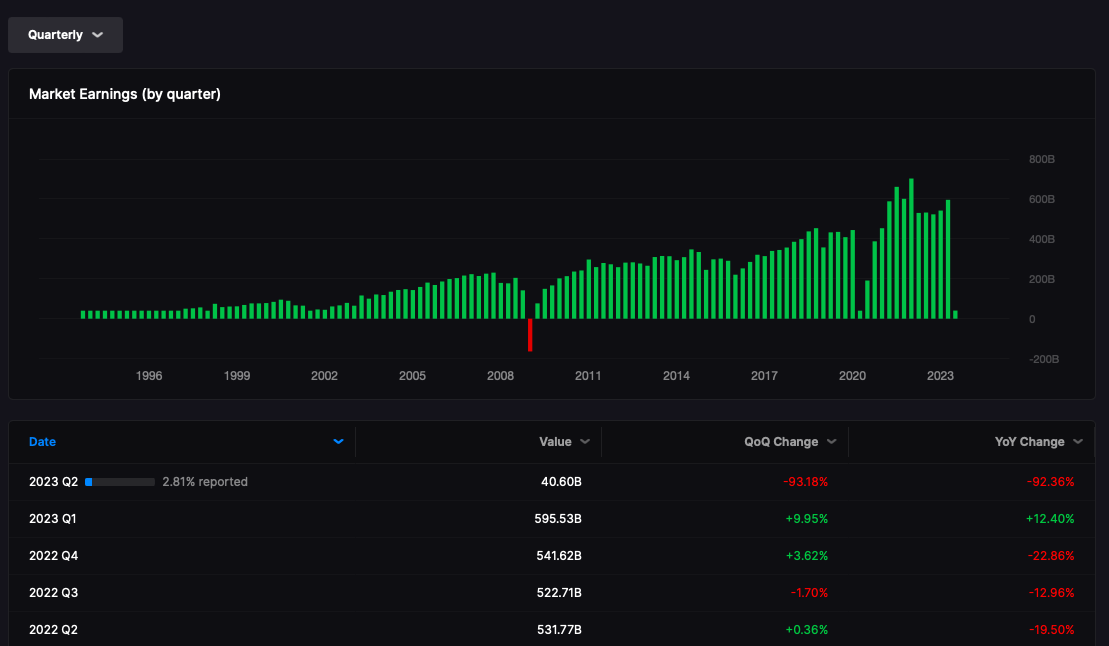

My portfolio actually recovered much of the early losses today — leaving me with losses of just 37bps. I am still long old man stocks.

Speaking of which, I am now cutting — after finally finding out today I was a fat fuck — having gained 10lbs recently without even knowing. If all goes according to plan, and it will because I am the most driven and stubborn person I’ve ever met, I’ll be back to kicking people into their faces by October — with both legs — stomach flat and ready to absorb return kicks to the gut.

I haven’t thought about the war or stocks much today — since I’ve been busy with other things — such as OBAMA PERHAPS MURDERING HIS FUCKING CHEF!

Comments »