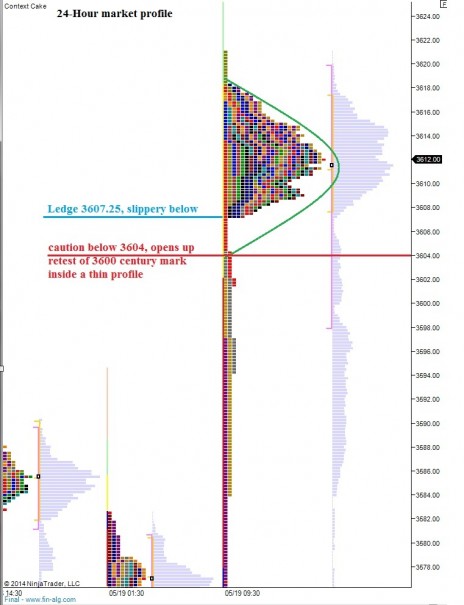

Nasdaq futures are trading a touch higher overnight in a mostly balanced session. The key feature that stands out from the 24-hour profile (which includes our globex session) is the ledge that formed at 3607.25. Markets have a tendency to spill over, or “flush through” these ledges. The context of a ledge is interesting because we can glean insight from it. If the market is instead unable to press below the ledge, then the profile piece is indicative of a strong bid in place. I have highlighted this ledge below:

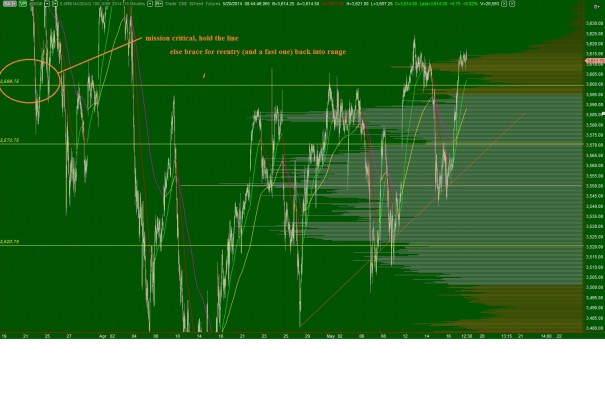

Taking our eyes to the intermediate term timeframe, we are at the top of our bracket range. This zone is as challenging an environment as I know to trade within. The forces of mean revision act like gravity on the tape and their powers are stronger until we exceed balance and begin exploring elsewhere. This is week 7 inside this bracket range which is fairly old in market years. The potential does exist to breach and explore higher, however you should be looking closely for signs of weakening propulsion. There’s no need to get fancy in this regard, keep your eyes on 3600. There is a very low volume node at 3599.75 which separates us from the main pull of mean revision. See below:

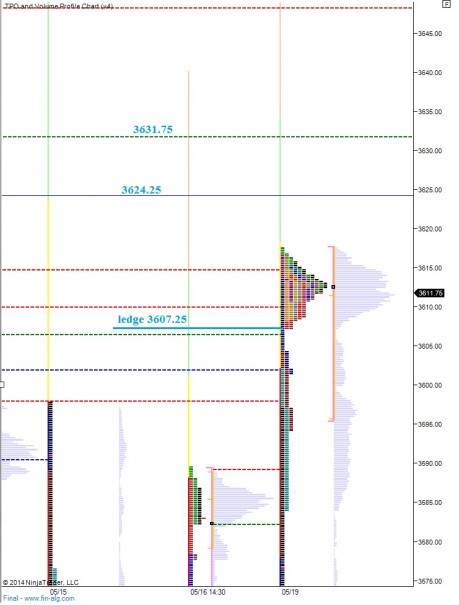

Short term, we are buyer controlled with yesterday’s profile finishing out with a strong distribution atop a thin zipper. This looks like an exaggerated short squeeze profile which often takes on a P-shape. It suggests the progress made in the morning was sufficient for the day and did not entice enough new buyers to continue the trend. That makes sense, given we have an entire week left. Upside targets are the 05/13 high at 3624.25, then the naked VPOC from 04/03 at 3631.75. Caution below the profile ledge at 3607.25:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: test lower, find responsive buying above ledge at 3607.25 and begin rotating higher to test HOD and eventually 3624.25

Scenario 2: test higher find responsive selling at or near test of VPOC 3611.75, chop above ledge before downward drift through 3607.25

Scenario 3: test lower, do not find responsive buying, flush through 3607.25 and drive toward 3600