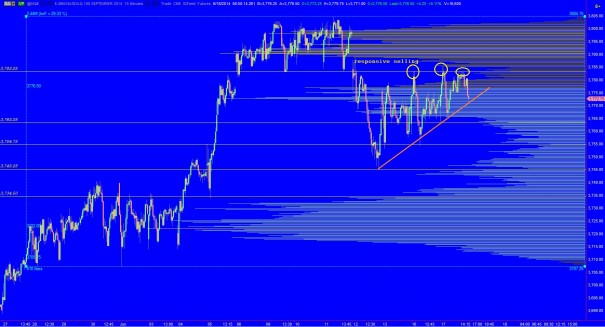

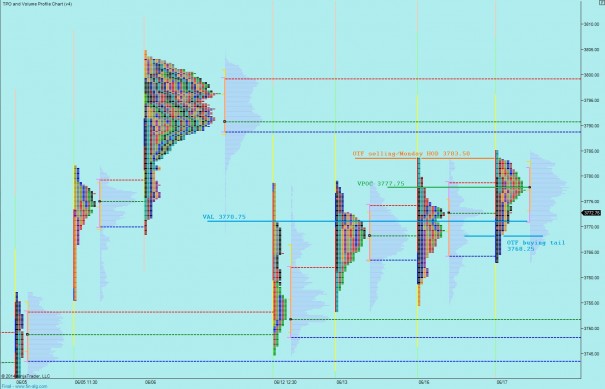

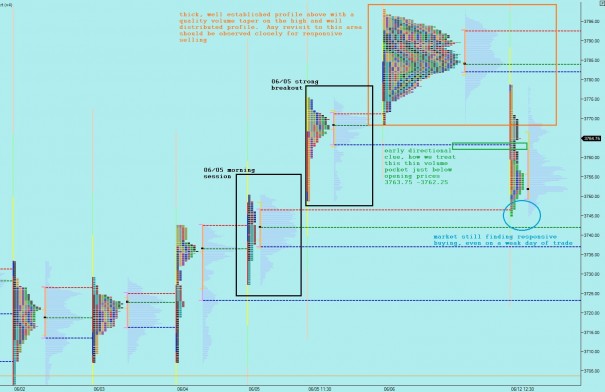

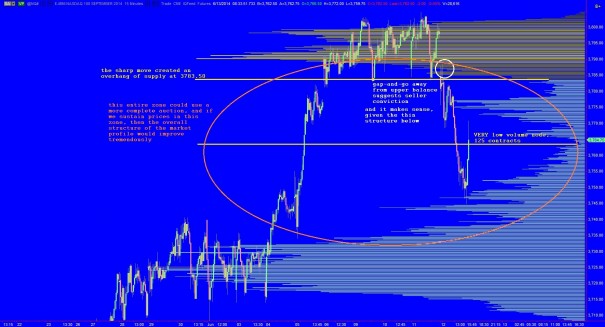

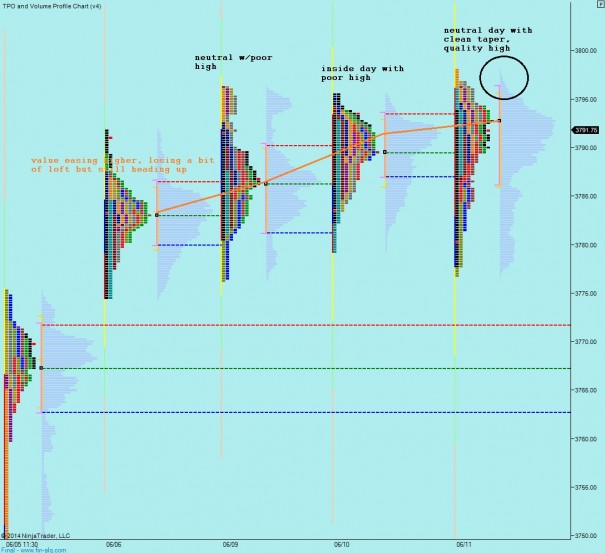

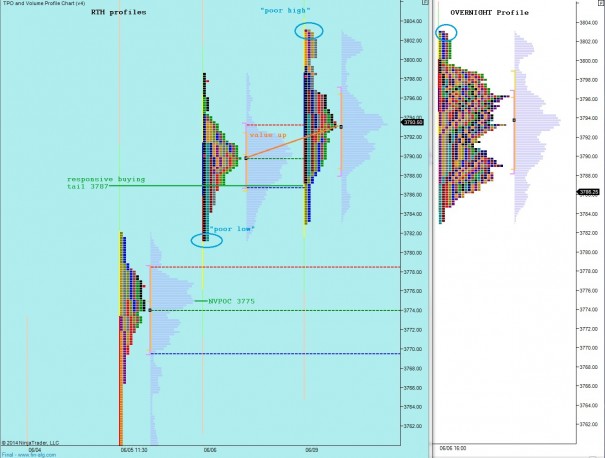

Yesterday morning we tested higher early in the session and found responsive selling early. The action followed through for much of the day until we reached the value area high from Wednesday’s initial distribution. If you recall, Wednesday traded like two different sessions, thus it made sense to split the distributions in market profile. The resulting market profile print from yesterday is a normal variation which ended near the middle but lower than Wednesday’s close.

The USA economic calendar is quiet on this Quad Witching Friday, however Canada is releasing the CPI information at 8:30am and we also have Euro-Zone Consumer Confidence at 10am.

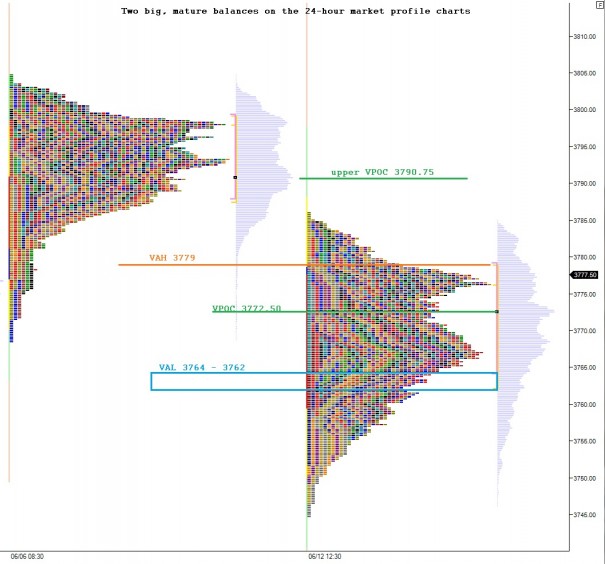

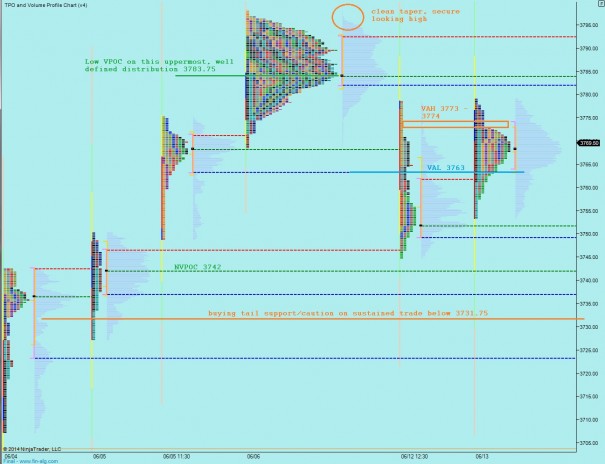

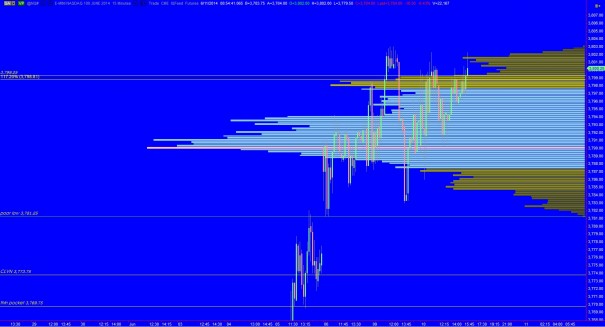

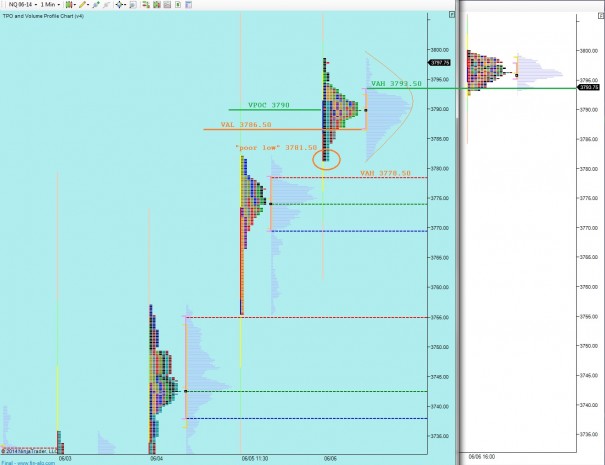

The overnight profile is squatted with no clear balance forming. We however form a shelf at 3784.75, only one tick above the slippery pocket spanning from 3784.50 – 3780 on the intermediate timeframe. This small pocket is critical in the short term because it separates price from the uppermost auction distribution and the below balance region. Even more important, sustaining the prices shows the market accepts the Fed rally. Otherwise, if we drop back down into the balance just below, the entire context is called into question, and the toothy thin zone below our most recent balance becomes a tasty target for short sellers. I have highlighted this intermediate term structure below:

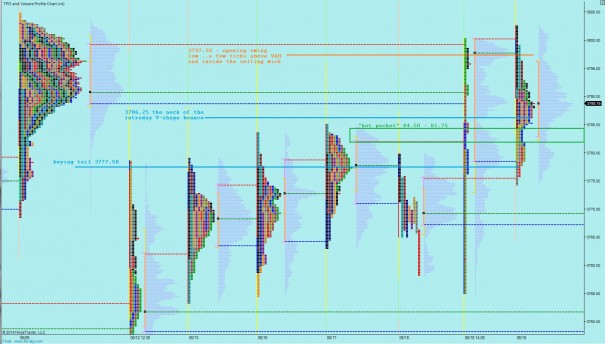

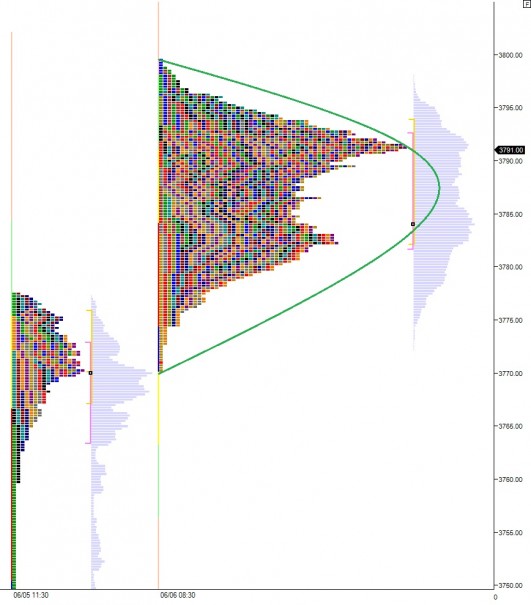

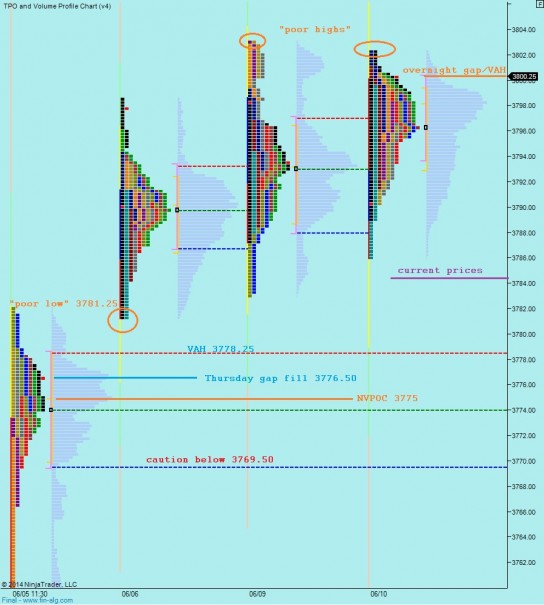

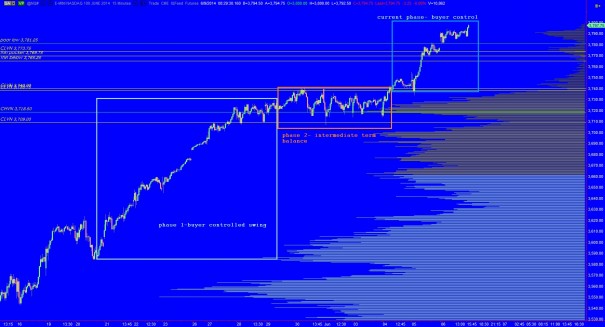

With that intermediate term context in mind, let’s put our eyes on the short term and find out where we can best gauge price action intraday. These levels are a bit more subtle to spot today by simply looking at the distributed profile, but when I split it open and observe some of the key characteristics of yesterday’s trade, the relevant levels jump right out. Use these levels early on today as your sign posts:

Comments »