Nasdaq futures were set to drift lower overnight after some mixed afterhours trade in Google and IBM added a layer of uncertainty into the trading environment. Drift lower they did until about 7am when a low volume ramp higher occurred. Since then we had jobless claims which was received initially with a push higher. We are currently trading inside balance and inside range from yesterday which suggests a lower risk/reward environment.

The intermediate term auction is interesting. Sellers came in where I expected yesterday, which was a patch of low volume nodes on the composite profile. Their response was perhaps exaggerated a bit by the afterhours earnings which kicked off the selling. Sellers still retain control on the intermediate term, but the most recent swing bounce has been the sharpest yet which leads me to wonder if the velocity will be enough to get us higher. Above yesterday’s high we begin to enter a zone of fast trade. First let’s observe the intermediate term trend:

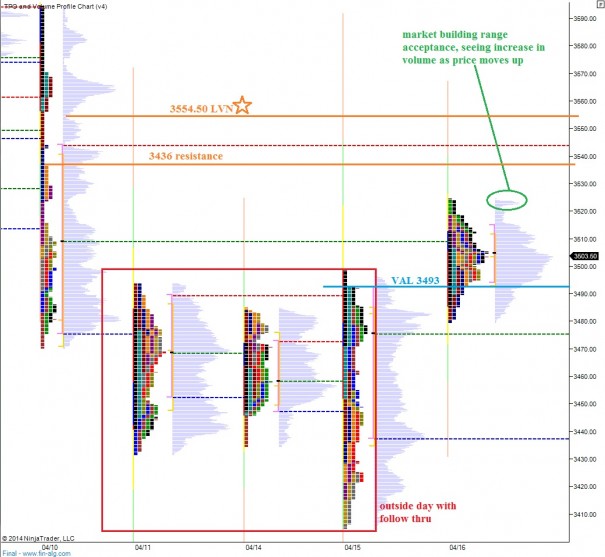

Now we can increase the magnification and observe the short term auctions. Tax day, 04/15, we printed an outside day where price exceeded both the high and low of the prior day. In this case, it was actually the prior two days. Yesterday confirmed the outside day by migrating value higher. These two bits of context tell me buyers control the short term auction. Volumes are lower given the holiday climate, but you can still see a clear distribution formed yesterday. One subtle footprint however is a spike of volume near the highs. Normally we would expect to see volume thin out at the extremes—if we are in balance. This suggests increasing prices facilitated more trade and that an imbalance may exists. I have highlighted this occurrence a few other observations on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

i coulda sworn your title said peeing thru the looking glass. I need more coffee.

that avvi is getting to your ka kutz!

yeah..I’m still here..watching the close.

and doing this:

Status Filled at $4.77

Symbol FXEN

Description FX ENERGY INC

Action Sell

Trade Type Cash

Market Session Standard

Order Date 04/17/2014, 03:24:51 PM ET

also sold a a couple lots of WPRT here:

Status Filled at $13.61

Symbol WPRT

Description WESTPORT INNOVATIONSINC COM NPV ISIN #CA9609083097 SEDOL #2956811

Action Sell

Trade Type Cash

Market Session Standard

Order Date 04/17/2014, 02:10:56 PM ET

will hold last lot scoop from 2 days ago(did not post entry)

04/15/2014 YOU BOUGHT

WPRT WESTPORT INNOVATIONS INC COM NPV ISIN #

Cash Shares: +****.000 Price: $12.62

*continue to hold FXEN at $3.30

Happy Easter all you Beautiful People