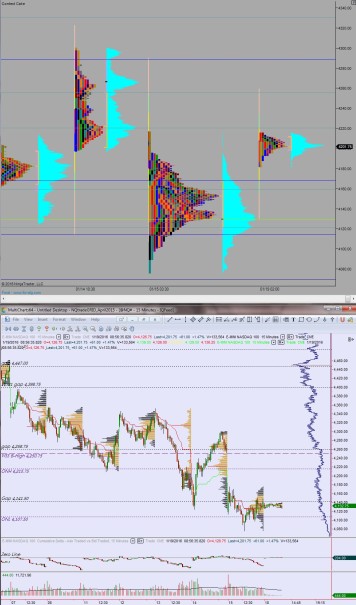

NASDAQ futures are coming into the holiday shortened week pro gap up after an extreme overnight session. Both range and volume are beyond third sigma on price that held last Friday’s low before working up to last Thursday’s midpoint. The market has held a tight balance since about 4am.

On the economic calendar today we have NAHB Housing Market Index at 10am, 3- & 6-month T-Bill Auctions at 11:30am, and Net Long-term TIC Flows at 4pm.

Last week we started out gap up and faded lower through most of Monday before finding a late-day responsive bid. Tuesday was gap up and faded lower to close the gap before finding an early-afternoon responsive bid.

Wednesday was gap up and after making a brief weekly high, it reversed and turned into a trend day down. Thursday was gap up and had a sharp move lower to a new weekly low before finding a sharp responsive bid and trending higher.

Friday finally had a huge gap down then a grind lower that ultimately formed an excess low and came into balance.

Heading into today my primary expectation is for sellers to work into the overnight inventory to test 4168. Look for responsive buyers here to reject a move back into last Friday’s range and work higher to take out overnight high 4215.75. Look for responsive sellers just above at 4220.50 and two-way trade ensues.

Hypo 2 sellers work down through 4158 to and and work the full gap fill down to 4141.50. Look for a continued move to target 4130. Look for responsive buyers around 4121 and two-way trade ensues.

Hypo 3 gap-and-go higher. Take out overnight high 4215.75 early and sustain trade above 4220.50 setting up a secondary leg to test up to 4250.75.

Levels:

Raul, quick profile question. Has the value area gone down precipitously and now leveling out? Been reading up on market profile so I can better understand your posts. Does my question make sense?