NASDAQ futures are coming into Monday with a slight gap up after an overnight session featuring elevated range and volume. Price was balanced overnight, grinding along the bottom-side of Friday’s midpoint. As we approach cash open, price is still hovering below the Friday mid.

On the economic calendar today we have JOLTS jobs openings at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

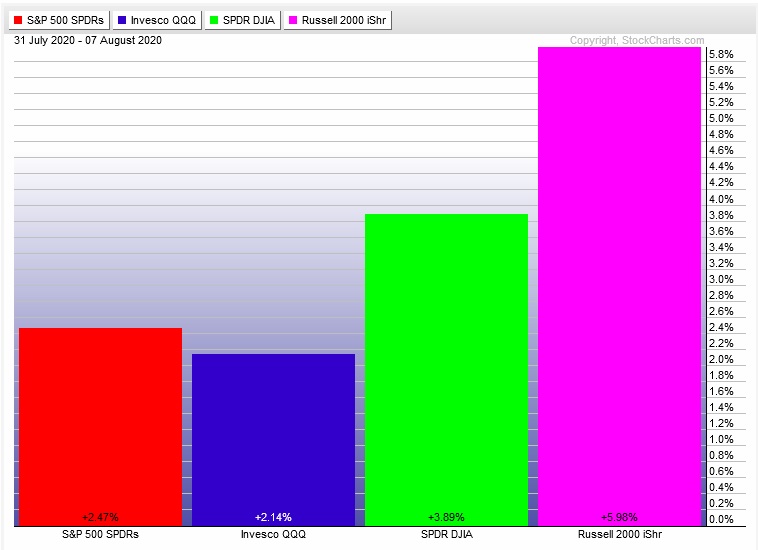

Last week kicked off with a gap up across all major indices. Then after a few days of sideways auction price rallied hard Thursday on the wings of Big Tech. Friday we experienced some selling across the board except for on the Russell, which demonstrated divergent strength into the weekend. The last week performance of each major index is shown below:

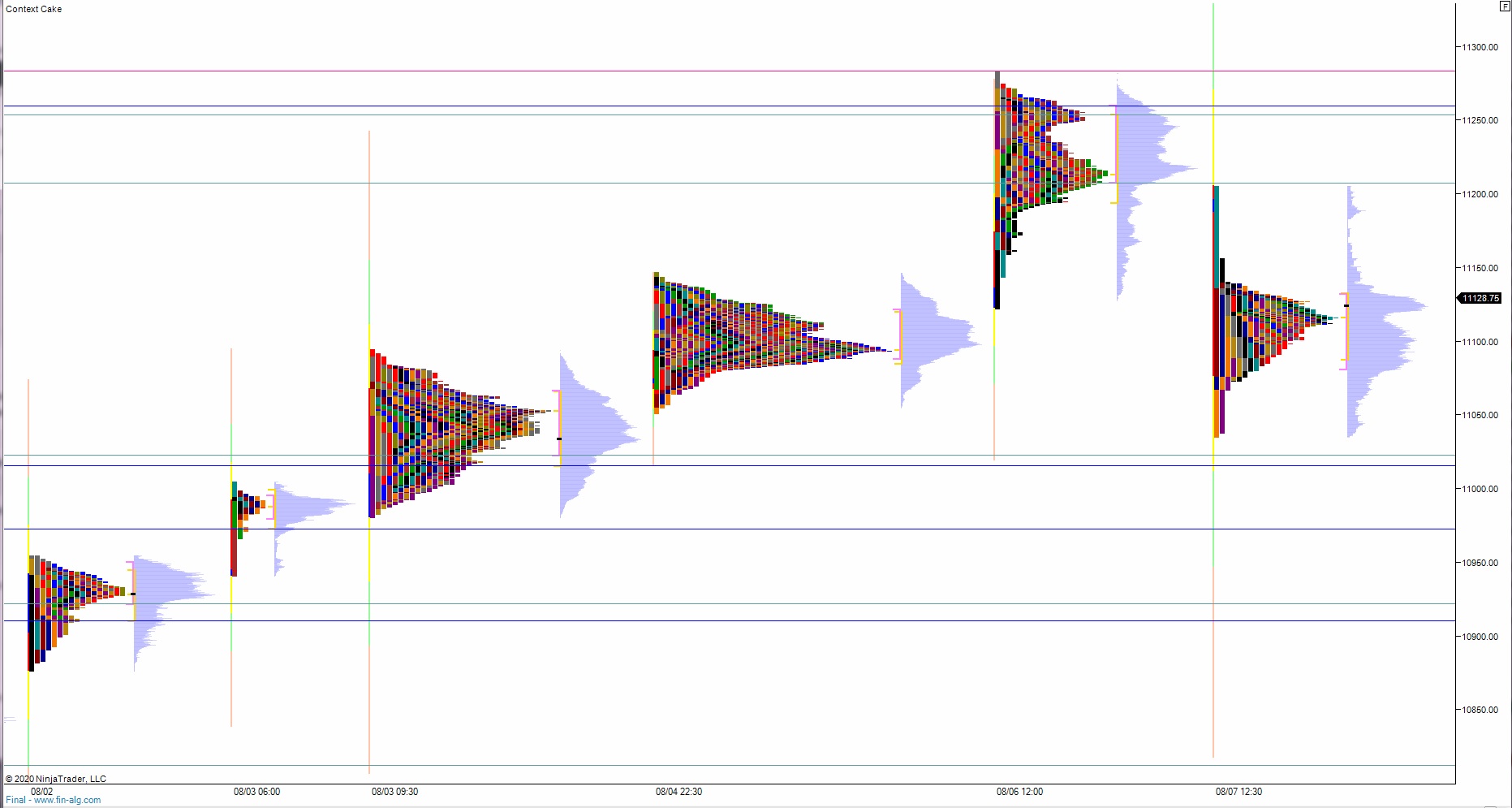

On Friday the NASDAQ printed a neutral extreme down. The day began with a slight gap down, still well up into the upper quadrant of Thursday’s range. After a two way auction buyers closed the overnight gap and even pressed range extension up late in the morning. Said buyers could not, however, extend their gains beyond Thursday’s high. Instead a strong wave of responsive selling pushed in and erased all the day’s gains and pushed us into a neutral print. Sellers rejected an attempt back up into the initial balance and this introduced heavier selling, selling that reversed all of Thursday’s range and eventually tagged last Tuesday’s naked VPOC nearly to the tick. We ramped into the bell but still closed in the lower quadrant of Friday’s range.

Neutral extreme, barely.

Heading into today my primary expectation is for buyers to take out overnight high 11,156.50setting up a move to tag 11,200 before two way trade ensues.

Hypo 2 sellers press down through overnight low 11,073 setting up a tag of 11,000 before two way trade ensues.

Hypo 3 stronger sellers liquidate down to 11,023.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: