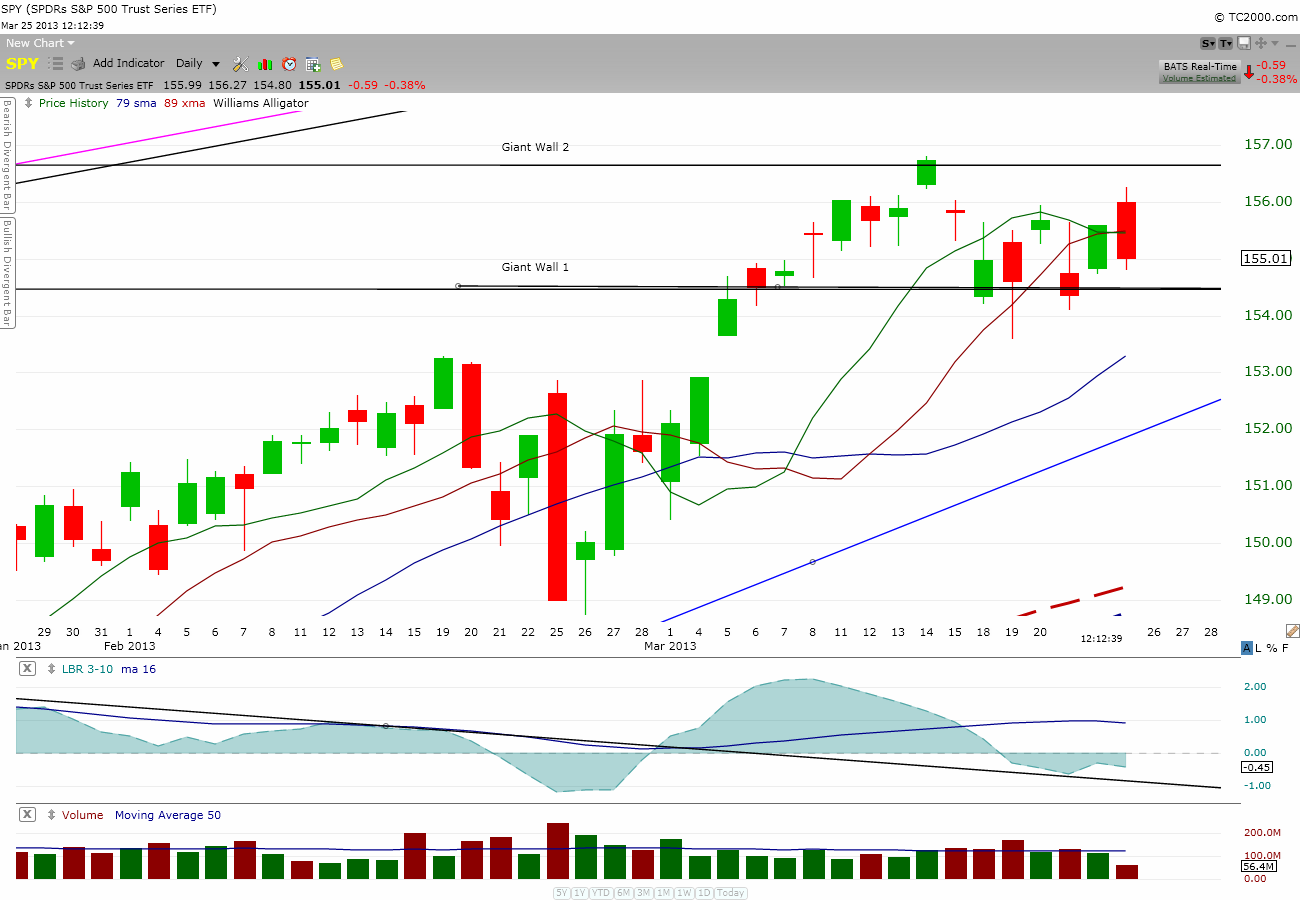

Today trading was quite thrilling in a manner of speaking.

Let’s started with the market open. Market opened higher and I was tickled to see my prediction came truth because I told myself that SP500 would open higher when it was printing a negative 2.50 last night.

Immediately I checked $DDD to see where it was. It gapped higher and I placed an order to add more and got filled at $31.7x. Then I checked $BBRY and saw the it was printing strong. I added a bit more and got filled @ $16.5x.

Lo and behold, right after I bought $DDD, price began to fall off and I was going, “You’ve got to be kidding me!”.

Without thinking, I sold 40% of my $DDD holding to lock in profit just in case the downdraft became a waterfall price drop. Remember, I came in the morning with profit from yesterday run-up.

I checked $DCTH and saw it was not acting well, so I sold half of my position to lock in some profit and minimize my exposure. Since my position size was no longer large enough to threaten me when price was gyrating around in the negative territory, I left it alone. I was also comforted by the fact that there was a large bids sitting at the support price level. This told me that a big whale is trying to accumulate for the next leg run-up.

$PACB was trading the same way $DCTH was and since my position was not large, I left it alone as well.

Price began to bounce up again on $DDD so I bought back half of what I sold earlier. At the same time, $XONE was also acting well so I added to my position.

Then $BBRY began to hesitate on its price movement, I sold immediately to capture the small gain. After I sold, $BBRY began its trek up. Not to miss the rally, I went back in with a tight stop but it was for naught since I was stopped out not long after I got in.

$DDD continued to head higher and took out the intra-day high in the process; so I added some more. But then, by mid-day, $DDD broke thru the 3-min uptrend line with a sudden drop in price. I immediately sold my whole lot of $DDD to lock in profit. I sold $XONE also to lock in profit as well since it also exhibited a sudden drop in price.

Then $AAPL captured my attention. It began to trek up while others were correcting. Sensing a coming rally, I immediately bought $AAPL and was glad I did. Price took off not long after I bought.

$DDD began to stabilize so I bought back the position size I came in this morning. This time I let it ride without further interference since I wanted to hold it over the weekend.

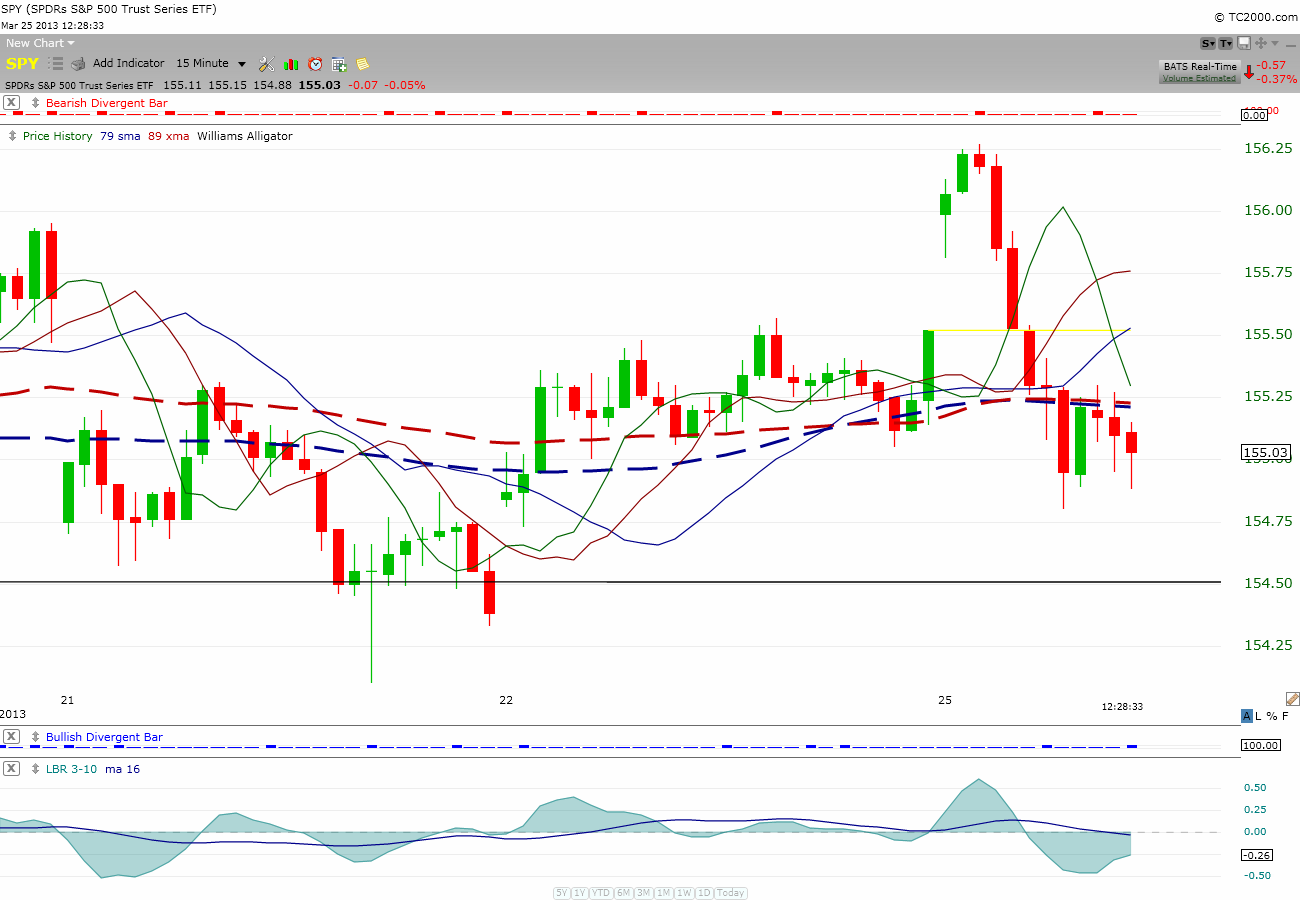

$BBRY, meanwhile, was behaving defensively the whole time while $AAPL was climbing higher. Price began to go under the 79 & 89 ma so I shorted a starter position with a tight stop above the ma lines. Prices bounced back up and I was stopped out for small loss. Then prices fell off below the ma lines again but I did not try to short again because it was trading near the $16 which I saw as a strong support line. Why chase when the profit potential was minuscule (being so near the support line)?

Then the unexpected scenario happened; $BBRY broke below $16 support line and all hell was released. I immediately shorted $BBRY because the $16 support was gone and it took out yesterday low. This time I shorted a larger position than earlier and used a trailing stop to protect profit. The fall was incredible fast and my trailing stop was not hit even though I kept moving it down to track the falling prices. By the time I was stopped out, I locked in over $1/share in profit for the run. I tried a few more re-entry shorts with a much smaller size position afterward and ended with a small loss and win which pretty much offset each other.

There there, although I missed the gap up on $BBRY only two days ago, I was made whole with today action. So you see, if you miss the boat, there is always another one waiting for you if you know where to look. So, don’t sweat it when you miss opportunity because you cut your loss quickly.

$AAPL meanwhile, kept going up but because I moved my trailing stop too close, I was stopped out with profit near the high. I waited for the minor correction at the top to settle down and by the end of the day, the mini-rally near the close convinced me to jump back in for the overnight hold.

While I had a good day on my swing/day trade; my portfolio kept on taking heat from $LRAD & $AMRN downdraft; but I wasn’t a bit faded by this portfolio balance change. The way I look at it, as long as I keep up with a net win on my swing trading, I should be fine. I simply don’t mix my position trades result with my swing trades result because, in my book, one has nothing to do with the others.

Why wouldn’t I take my loss on the position trades and buy them back cheaper, you may ask. It is because I’m making a heavy bet based on an unexpected news that could drive my position trade up with no warning. That is the kind of play I’m waiting for; therefore, I’ve to suck up any heat I may be taking now.

E.g. With $AMRN, any surprise news regarding NCE, takeover prospect, positive prescription demand, etc can drive the price up overnight with no warning.

And thus end another week of trading…

Current holdings:

LRAD, AMRN, SZYM, TINY, DDD, CUR, AAPL, DCTH, GLOG, CDXS, PACB and 33% cash.

Btw, I log-in my trade activities within a reasonable time in my twitter account, you can see them here: @tradingmy2cents

My 2 cents.

Comments »