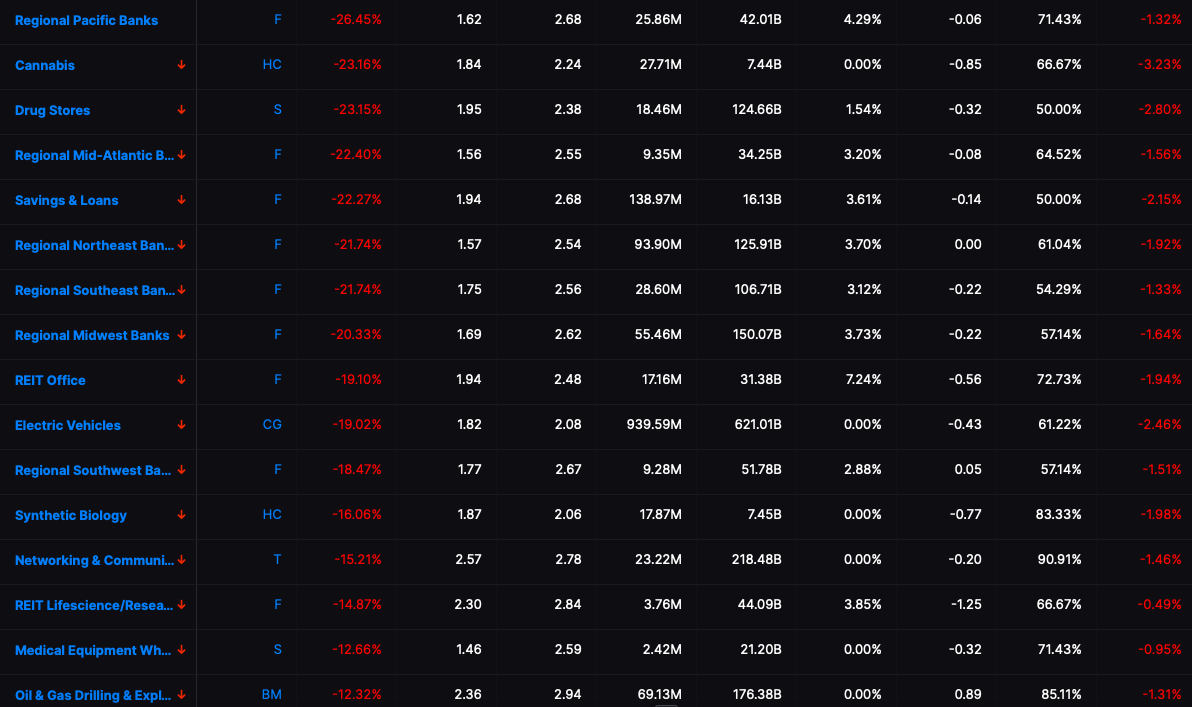

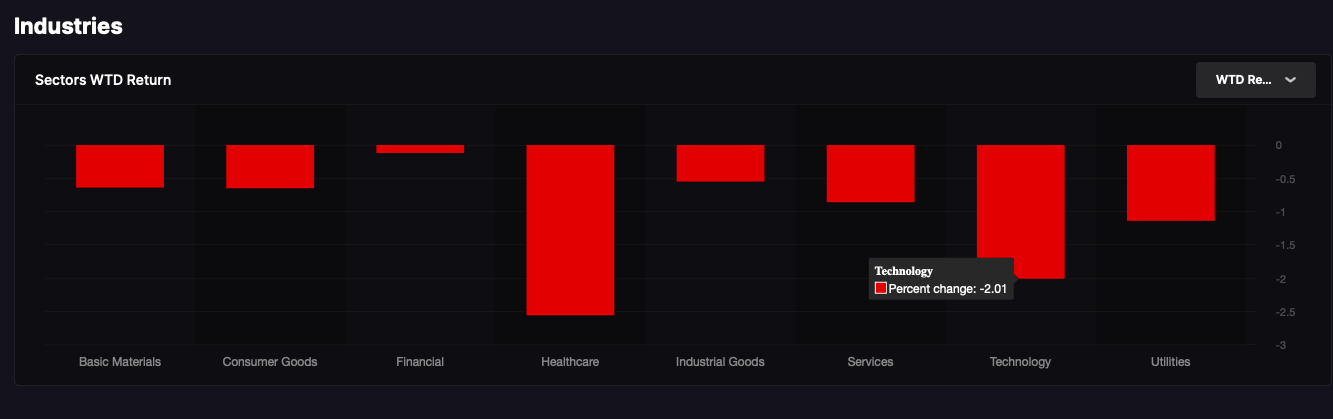

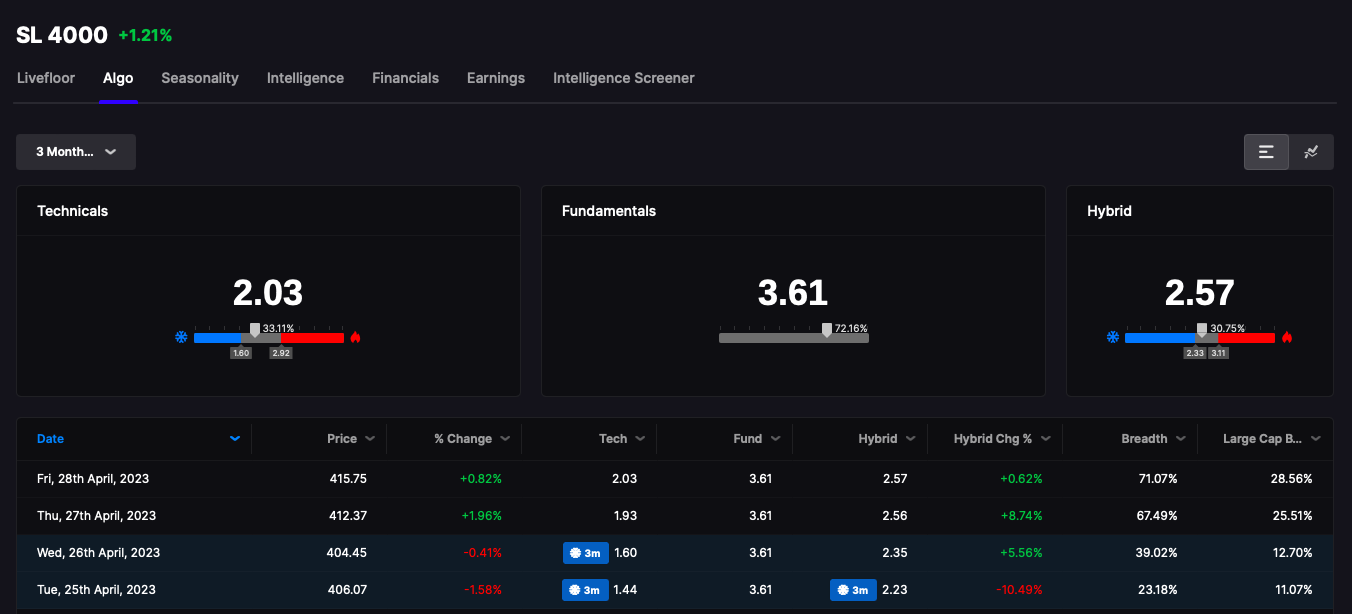

Pardon the late blog — I have been stricken with panic at House Fly this morning and it isn’t market related. To be honest, I don’t even know why markets are CRASHING lower and I really don’t care. It’s all bullshit anyway. We understand the regional banks have collapsed and will continue to collapse. We know the economy is diving headlong into a deep recession. Hell, in Stocklabs the aggregate revenue growth is now NEGATIVE for 5 consecutive quarters.

My crisis lies in the soon to be destroyed Europe, where I will be on holiday in about a fortnight. Apparently the drunkards in Scotland will strike and decide not to drive their trains. Me being the consummate planner and miser, I booked a train from Edinburg to London and now needed to draw up a backup plan — due to the fact that my train will not be running.

Whilst many of you are RACKED with losses this morning, I am +15bps — due to some hedged and well timed circumstances. I am not even trying and I am beating you — imagine what would happen if I truly applied myself.

I don’t place much credence into down 600 Dow days because they’re mostly rigged. However, I would enjoy a nice crash, over say a cabernet — perhaps a strong year with a very nice brand.

BTC and gold are running and the world is falling apart. Let me go walk the dogs and get back to you on this later.

NOTE: We are accepting FREE TRIALS for Stocklabs for a limited time. If interested, email me at Fly@Stocklabs, or fuck off.

Comments »