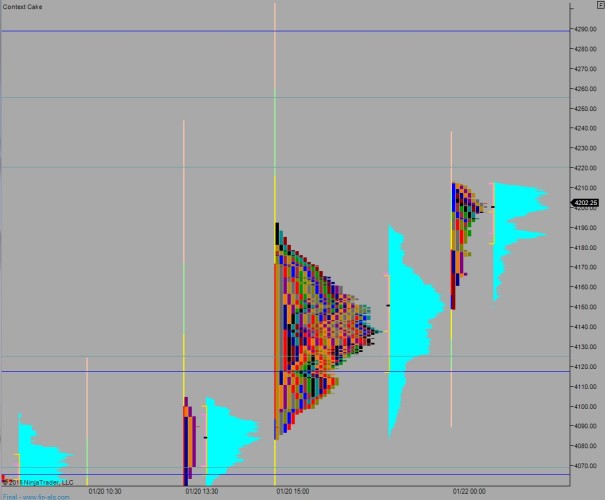

NASDAQ futures are priced to open pro gap up after a Globex session featuring extreme range and volume. After a balanced session through midnight, price trended up to make a new high on the week. Responsive sellers stepped in right at the midpoint from last Thursday.

On the economic calendar today we have Markit Manufacturing PMI at 9:45am, Existing Home Sales and Leading Indicators at 10am, and the Baker Hughes Rig Count at 1pm.

Yesterday we printed a normal variation up. Price opened gap up and we had a rejection reversal sell on the open. Responsive buyers stepped in around the 4100 century mark and made a hard push higher which transitioned into a sideways, grinder market.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 4187. Look for responsive buyers here (responsive relative to the open, initiative relative to yesterday close) who reject an attempt back into Thursday’s range. Then look for a move to take out overnight high 4213. Responsive sellers show up at 4220.25 and two way trade ensues.

Hypo 2 buyers push up through 4220.25 and sustain trade above it, setting up a fast (pocket) move up to 4255.50 before two way trade ensues.

Hypo 3 sellers aggressively work into the overnight inventory, make short work of 4187 and test down to 4166. Responsive buyers show up here but are overrun and we continue lower to fill the overnight gap down to 4130.25. From here take out overnight low 4119. Look for a strong responsive bid down at 4117.25.

Levels:

kudos for the color

no prob, that’s what I do proB