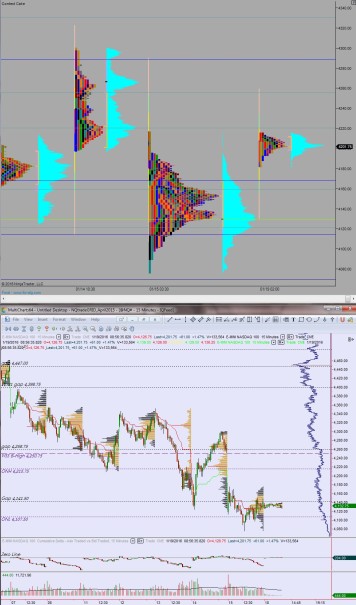

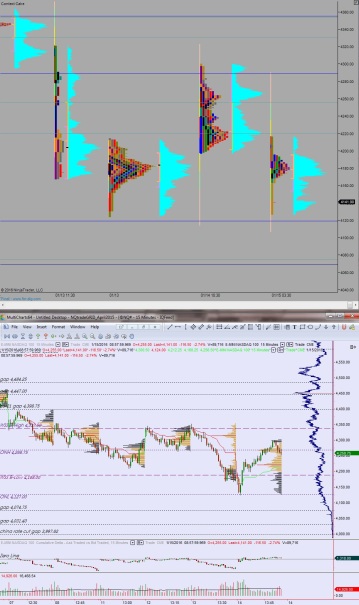

NASDAQ futures are priced to start the week out gap down after an overnight session featuring elevated [but not extreme] range and volume. Price managed to briefly push above the high print from last Friday before settling into balanced trade.

The economic calendar is light today with only a 3- and 6-month T-Bill auction at 11:30am to be aware of. Remember, Wednesday afternoon we have The Fed Rate Decision which is the highest impact event for the market currently.

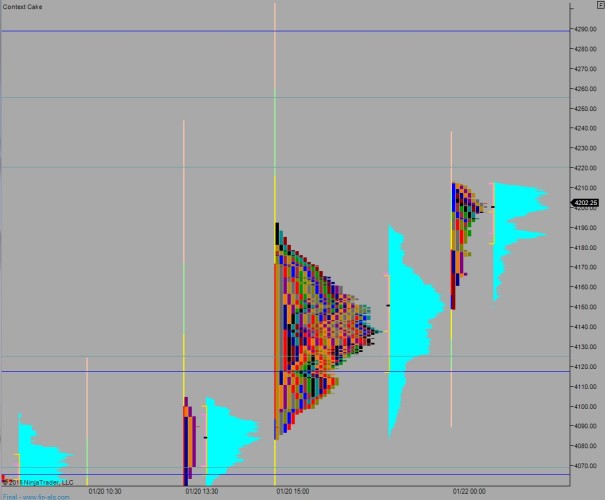

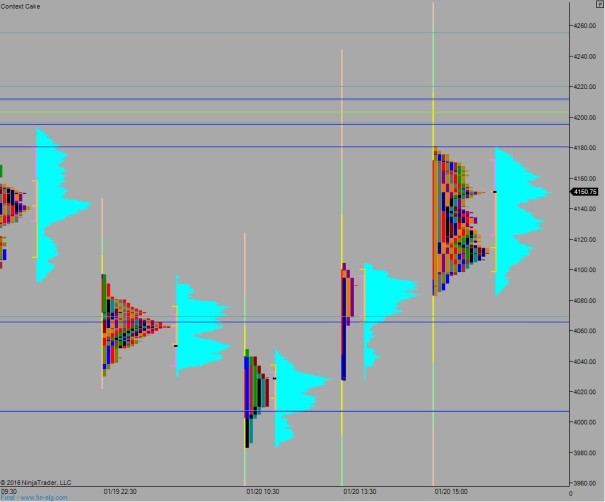

We came into last week on a Tuesday. Markets were closed Monday in observation of Dr. Martin Luther King day. On Tuesday price opened gap up and we spent the day working lower. Responsive buyers stepped in at the end of the session. Tuesday opened pro gap down and drove lower all morning. The action found a strong responsive bid by early afternoon and we spent the rest of the week auctioning higher.

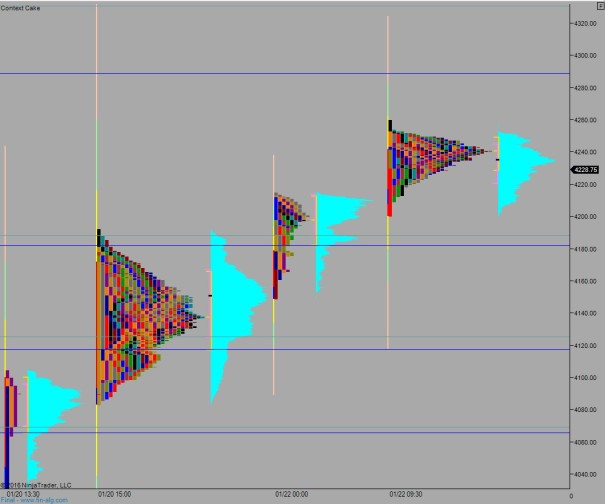

Last Friday opened with a big gap up and price was set on a slow grind higher.

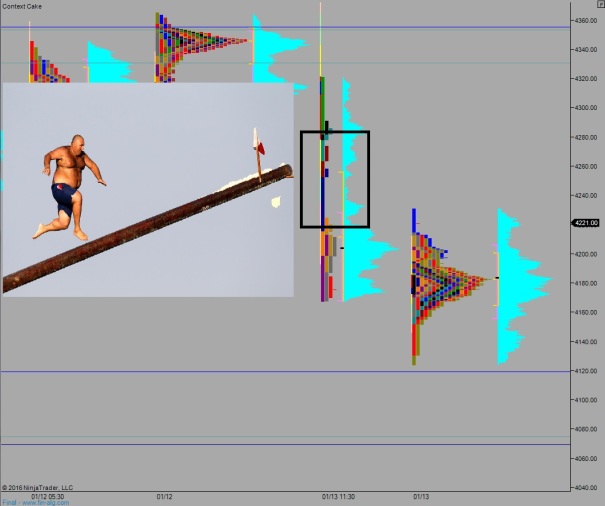

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4247. Then look for a test above last Friday’s high 4253 however sellers step in ahead of overnight high 4260 and work us back down through the range to take out overnight low 4218. This sets up a move down to 4188.25 before two way trade ensues.

Hypo 2 buyers fill overnight gap up to 4247 then set their sights on overnight high 4260 which also lines up with the 4258.75 open gap from 01/14. Look for buyers to sustain trade above this level setting up a move to target 4288.50 before two way trade ensues.

Hypo 3 buyers cannot fill overnight gap. Sellers take out overnight low 4218.50 and work down to 4188.25. The initial buyers in this region are overrun and we continue lower to target 4154.25 before two way trade ensues.

Levels: