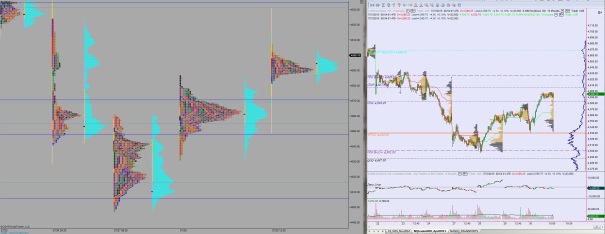

Today marks the fifth statistically normal session of globex trade in the Nasdaq. The action was balanced overnight until we saw buying pressure pick up at the 8:30am mark. As we head into cash open price is pushing above yesterday’s high and up into the contextual pole—a market profile feature.

The economic calendar is quiet to end the week. The University of Michigan will provide us a final read of Confidence for July at 10am and Baker Hughes will tell us how many rigs they counted at 1pm.

Yesterday we printed a double distribution trend day up. This day-type has tons of directional conviction but not as much as a full-on trend day. It started with a gap down and sellers proceeded to take out Wednesday’s low before finding responsive buyers at value area high from 7/27. Buyers became initiative late in the morning and continued to take risk throughout the session.

Intermediate term we’ve bounced off the check-back to the breakout. Their challenge is sustaining this strength and not succumbing to a push back below the breakout area around 4500. Keep an eye on Nasdaq transports too because they’re back at range high—a place where I expect sellers to defend. Finally bear in mind that Monday is a new month. New months that start on Monday are statistically bullish.

Heading into today my primary expectation is for early action to give way to quiet summer trade. I will look for buyers to press the pole climb up to target 4631.75 before 2-way trade ensues.

Hypo 2 deals with the shelf built at 4588. If sellers push down through it, look for a move to take out overnight low 4583.25 and a test of the value area high at 4570.

Hypo 3 is a full on barn burner to recapture the Apple gap down (7/21) up to 4668.25.

If you enjoy the content at iBankCoin, please follow us on Twitter