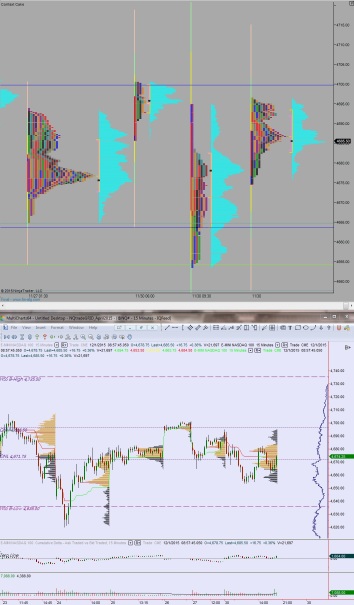

Price is set to gap up heading into December after an overnight session featuring normal range and volume. Soon after the closing bell buyers pressed the market up through the high print set Monday at 4694.75 before the market came into balance.

Today at 10am Construction Spending and ISM Manufacturing data is released. We also have Fed Evans speaking in on economic policy at 12:45pm.

Yesterday morning sellers stepped in and our week began with selling pressure. Price pushed about half way down into the range from last Tuesday before responsive buyers stepped in. The overall print was a normal variation down.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 4674.25. Look for responsive buyers to make an effort here but be overrun as sellers target overnight low 4671.75. Buyers defend 4670 and two way trade ensues.

Hypo 2 buyers are active above 4678 and press higher to take out overnight high 4696.50. Look for a move to test above last Monday high 4706.75 before responsive selling comes in.

Hypo 3 strong selling pushes gap fill 4674.25, take out overnight low 4671.75, then press down to 4660. Trade is sustained below 4670 setting up a liquidation leg to test below Monday low 4653.50. Look for responsive buyers at 4647.50.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

I still like reading these to get a broader market context and your overall opinion of market action. Good stuff!