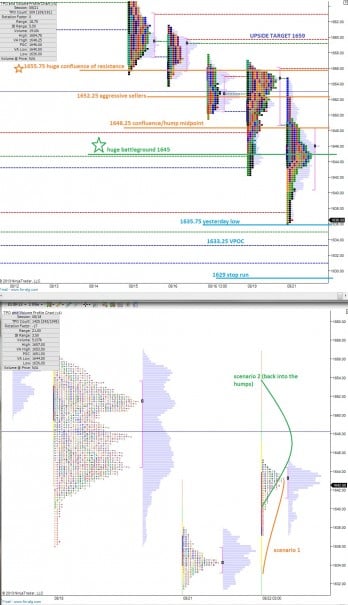

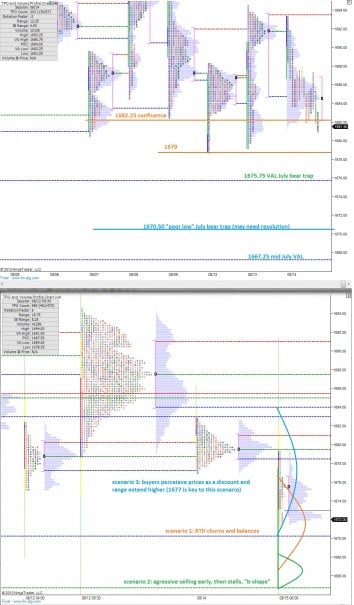

Large waters overnight in the S&P 500, where the globex session printed a 14 handle range. Wednesday’s late afternoon selloff continued into the evening before stabilizing around 9pm at 1631.50, which is right at the lows of 07/08, the Monday after Independence Day. As of this writing, the market stalled out 1645.25 which marks yesterday’s volume point of control (VPOC) and also the tip of the lower breast we observed yesterday afternoon.

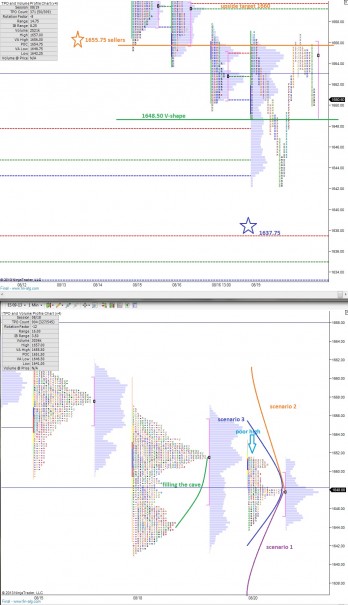

The upward rotation overnight picked up steam around the European open, and put the squeeze on from 1637.75 – 1643.75. What I mean to say is the market made no pause or rotation lower throughout the entire move upward, giving overnight shorts little room to cover.

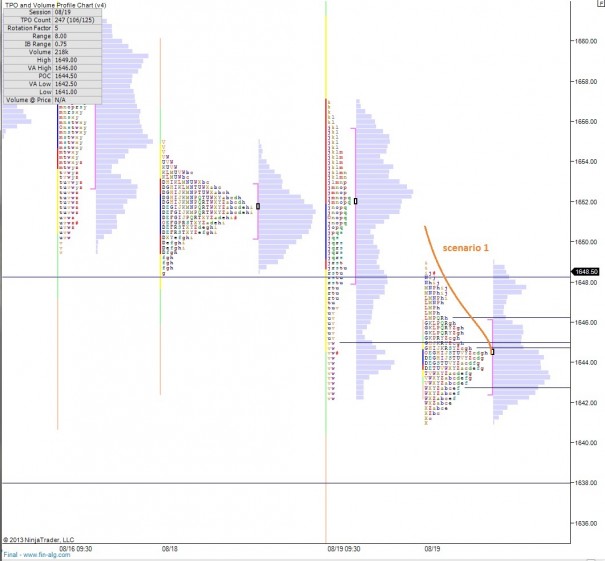

Since then the market has stalled a bit, but is aligned in such a manner that welcomes bulls back into the tape. Whether or not they will oblige early on is debatable.

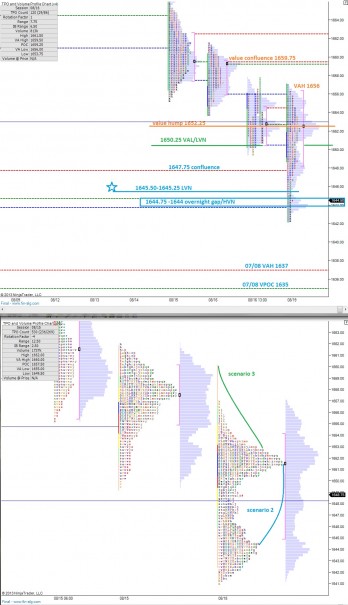

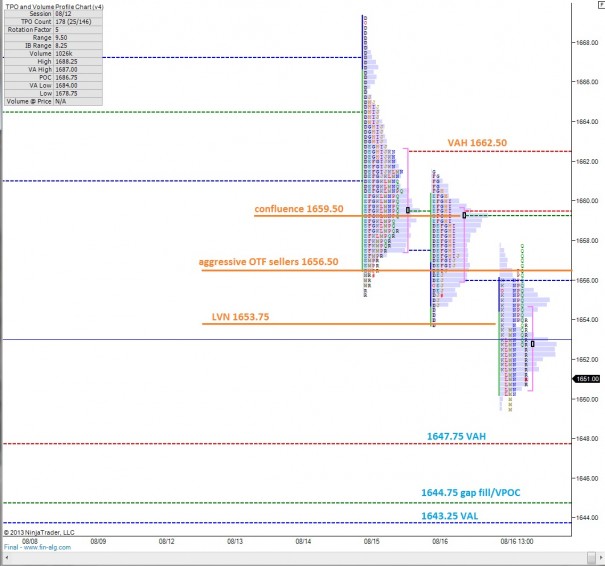

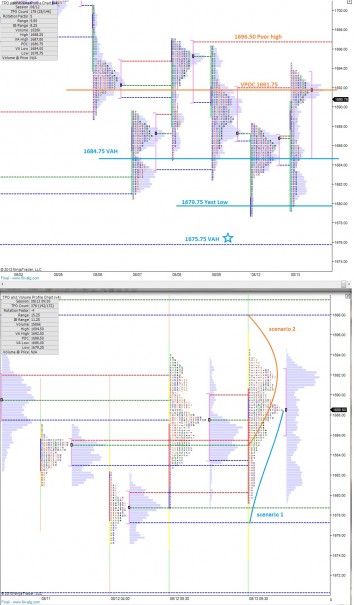

I’ve split the overnight profile into two parts to emphasize the short squeeze P-shape that developed and highlighted a few scenarios for today’s trade. I’ve also marked the RTH profiles with levels of intraday opportunity on the following profile charts:

Comments »