Normally, after completing all my research and coming to the conclusion that my model has a short bias, I come here, to public forum, and pen a melodramatic epilogue foretelling fire and brimstone raining down on the financial markets. In light of the recent terrorist attack, I am going to just tell it to you straight.

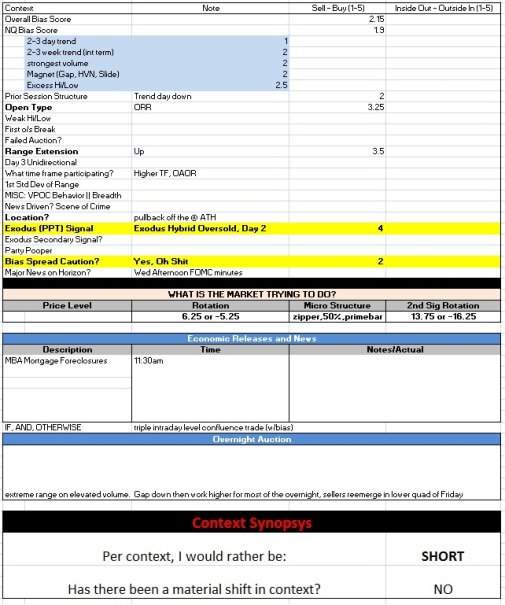

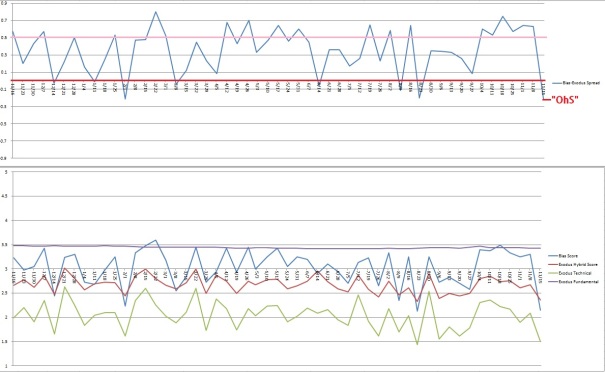

My model has a short bias. The model is based on scoring all four major indices (SPX, COMPQ, DJIA, and Russell 2000) similar to how Exodus goes about scoring stocks and ETFs. I then subtract the Exodus score from my bias score. If the difference between the two scores is greater than 0.50 I have a short bias and if it is less than zero I have a short bias. IT ONLY OFFERS SHORT BIASES

Most of the time the model is neutral, but it has carried a short bias since October 4th aka it missed a HUGE rally.

The two short signals expect different conditions. The one that triggered last Sunday called for downward pressure on the tape. I named it Rose Colored Sunglasses because the index scores come in way higher than Exodus, which ranks each stock individually. It is like the indices are painting a reality more optimistic than what is actually going on. This is what happens when you wear rose tinted sunglasses, especially during the autumn colors.

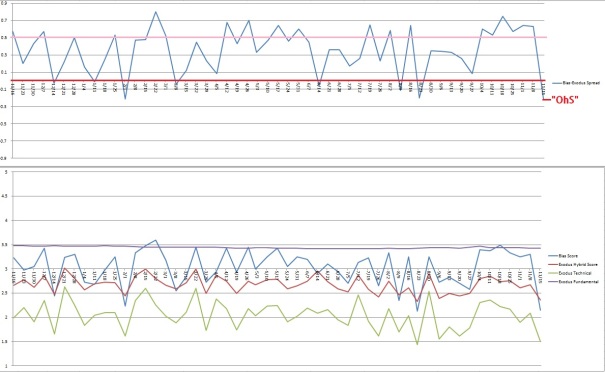

This week we triggered the Oh Shit [OhS] score, a reading below zero. It is actually the lowest score recorded over the last 52 weeks. The name came from the action I historically observed when this reading happened—fast, capitulation type moves lower. I call them capitulation moves because over the last year they were almost all sharply reversed by mid week, V-shape style. This week, given the recent terrorism, may just be hard liquidation.

The most important fact you need to know is past performance is not indicative of future results. When dealing with models and probabilities you are working with just that—probabilities. The OhS signal only has 8 samples. So far all of them have featured fast moves.

Here is the bias log thus far. Today is my models birthday. 52 weeks ago I started this baby:

Exodus members, the latest issue of the Strategy Session has been published. Check it out.

Comments »