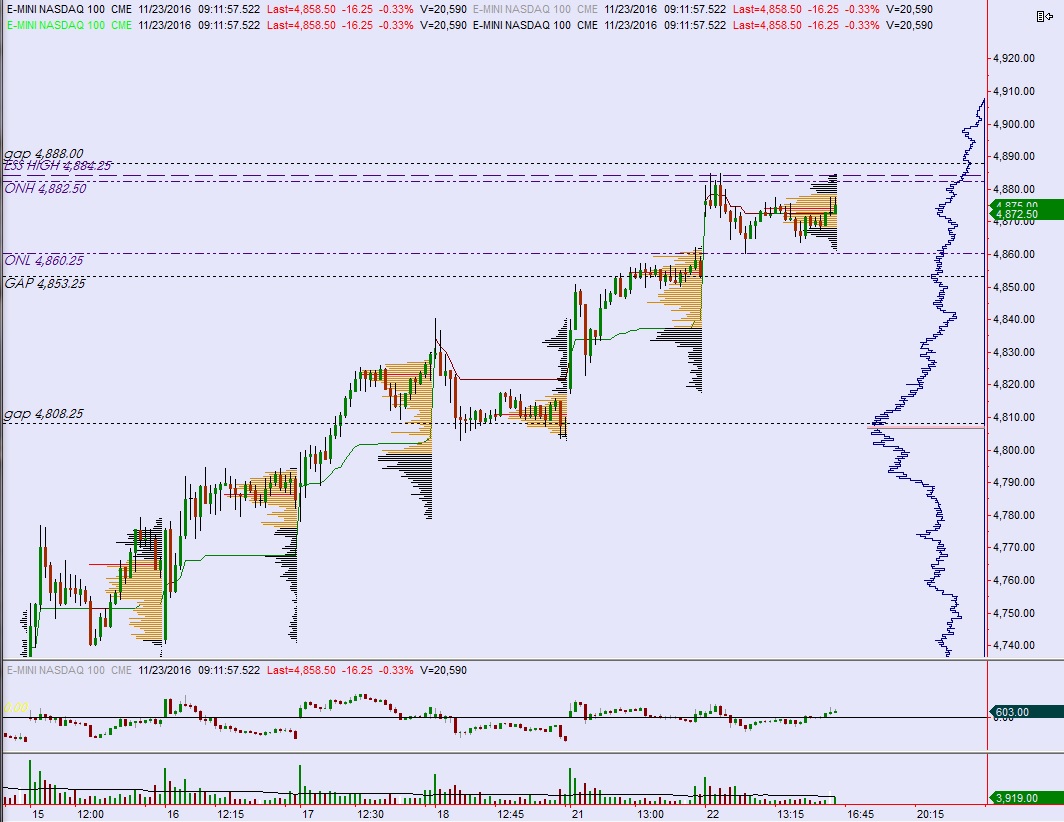

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring normal range and volume. Price worked lower overnight, and as we approach cash open the market is probing its Tuesday low. At 8:30am Durable Goods Orders were much stronger than expected and Initial/Continuing jobless claims were inline with expectations.

The key event today comes at 2pm when the FOMC will release Minutes from their November 1-2 meeting.

Yesterday we printed a normal variation down. After opening gap up we printed a weak, double high at 4884.75 before going range extension down. Responsive buyers (responsive relative to Tuesday open, initiative relative to Monday close) defended the Monday high and two-way trade ensued.

Heading into today my primary expectation is for sellers to push the Monday gap fill down to 4853.25. Buyers show up here and work up though the Tuesday weak high 4884.75 to target the open gap up at 4888 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and close the gap up to 4875 then take out 4888 and sustain trade above it setting up a move to target 4900 century mark. Stretch target is 4918.

Hypo 3 sellers trigger a liquidation after a gap-and-go lower sustains trade below 4850 setting up a move to target 4833.25.

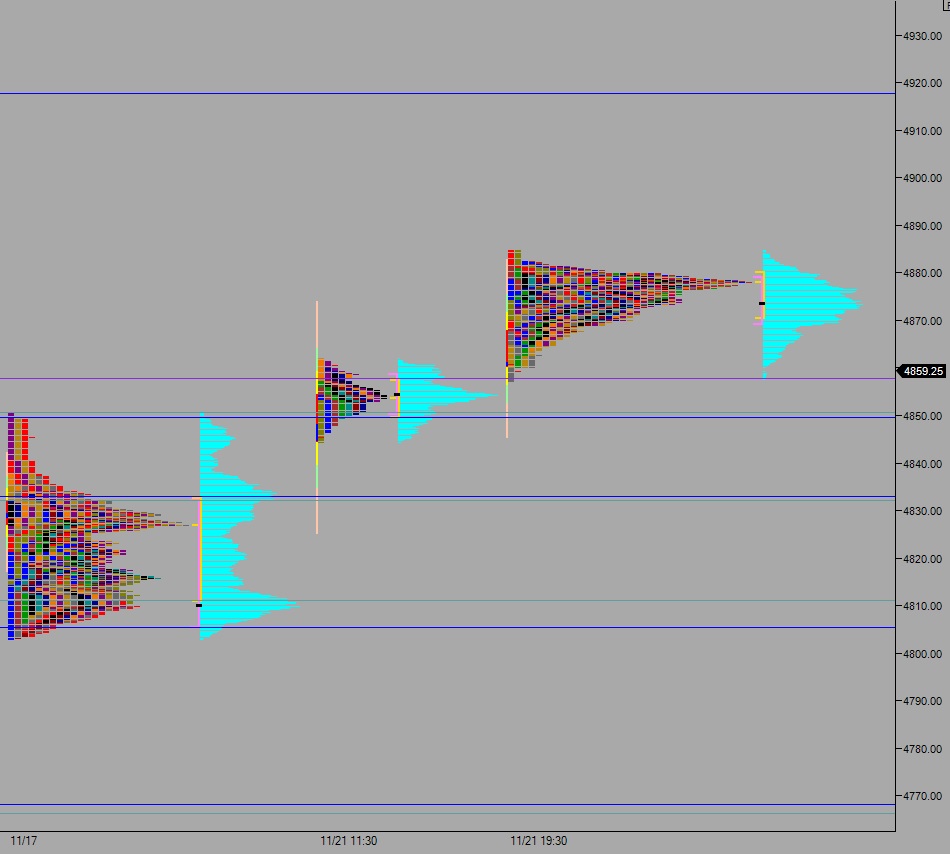

Levels:

Volume profiles, gaps, and measured moves:

twas quite an easy day to trade