Today was a bag of mixed nuts…

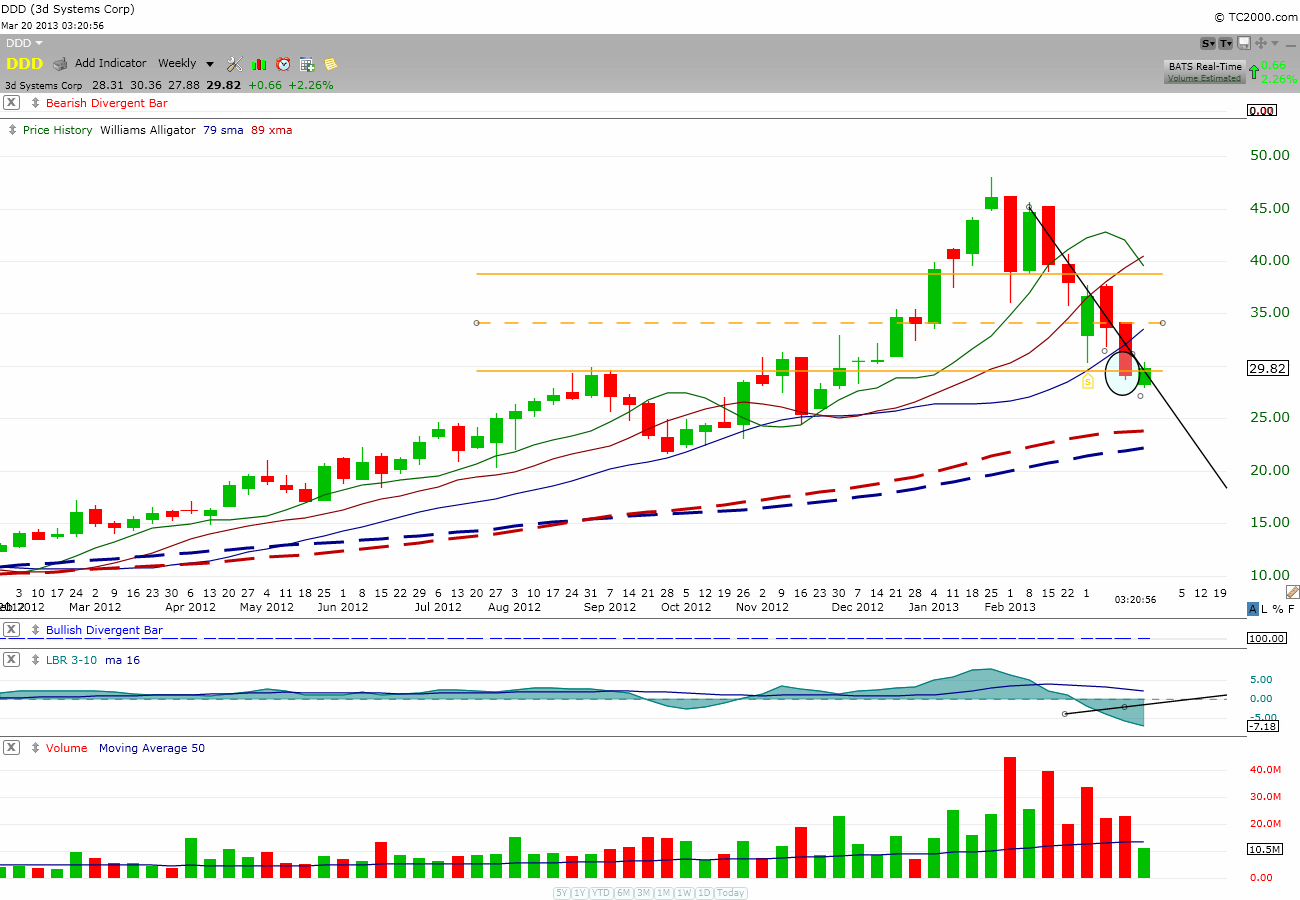

Market opened down and $DDD actually opened and stayed positive for a good five minutes before it started to go with the crowd. I was tempted to cancel my stop so I could sell at the market. Why wait for the stop to fill, right? But then the memories of my previous action of jumping the gun before the stop hit reminded me of the foolhardiness of deviating from the plan. Often times, I would jump the gun and watched the price took off without me; if I had stuck to my original stop, I would have stayed on with the runner. So, I decided to let my stop do the work and surely it did.

Not to be cut out of a possible turn-around (trap or not), I waited for a confirmed green bar after a minimum of two red bars before jumping back in for a bounce. It happened and I went back in with half of what I stopped out with. I placed my stop below the low of the day and wait. It was a volatile wait for price went up and then came back down. Thanks goodness I refused to jump the gun and stuck to my stop. In good fortune, the mini-downdraft was not strong enough to take the price down to hit my stop. From there on, the price began to climb and never looked back until the last 40 minutes before close. I continued to add more $DDD during the uptrend. I now hold a bit more than what I stopped out from this morning. By end of day, I was doing pretty good with $DDD.

I had another “miss” that, this time, it bothered me a bit more than yesterday’s miss on $BBRY. $DNN shot up and I completely missed it because I was busy watching $DDD and a few other stocks. I had a pretty good size position on $DNN yesterday until I thought I was being smart to sell the position to raise cash even though I was at breakeven level. Well, with hindsight, it was one of those bonehead “yellow belly” move that I ought to give myself a kick on the behind. I spent a few more minutes “regretting” the $DNN miss than what I spent on $BBRY’s but that was about it. I moved on.

$DCTH looked strong in the morning and I felt pretty good with my decision to get back in yesterday. Then I checked $PACB and it was acting positive as well; so I decided to buy back some $PACB.

$BBRY looked strong above $16 and did not look like it would correct down below; so I bought a starter position on $BBRY with a stop below intra-day low. So far, I’ve not been stopped out yet.

I checked $GLOG, one of my favorite stock to buy, and the chart looked good- like a bunch of jumping beans on the support line. There was a strong support in the low $12 on the weekly chart so I decided to buy a starter position as well. Unfortunately, price did not stay up and eventually came down below my entry point. Since my paper loss was minimum and I don’t mind taking heat as long as it hasn’t dropped below the $12 support area.

By end of day, $PACB clearly looked sick since my entry so I reduced my position size by 60% to cut loss and minimize exposure. If it doesn’t bounce tomorrow, I will sell the rest.

Meanwhile, I continue to take heat on LRAD, AMRN, and TINY; the rest was just small paper losses that I could wait to see what would happen tomorrow before deciding to cut loss or not.

In general, I don’t mind taking heat on my position trades because it is “part of the job” to do so. While I may be taking some heat now, I see this heat as pale in compare to the potential gain I expect to see in the future. Therefore, I don’t sweat the heat here.

Current holdings:

LRAD, AMRN, SZYM, TINY, DDD, DCTH, CUR, GLOG, CDXS, PACB, XONE, BBRY and 28% cash.

My 2 cents

Comments »