Nasdaq futures are lower over the duration of the globex session with the bulk of the selling occurring yesterday evening. We seem to have found a buyer around the time Europe opened and we are since trading back at the mid of the overnight session range. Today’s economic calendar has Existing Home Sales at 10am. Also, Mario Draghi is scheduled to speak in Brussels at 9am, and the entire week features a variety of Fed speakers (no Yellen) speaking at a several of events. On Friday we have GDP stats set for release.

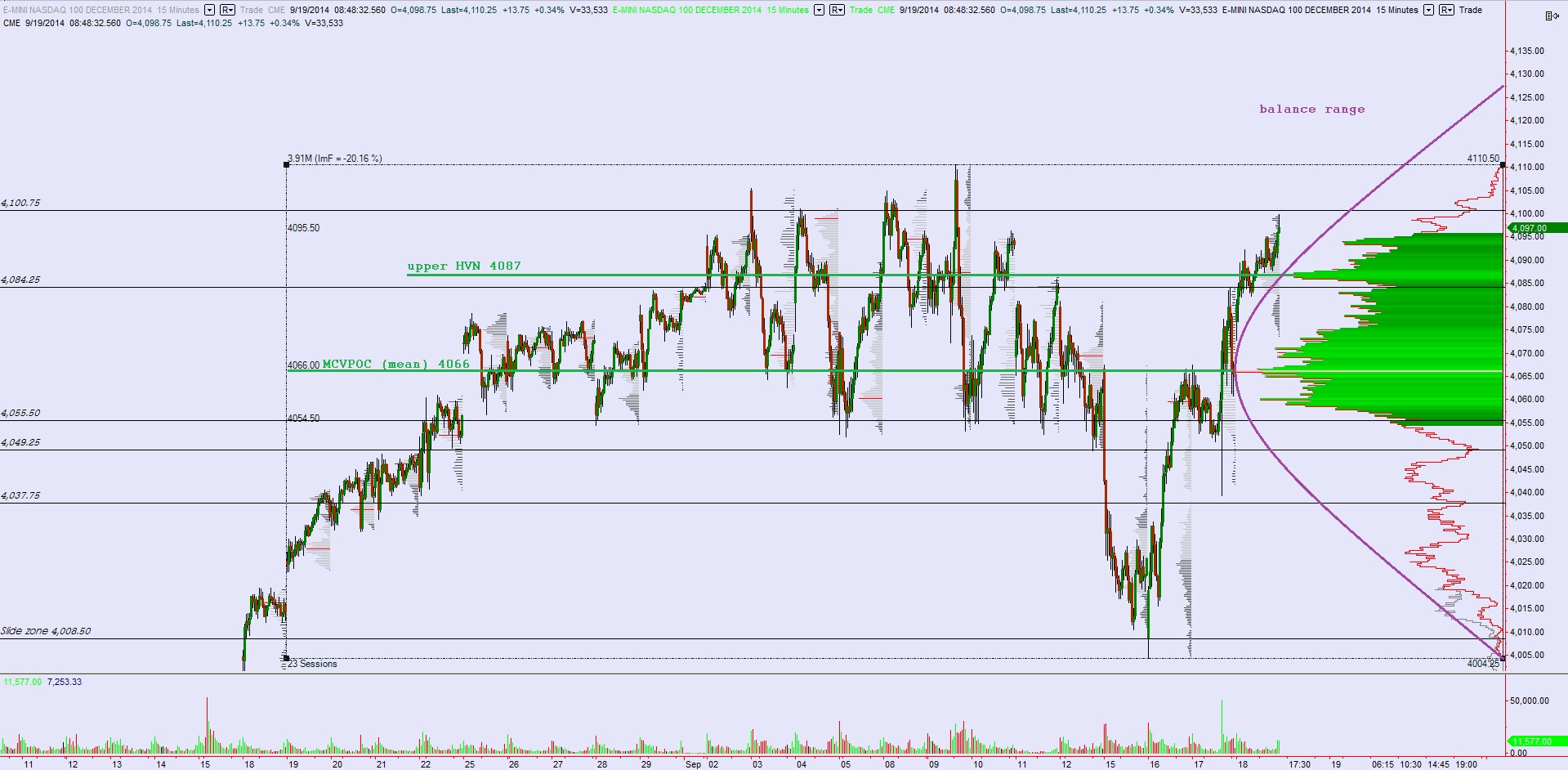

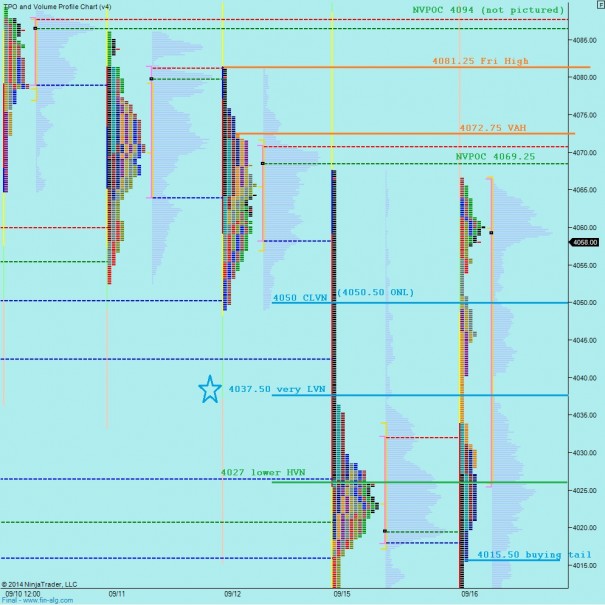

Intermediate term, although we see this timeframe in balance with these longer timeframe participants actively establishing a value through their actions, we can also see the difficulty we are having establishing intraday value. This suggests two things. First we are participating in a market with active longer timeframe participants who push price around with their actions. Second, we are not very complacent nor certain that current prices properly represent value. As this value matures, now 24 sessions old, the likelihood of transitioning into price discovery increases. I have noted the key price levels of our intermediate term on the following volume profile chart:

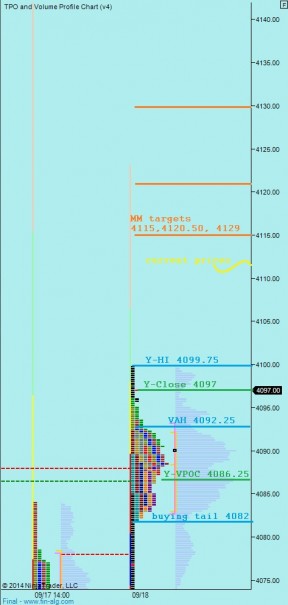

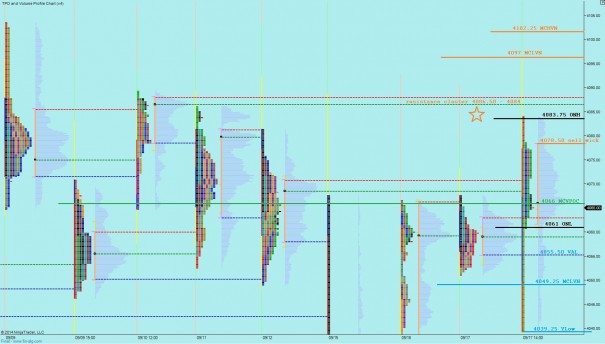

I have marked up the market profile chart with the levels I find interesting going into today’s trade. The lack of value areas recently makes for an interesting landscape of peaks and valleys for the market to explore. Where we ultimately locate price acceptance will be telling to start the week. See below:

Comments »