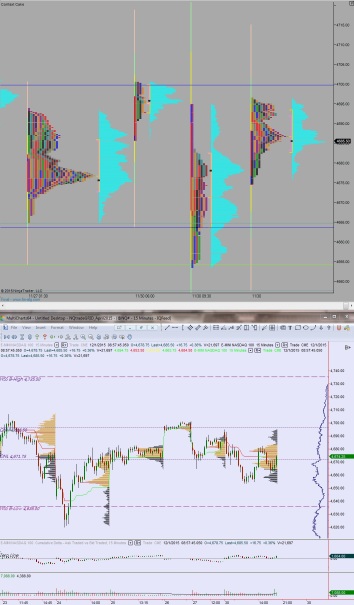

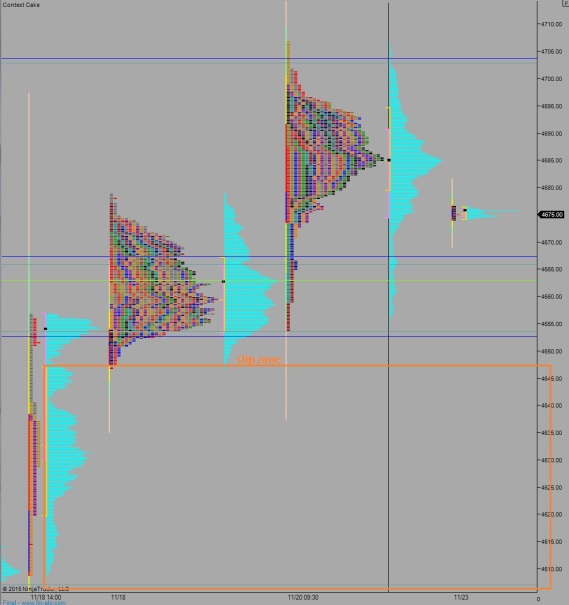

Futures are flat on the NASDAQ after an overnight session that featured normal volume and range. The Globex session was balanced with price holding up above the high print from yesterday. A wave of selling pushed through around 7am when the Russian defense ministry released evidence of Turkey purchasing ISIS oil. At 7am MBA Mortgage Applications came in better than expected. Same goes for ADP Employment Change which was released at 8:15am.

On the economic docket during the cash session we have crude oil inventory data at 10:30am. Yellen is set to speak at 11am but her testimony takes place tomorrow. I am not sure if today will have much impact on the markets but it is work keeping in mind. We also have the Fed Beige Book at 2pm.

Yesterday we printed a normal variation up day. Price opened gap up and buyers were seen defending the gap. Later in the day aggressive buying managed to close out the session near up at the high.

Heading into today my primary expectation is for sellers to push down and test down to 4703.50. From there look for responsive buyers who make a move on overnight high 4728.75. Just above at 4729.50 is contract high. Look for a push above it to target 4735.50 then two way trade ensues.

Hypo 2 sellers push down through 4700 to target 4693.75. Look for responsive buyers down at 4691.25 and two way trade to ensue below 4710.

Hypo 3 strong buying early, up through 4735.50 and exploration of new highs.

Hypo 4 liquidation takes hold. A push down through 4691.25 sets up a gap fill trade down to 4674.25.

Levels:

Comments »