The overnight trading session in the Nasdaq was quiet, trading less than an eight point range throughout the globex session. During the session the major news flow came from the east where Japan released several economic stats including their GDP and most of the economic data points were positive. The docket for the USA session is fairly open—we have Fed speak from Bullard at 9:10am, a few short term treasury auctions at 11:30am, and then two more random Fed members speaking at 12:45pm and 1:30pm.

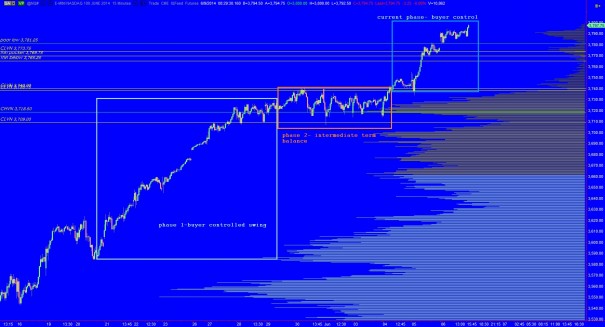

Starting at a high level, we can see the composite index is buyer controlled. Last week was their second week of controlling the tape and the progress was sufficient to press through the low end of prior swing high balance. I present this long term picture zoomed out to show our proximity to the great dot com bubble, thus you may have to enlarge the picture and squint slightly to see how we have pierced swing-high balance.

At the same time, we should be on guard for a lower high, and the subsequent reaction that could materialize from such an event.

The intermediate term is buyer controlled and perhaps a bit extended. We never quite know how far a swing will go in any direction, but we can say without question this current swing is 3 days old and built upon a layer of balance built upon 8 days of swinging higher. The net is 13 days of upward-to-consolidating-to-upward prices. I have highlighted these transitions and some key levels below:

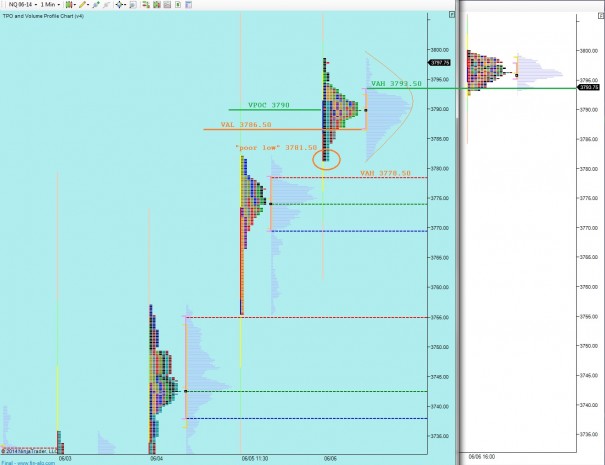

The short term auction is buyer controlled. I have colored the background on my regular trading hours market profile chart baby turquoise to discern it from globex. We printed a higher distribution overnight even though prices are currently a touch lower than where we closed on Friday. This mainly suggests the prices were accepted overnight. There are several untested levels below on prior day profiles, but whether sellers have the conviction to test them will first start with recapturing yesterday’s value, which we are currently trading just on top of. I have highlighted this price level as well as others on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Scenario 1: push into Friday balance, below 3793.50, work through VPOC 3790, and test VAL for responsive buyers 3786.50. If they no show, test the poor low @ 3781.25 then Thursday VAH at 3778.50

Scenario 2: test lower, find buyers at VAH 3793.50, close overnight gap to 3797.75 and balance out along VAH 3793.50

buy a decent suit. You can’t come in here looking like this. Go to Morty Sills, tell him I sent you.

bathing suit?