Volume was very low overnight on the index future instruments, particularly the Nasdaq. This is likely a product of two pieces of context—we are in a tight short term balance and this morning active traders roll forward to the September contract. I used to wait for more volume to occur in next quarter’s contract before moving on from the front month, but this often led to more intraday confusion then one should really manage.

There were economic numbers out of France overnight and a growing tension in the Mideast as Iraq is degrading into a troubling situation. The USA just released Retail Sales as well as Initial Jobless Claims. Both numbers appear weaker than expected and our initial market reaction has been a bit of selling. The rest of the day has little on the docket—we have business inventories at 10am, a Natural Gas Report at 10:30, and at 30 year bond auction at 1pm. The Fed is set to release their Balance Sheet after hours today.

The intermediate term is in balance. This balance is occurring at elevated prices. When you take the perspective of a weekly chart of the composite index itself (not the front month future contract) you see buyers are sustaining this intermediate term balance near annual highs and just below the manic phase of the dot com bubble:

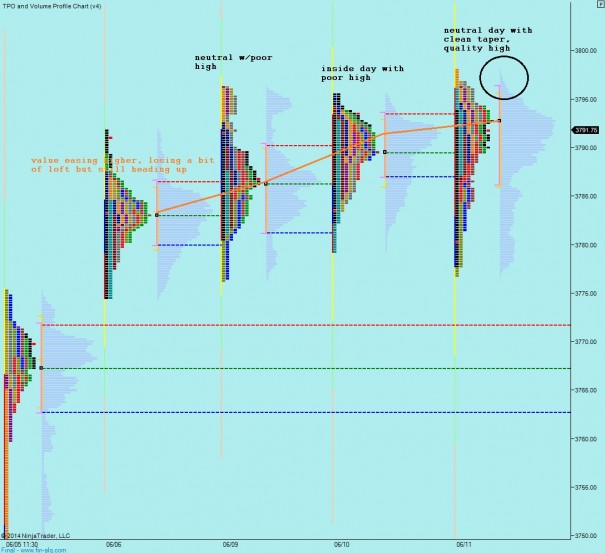

The intermediate term balance stretches four sessions, and this being the Thursday before OPEX and also roll forward for futures traders, we may see resolution very soon. I have highlighted this intermediate term balance, as well as key levels in-and-around it to keep in mind as we move forward:

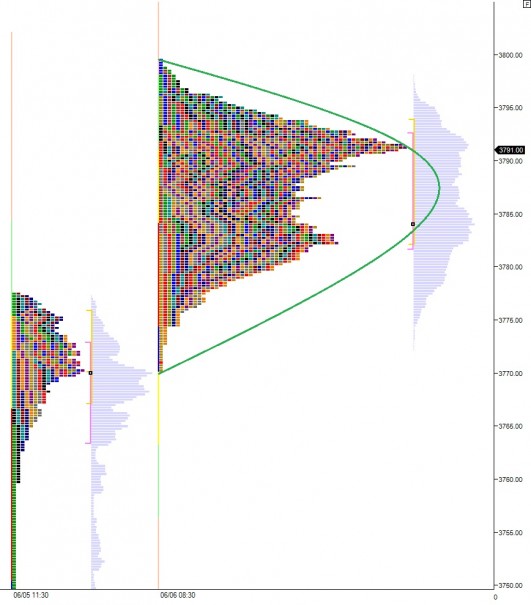

Seen from a slightly different perspective, below I have built a profile of the last four trading days using the 24-hour trade of globex. As you can see, a bit of back-and-fill could take place to further build the structure of this balance. The move from this well established balance is likely to be a quality one:

Turning our attention to regular trading hours market profile, we can see the Nasdaq coiled tight like a spring. We have printed the following series of profiles: Neutral-Inside-Neutral. The market has been local-to-local mostly, with OTF waiting near the extremes of the price action. We have key levels below to explore, however yesterday’s auction cleared up the poor highs that were in place from the prior sessions and shows a nice, clean taper at the highs. This suggests a sturdy high, however up may still be the path of less resistance because value continues migrating higher. I will be keen on the next big value shift, but for now I have highlighted the short term, balanced context below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: test lower, take out poor low at 3774.50, find responsive buying ahead of VAH 3771.75 and begin rotating higher up to YEST VAL 3786

Scenario 2: test higher to 3791.75 overnight gap fill, find responsive sellers and balance out above 3776.75 (yest LOW)

Scenario 3: drive lower, take out VAH 3771.75 and probe to 3767.25 then 3762.75