Sellers went to work early this morning in the Nasdaq futures. Their initiative appears to be derived from several economic data points released in the UK. Their overall employment change was a positive beat while average earnings were worse than expected. We are seeing some responsive buying come in just below the gap we left open last Friday morning. There is not much news flow expected from the USA today. There is a petroleum status report at 10:30am which may affect the energy traders.

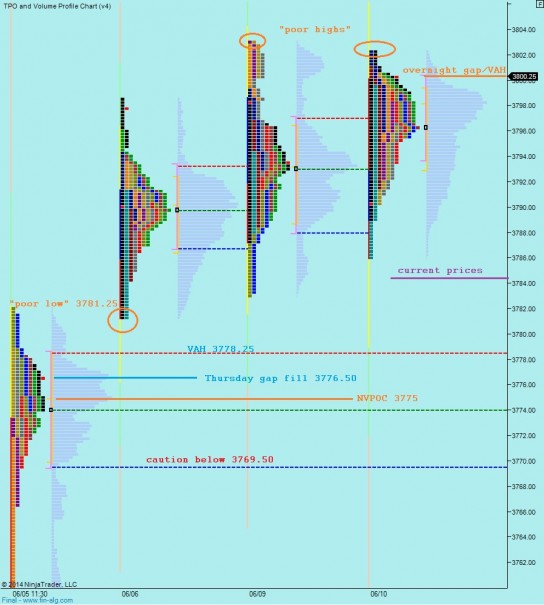

We have been observing a poor low on the 06/06 market profile for a few days. This poor low is likely to be settled during today’s session. We already exceeded the 3781.25 handle during globex, but we are currently trading just above it as we approach cash open. Taking out the poor low creates an opportunity to target a gap trade down to 3776.50 and if we are down there the naked VPOC at 3775 would be a tasty target for the short sellers. I have highlighted these levels below on the market profile:

It is important to remember that order flow ultimately dictates the direction of price in the short term, thus we may reveal a large buyer on the open. In that case we might want to shift our focus to the overnight gap and the poor highs above. Keeping an open mind and having a few plans (scenarios) in mind is key to trading the intraday action in futures well.

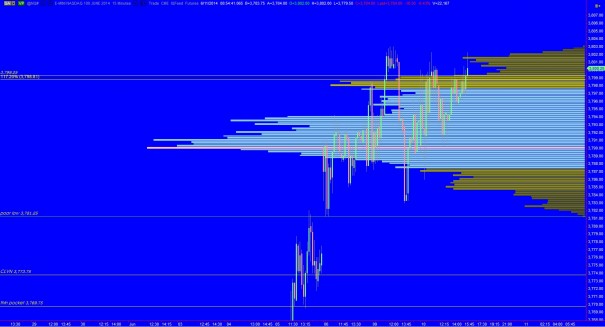

Zooming out a bit to the intermediate term, we can see three sessions of balance and we are about to open on the low end of it. Markets spend more time in balance then they do in vertical exploration. However, early in the year we saw aggressive selling which vanquished intermediate term balance theory. This is something to keep in mind. However, we have logical price levels to observe. If we trade down into last Thursday’s prices, then we should be keen on the composite low volume node at 3773.75 and more importantly raise our guard if trade is sustained below 3769.75. Price might start moving fast if we trade below that level as the structure is very thin. I have highlighted these levels with price levels, however the volume profile pictured only encompasses the three days of balance:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: test higher overnight LVN (scene of sell off and INT TERM VAL ) 3787.75, find responsive selling, take out poor low at 3781.25 and look for entry into last Thursday value area 3778.50 to ultimately target the VPOC at 3775

Scenario 2: test lower, take out poor low at 3781.25 and find responsive buyers ahead of last Thursday’s value area 3778.50, rotate up above 3787.75 and work up to yesterday’s VPOC at 3798 and overnight gap fill to 3800.25

Scenario 3: test higher to 3790, chop and balance below yesterday’s VAL 3793