NASDAQ futures are set to begin the week gap up after an overnight session featuring an elevated range on normal volume. Price briefly took out last week’s low before a hard spike rotation took price higher. Since then the action has been consolidating up above Friday’s MID.

There are only a few economic events to be aware of today–first are the 3- and 6-month T-bill auctions at 11:30am and second Fed Chair Yellen is meeting with President Obama at 3pm.

See also: Obama To Meet Yellen Tomorrow To Discuss Ways To Screw Wall Street

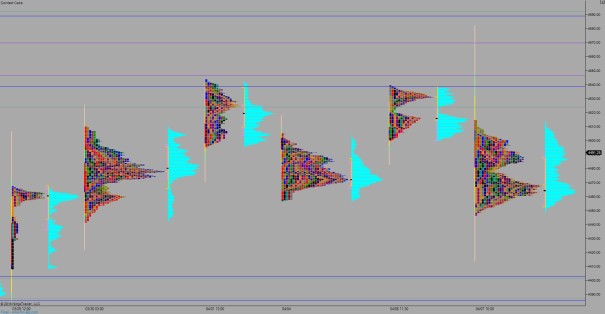

Last week price went sideways. After we spent all of Tuesday consolidating a gap down, Wednesday featured a trend up which was promptly negated Thursday by a trend down. Friday price opened gap up and faded lower, bouncing along the lows as we wrapped up the week.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4468.50. Look for responsive buyers down near 4454 and two way trade to ensue, slowly working higher to eventually take out overnight high 4498.

Hypo 2 buyers defend north of the low volume node at 4477.50 setting up a move to take out overnight high 4498. After a bit of struggle around the 4500 century mark price continues higher to test above Friday high 4509.75. Look for responsive sellers up at 4523.75 and two way trade ensues.

Hypo 3 sellers close overnight gap down to 4468.50 then set their sights on overnight low 4446.50. This triggers a liquidation move down to 4415.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: