We printed a neutral day over on the NASDAQ. Neutral days are my favorite day type because they are uncommon—only about 20% of sessions end up neutral. The probability of consecutive neutral days is even lower. It is like spotting a rare bird.

Late last summer the market defied statistics and went on a 10 consecutive neutral day streak. It was insane—the so called long-tail risk that is ubiquitous reared its ugly head and humbled my inner statistician.

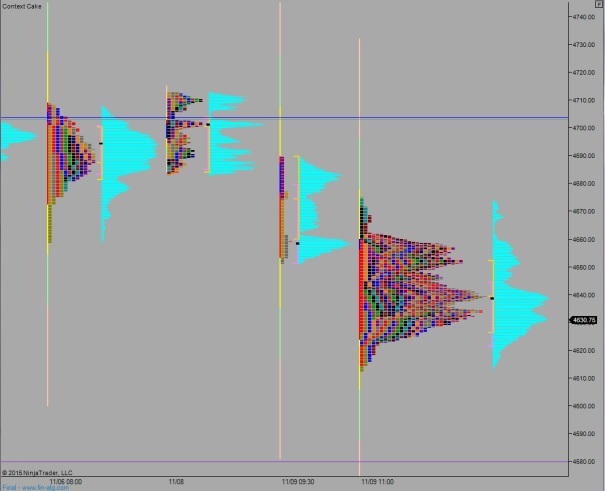

A neutral day is when both the high and low price from the first hour of trade (initial balance, or IB) are exceeded. Pressing past the initial balance is called range extension and suggests higher timeframe participants are becoming initiative as the day matures. I highlighted the range extensions from today on the following 15-minute bar chart:

The neutral we saw today comes at an interesting location because they tend to occur at-or-near inflection points. The market is about 5 days into a pullback after making new contract high. However, this neutral day closed in the lower quadrant—earning it the neutral extreme nomenclature. It also formed a a prominent excess high, shown as a shadow or ‘wick’ on the daily candle.

The main idea to take home when seeing a neutral day is its market behavior footprint. We are coming into short term balance. Both higher time frame buyer and seller are aggressively engaging the market but neither can break away from the magnetic force happening inside value (about 4650 – 4620).

In these conditions it usually makes sense to fade extremes back to the mean, at least until a definitive break occurs. Some prefer to play both sides, others stick to their bias and play their side of the ping pong table.

Speaking of value, we have a nice one formed, check it out:

Neither sellers nor buyers have much structure to lean on outside our current value mass. The next levels for bulls are a distribution formed during a globex session down at 4580. For bears it’s a series of chutes and ladders aside from the chunky formation up at 4703. Therefore it will be a challenging fade trade going into tomorrow. Maybe tomorrow would be better spent taco Thursday style…developing…

If you enjoy the content at iBankCoin, please follow us on Twitter