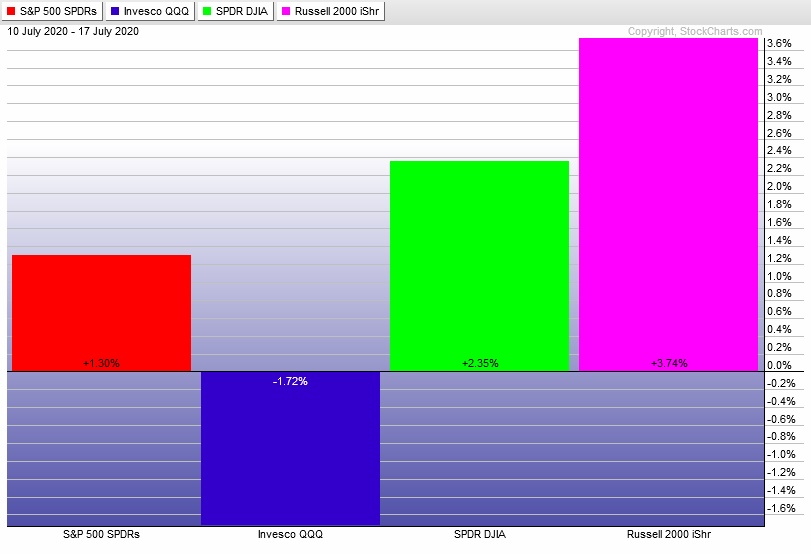

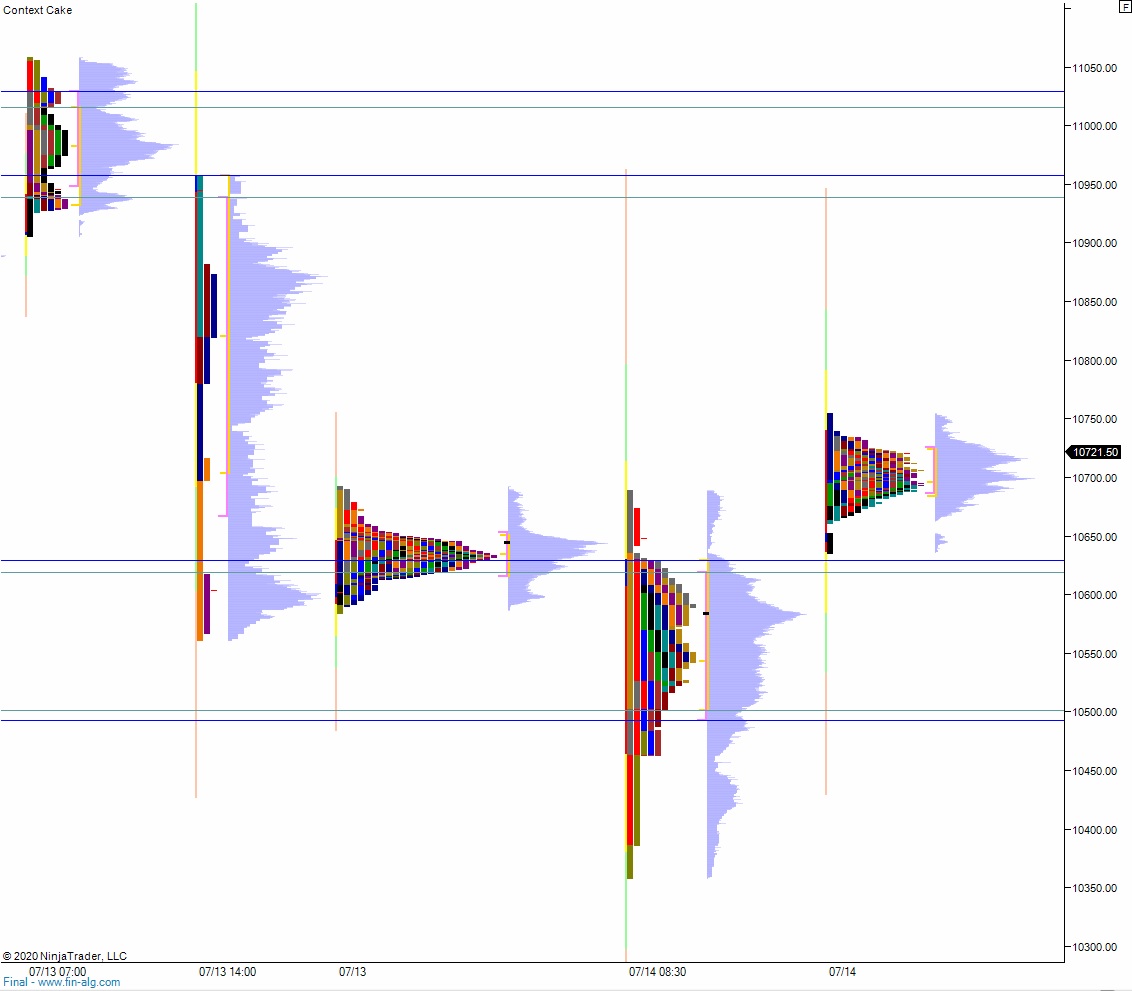

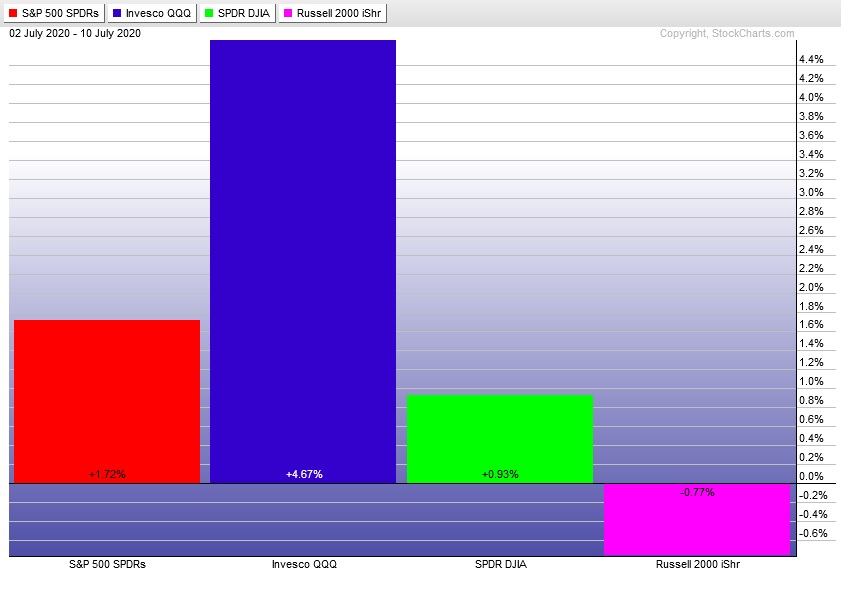

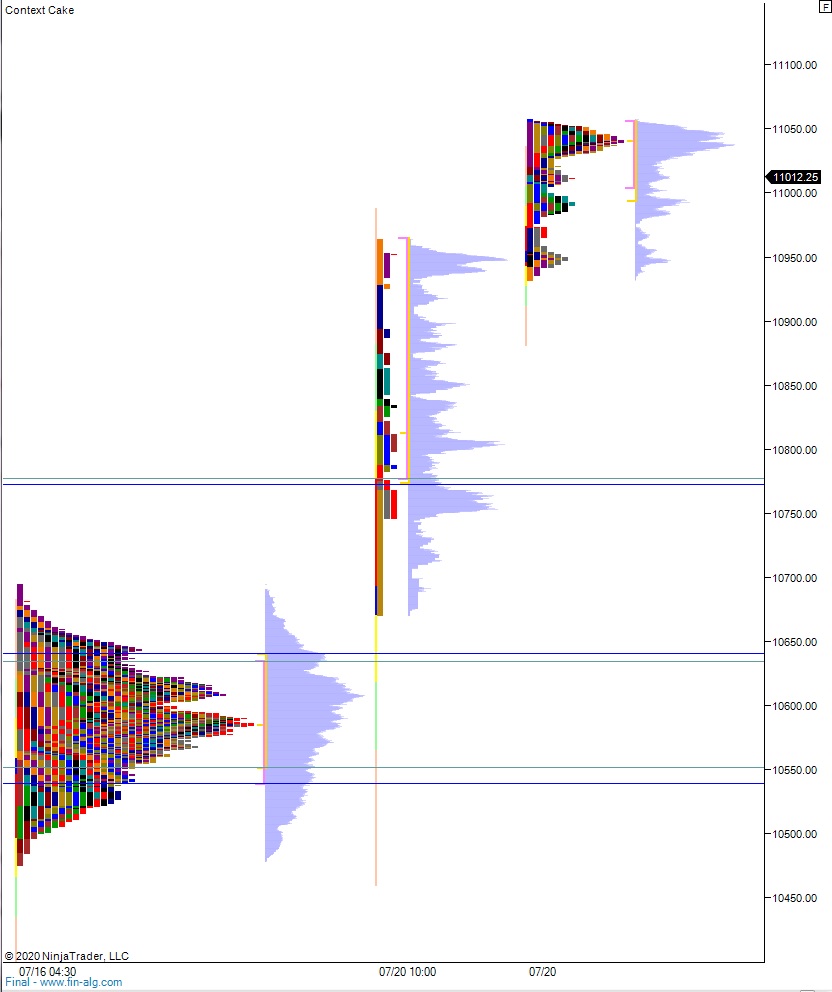

NASDAQ futures are coming into Tuesday pro gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, extending the trend up gains acquired Monday. Price stalled just three ticks below the prior all-time high set on July 13th. As we approach cash open, price is trading up beyond 11,000.

There are no economic events today.

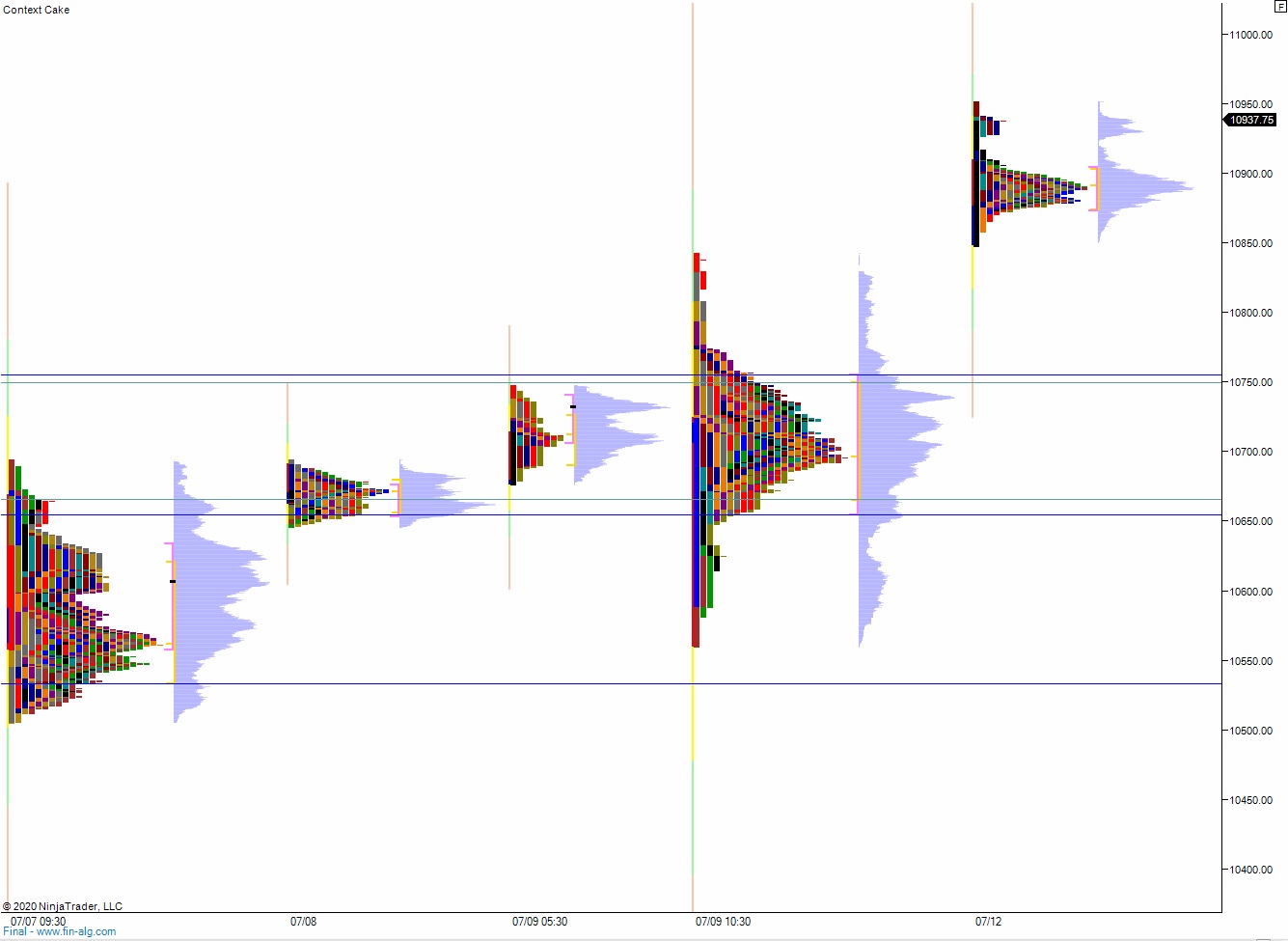

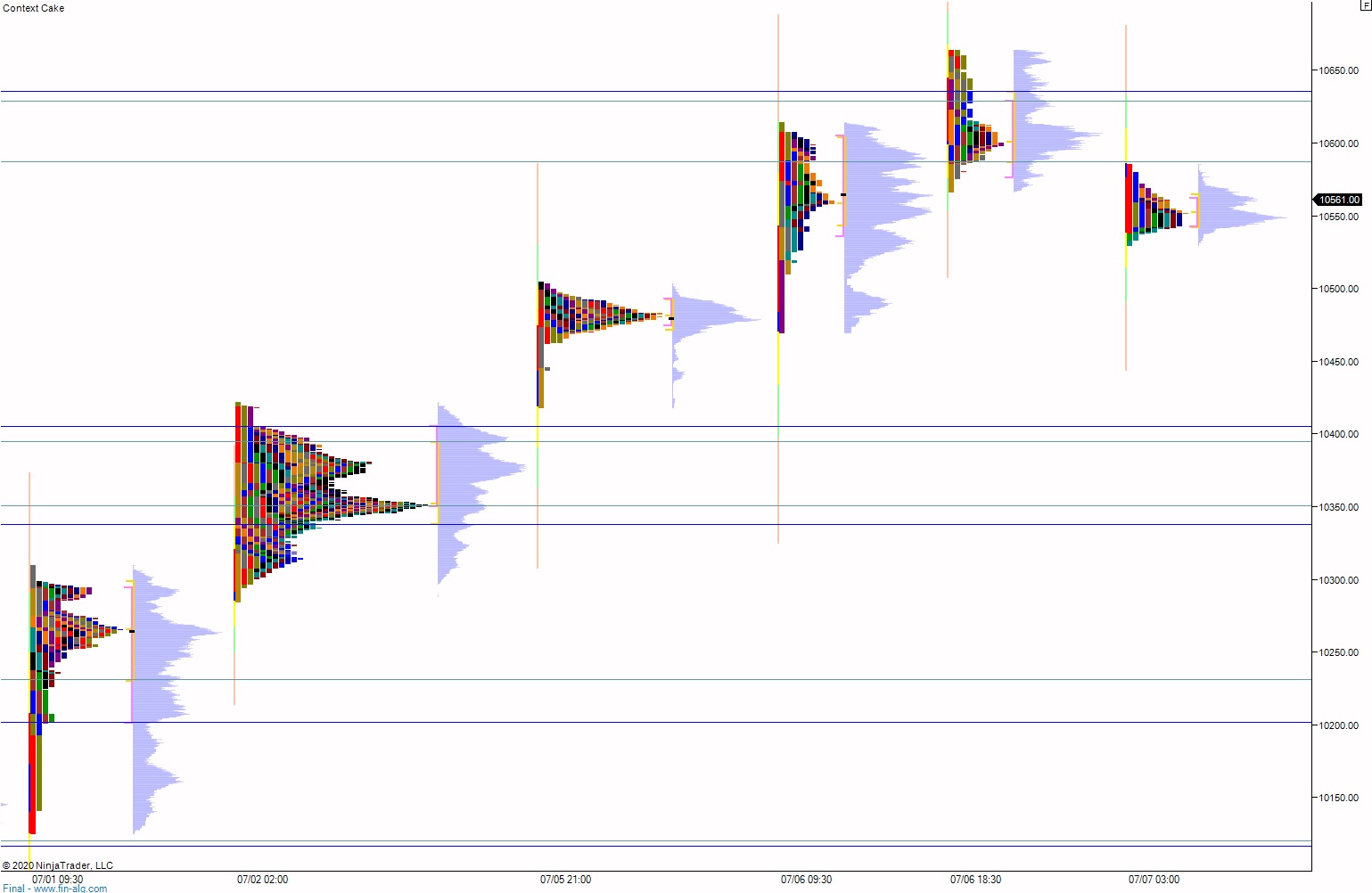

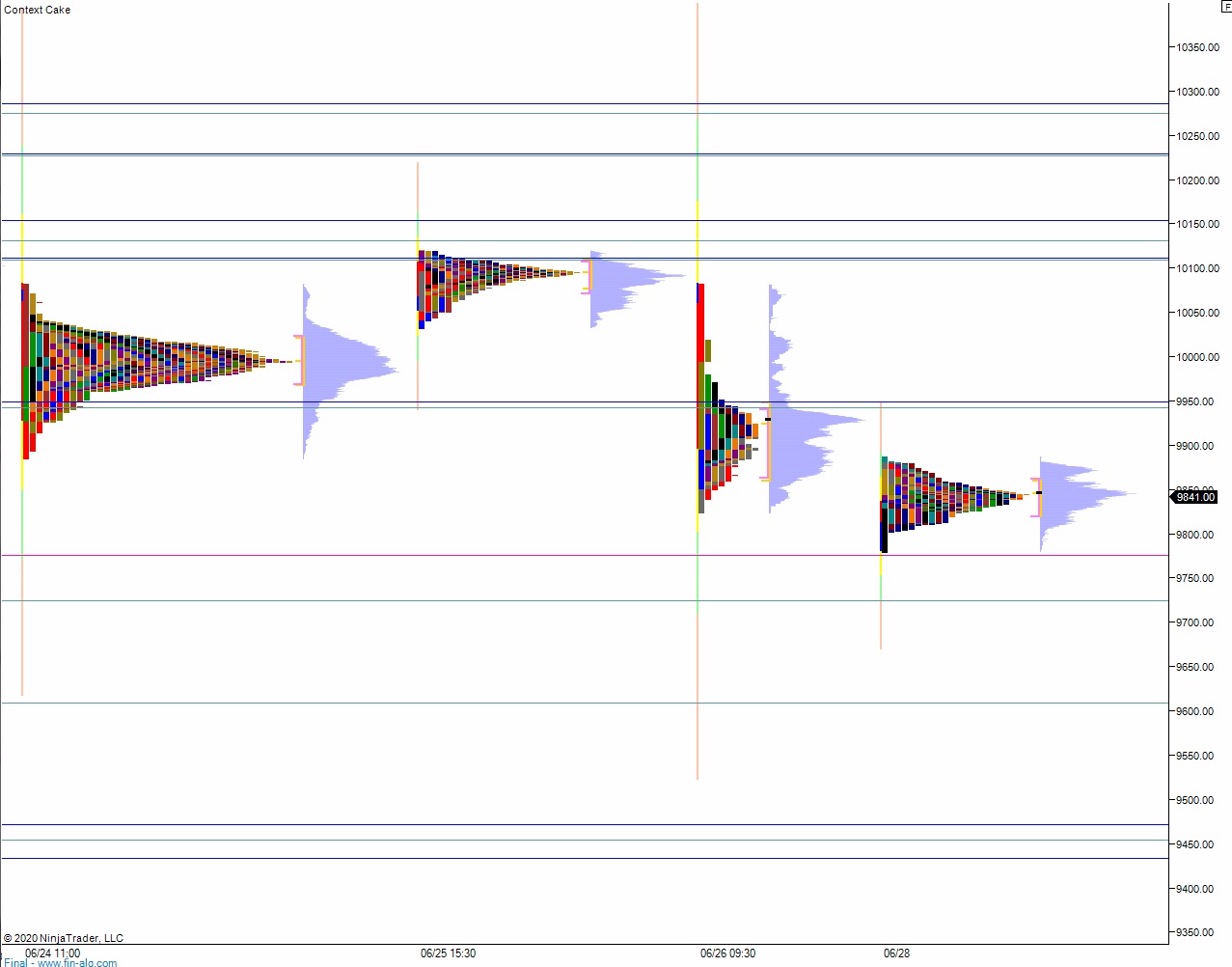

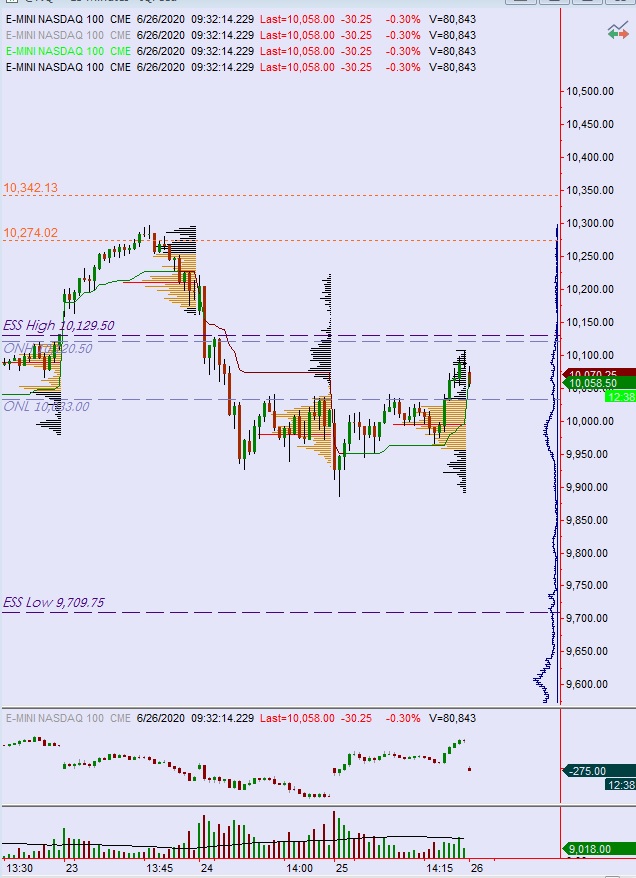

Yesterday we printed a trend up. The session began with an open-test-drive inside last Friday’s range. After a brief test lower buyers stepped in and spent the entire session in control, driving price higher, taking us to levels unseen since July 13th. We ended the day about 80 points below all-time high.

Heading into today my primary expectation is for buyers to gap-and-go higher, taking out all-time high 11,058.50. Look for sellers up at 11,100 and two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 10,953. Buyers reject a move back into the Monday range high 10,964.50 and two way trade ensues.

Hypo 3 stronger sellers reverse Monday’s trend, driving down to 10,900 early on then continuing to 10,800.

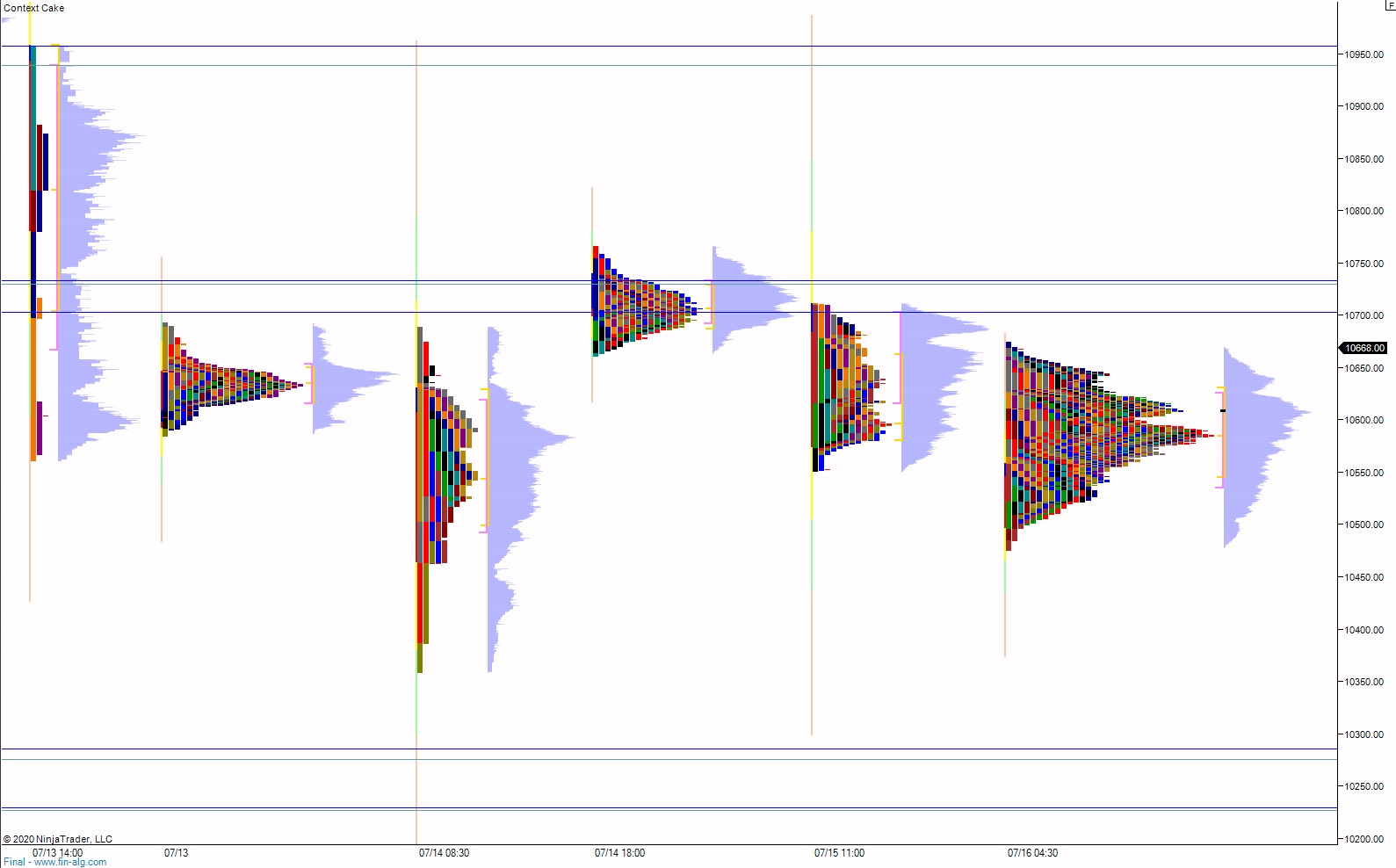

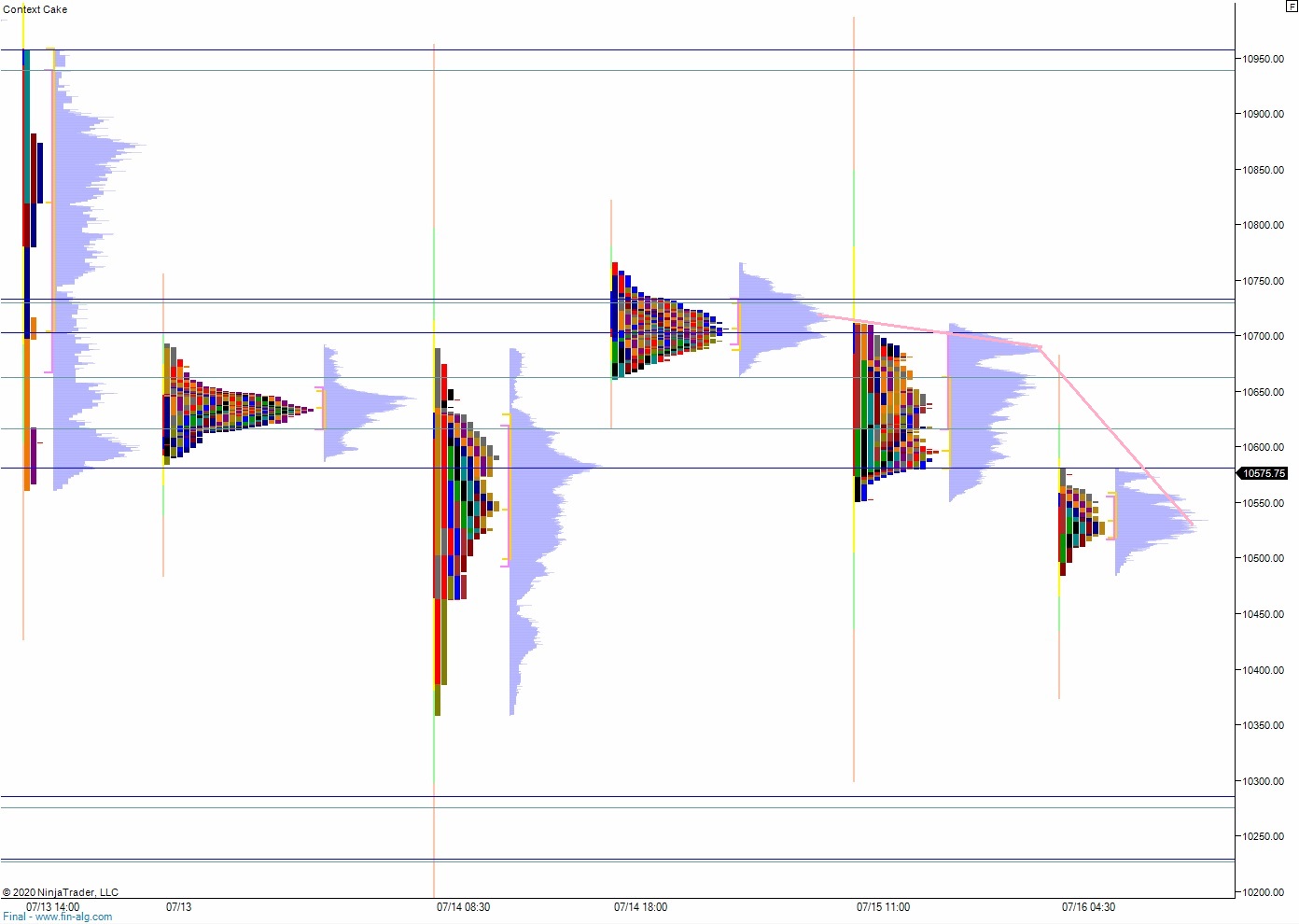

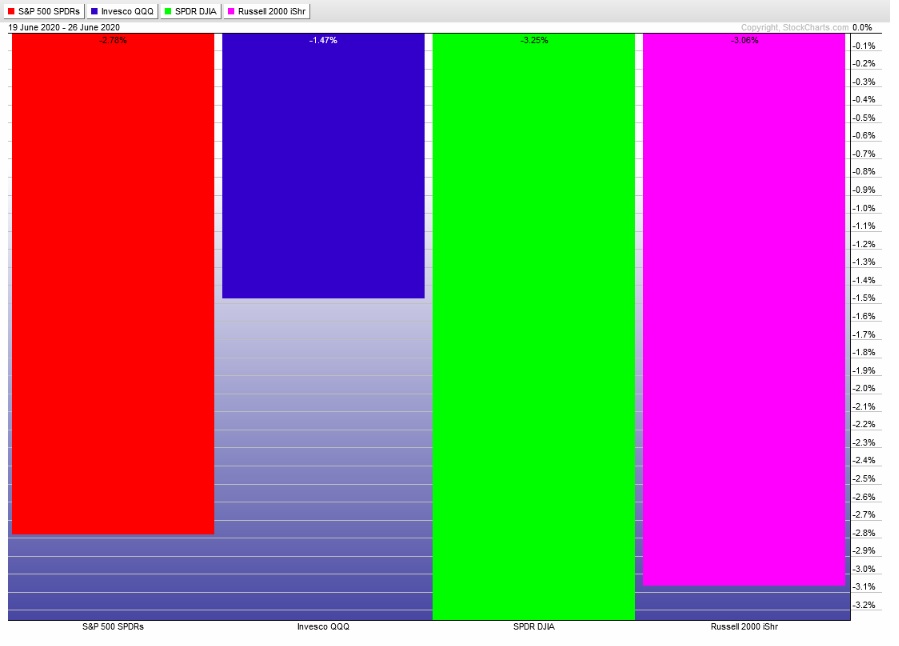

Levels:

Volume profiles, gaps and measured moves: