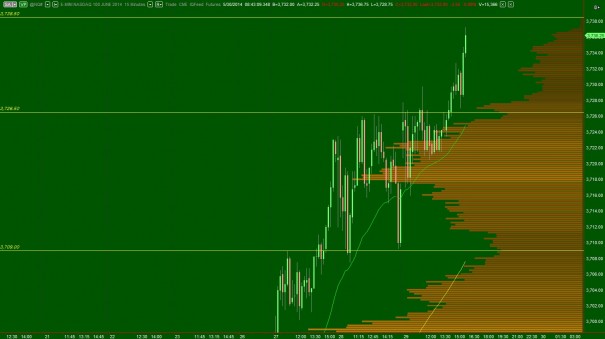

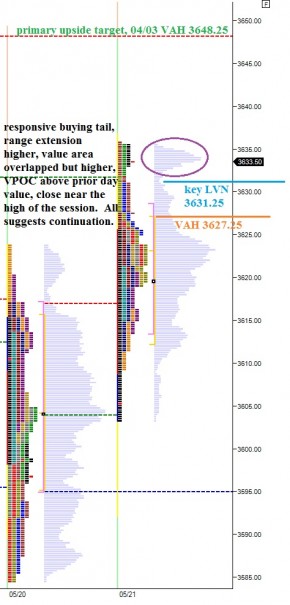

We are coming into the month with a slight gap higher. We are currently priced to open inside of range and balance from our previous trading day (Friday) which suggests we are in a lower risk/reward environment. We have some manufacturing data coming out at 10am and a few treasury bill auctions at 11am.

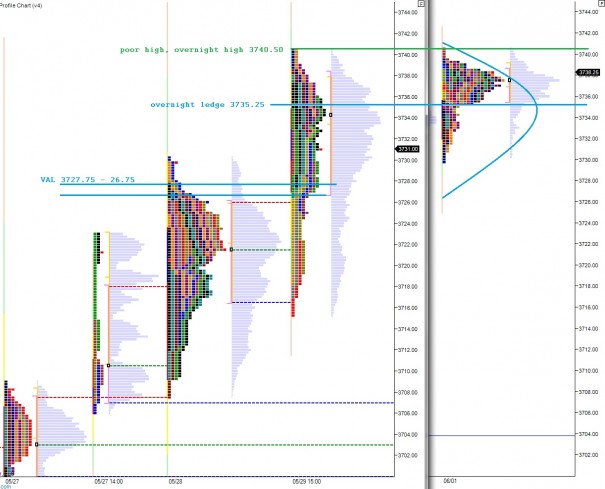

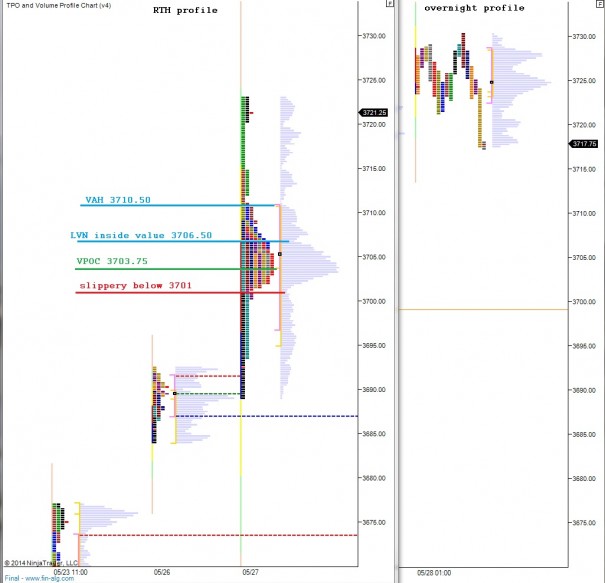

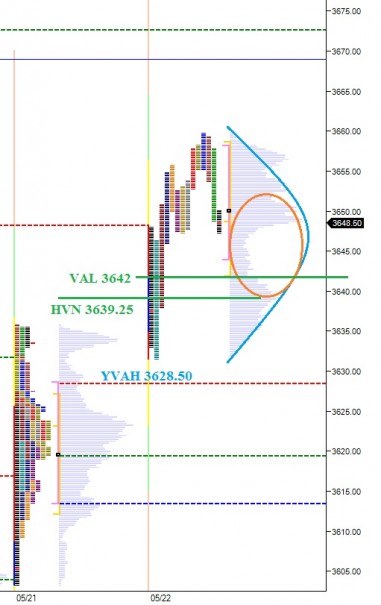

The long term timeframe left the balance bracket behind as buyers took the reins of control last week. The question now is the impact we will see from the above supply we are pricing into. See below:

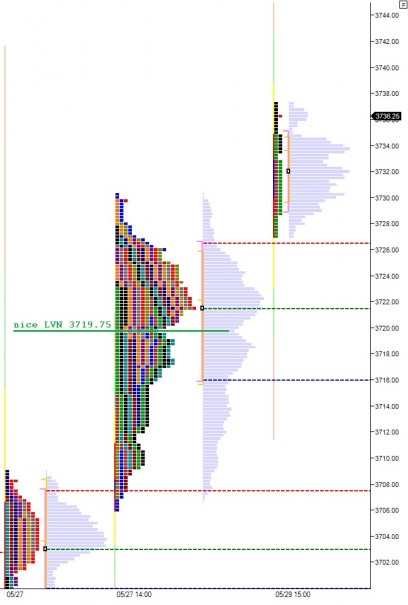

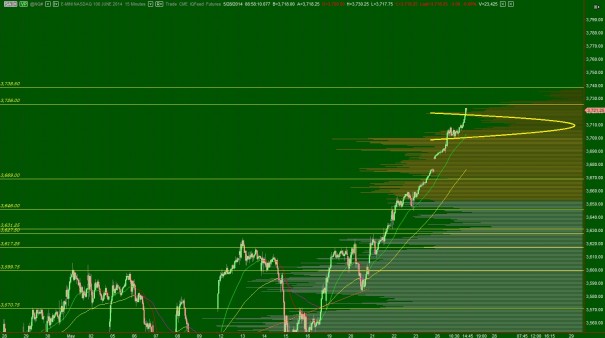

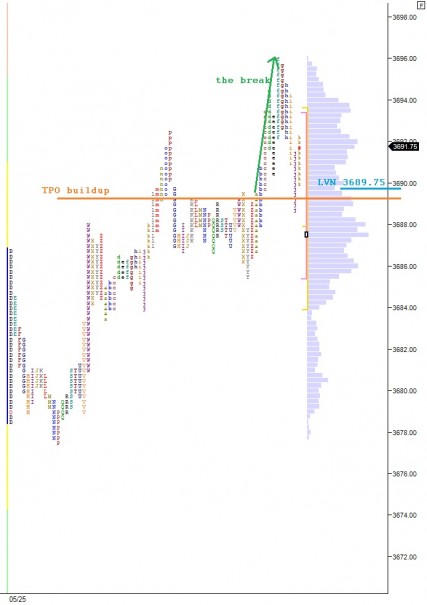

Turning our attention to the June contract, our front month contract for the next few weeks of futures trading, we are trading just a touch below all time contract high. Buyers sustained control of the intermediate timeframe into the close of last week. It will be interesting to see if they continue controlling the tape or whether we come into balance. See below:

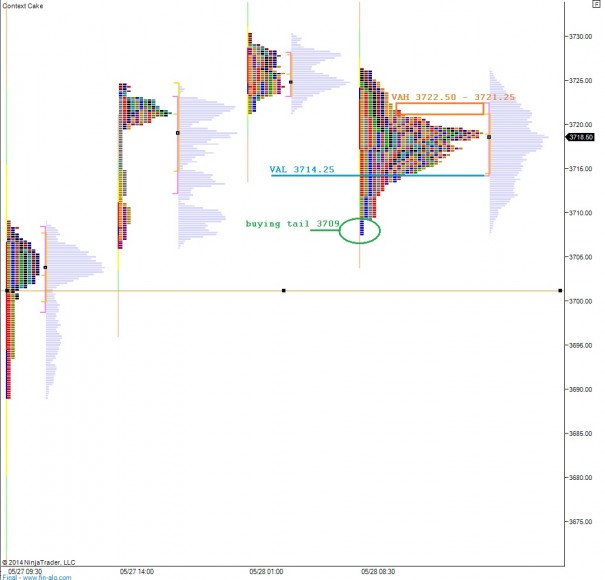

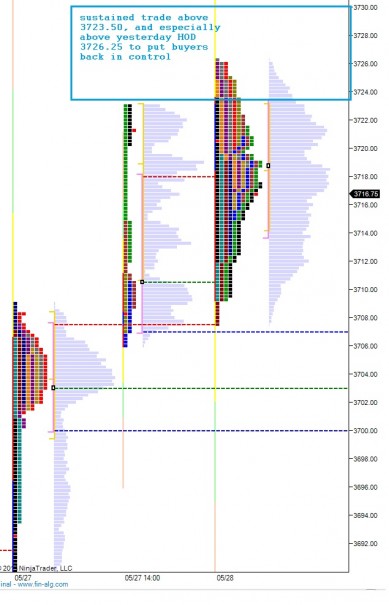

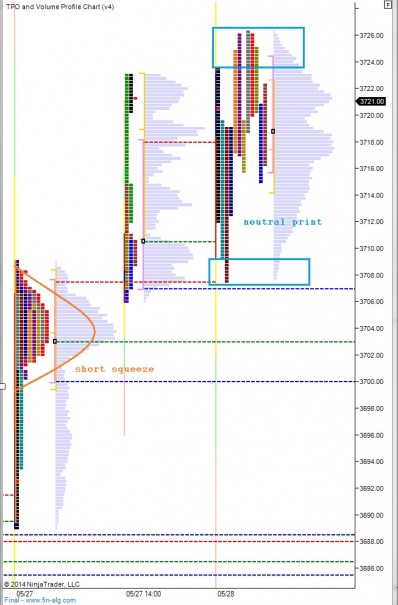

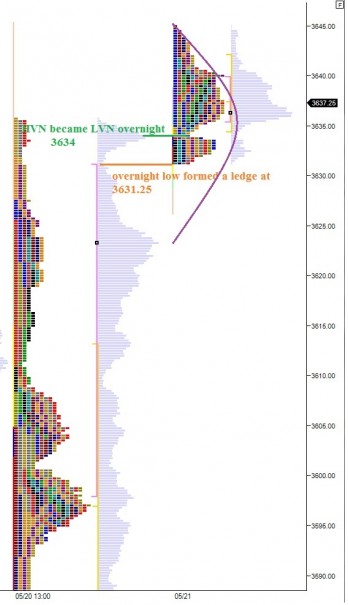

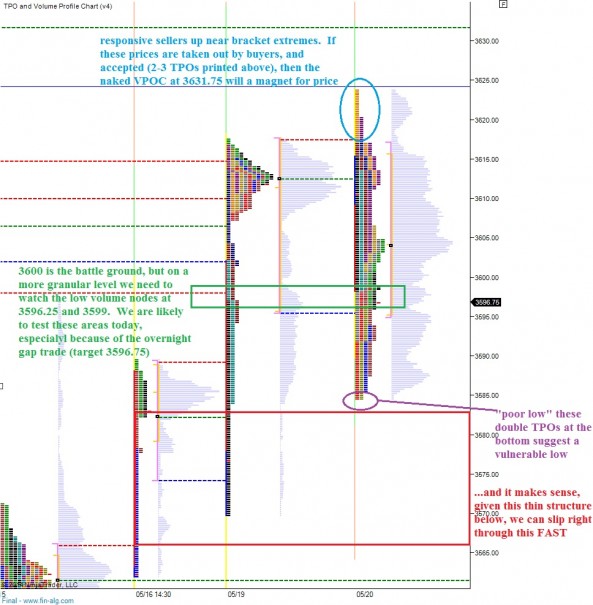

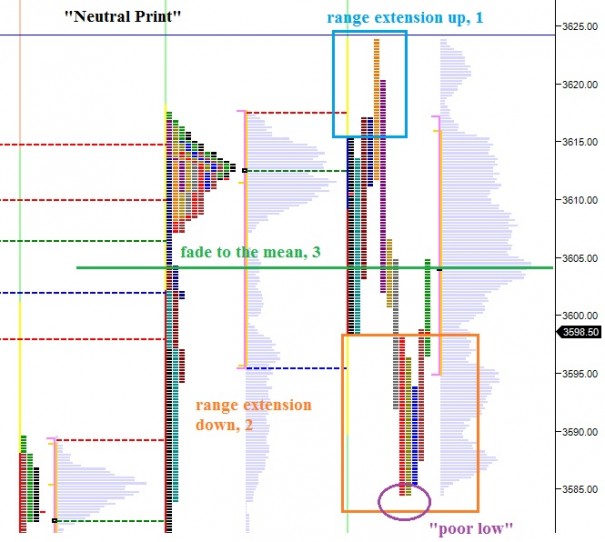

The short term auction has some interesting market profile context. You can see a ledge formed overnight and the potential for us to trade lower and rotate through Friday’s balance. Whether this ledge gives way or not early on will be a key component of early trade. We also have a “poor high” from last week, where two TPOs printed at the high, this lines up with the overnight high of 3740.50 and overall looks vulnerable. See below: