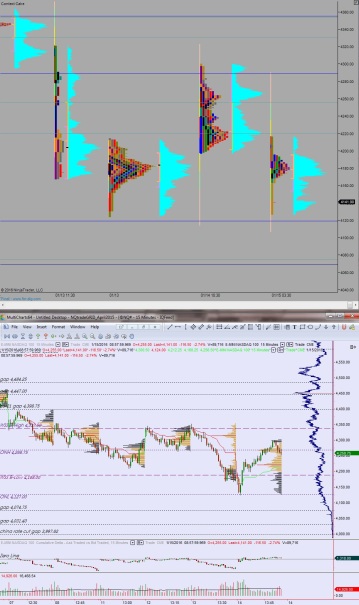

NASDAQ futures are down about 120 points heading into Friday after an extreme session both in volume and range. Price spent the entire session trending lower, and we are set to open right around the low print from yesterday. At 8:30am Advance Retail Sales data came out in line with expectations, but worst than expectations ex Gas and Auto. At 8:30am Empire Manufacturing also came out and was surprisingly low at nearly -20%. The initial reaction to the news is hard selling–price is lower by nearly 40 points since the data.

Also on the economic calendar today we have Industrial/Manufacturing Production at 9:15am, U of Michigan Confidence read at 10am, and the Baker Hughes rig count at 1pm.

Yesterday we formed a double distribution trend day up. Price opened gap up and quickly faded lower to take out overnight low before finding a strong responsive bid and grinding higher. Sellers stepped in toward the end of the session.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade back up to 4175 (the scene of the 8:30am data). Look for initiative sellers here (initiative relative to yesterday’s close, responsive relative to the open) who work to take out overnight low 4127. Look for responsive buyers t 4119.75 and two way trade ensues.

Hypo 2 gap and drive lower. Take out 4119.75 and set our sights on the open gap down at 4074.75. Look for a strong responsive buyer here.

Hypo 3 buyers push up through 4175 and sustain trade above it to set up a secondary leg to target yesterday’s VPOC 4222.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter