The drone strikes shall continue. The ISIS ideology will be destroyed one 400 pound payload at a time.

On the home front, citizens of modern civilization need to ratchet up procreation 4-fold. We need to fight these bastards. We need numbers. Get busy.

Refugees are a huge problem. I have no idea how they should be handled. My old man made it to USA because Italy was shit post WWII. I imagine normal people in ISIS-ruled lands want to get out. But I also feel like USA is the last great nation—it makes me selfish, and I want to lock her down.

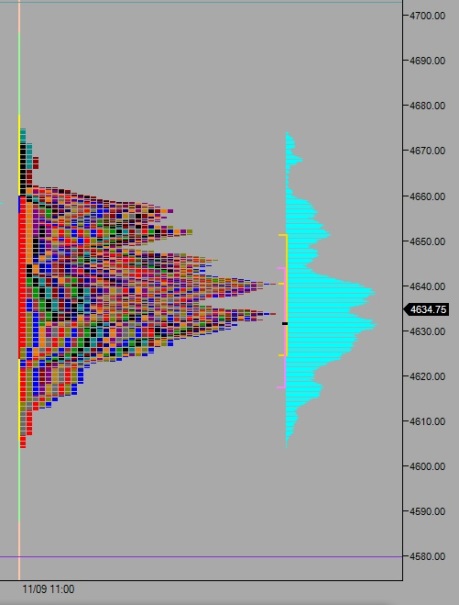

Stock markets—yes, we have to talk about it. This is going to introduce volatility. We need to remain objective and watch for extreme sentiment. As traders it is our job to survive and, yes, profit. Be aware of your own emotions and if they are affecting your ability to execute. You can always go to cash and regain your balance.

I am looking forward to another Investor Conference. I think Jeff’s presentations on Understand Market Dynamics and Trading Through Different Market Conditions are crucial during an international crisis.

My thoughts are with the people of France. Terrorists shot up and bombed an Eagles of Death Metal concert. I have been to several of their shows and they attract people like me—weird, fun-loving rockers.

The terrorists want to break the modern world and bring us back 500 years by restoring the Islamic Caliphate. They will lose. In 100 years ISIS won’t even occupy a half page in the history books.

“Ideals are peaceful. History is violent.” – Fury

Comments »