The Nasdaq composite is up slightly overnight on a balanced session of trade. One of the economic releases I will be watching today is the 10am Existing Home Sales and whether it stimulates trade in my shares of Zillow. There are no other major economic reports out today, but we do have a slew of earnings on tap in the coming days which may materially affect the manner in which the NASDAQ trades.

The long term auction is in the process of balancing via a bracketed trade. My goal in these conditions is to locate bracket extremes as well as the midpoint and base my risk around these parameters. Currently I estimate we are below the midpoint but far enough away from bracket lows to justify reducing risk a bit. As this balance progresses, the parameters will become more clear. This process is more art than science.

The intermediate term swing trade is buyer controlled. I decided to change my interpretation of the intermediate term timeframe recently. The intermediate timeframe is not something I measure in time, but rather by the swing trade occurring. Buyers control the current swing but are tasked with either printing a higher low, a higher high, or both. Thus even through the control the current swing, their control is still in question. See below:

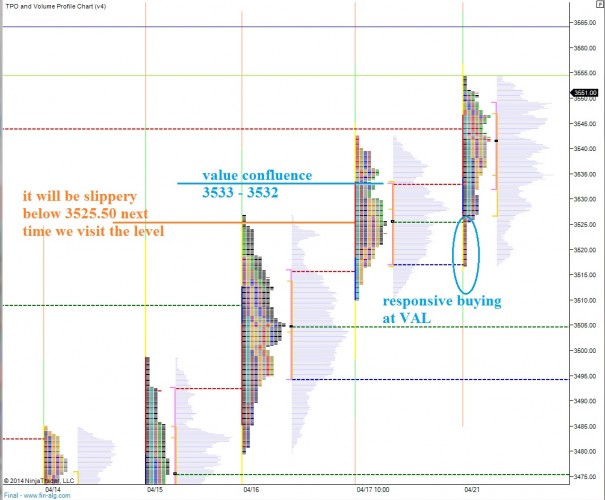

The short term auction is buyer controlled. We are seeing their force abate slightly as value begins to overlap. However buyer participants came into Monday seeking lower prices and when they saw a perceived discount they snapped it up. Look at the strong responsive buying tail we printed yesterday as well as the follow though initiating buyers who closed us near the high of the session. This is a solid example of a buyer controlled market profile:

If you enjoy the content at iBankCoin, please follow us on Twitter