The morning report is a bit delayed by the arduous task of rolling into the December contract. Stay tuned.

THERE WILL BE SHENANIGANS

Today I placed my first index hedge since this bull run started at the beginning of August. There has never been a transient reason to don protection prior to today, and to be clear I prefer transient reasons for most any market action. It is simply my nature.

However, we must always explore outside our comfort zones, and doing so has been good to me. Look at these investments, GPRO and TWTR, the former quickly nurturing my book and the latter finally beginning to bear fruit. These positions are funny, two of my largest, and I do not keep an active chart for either. They are investments. I observe them occasionally inside the newspaper, old school. Oh, how I have digressed.

You guys truly run wild sometimes, carnivorous animals hunting out your next meal. Sentiment says otherwise, that we are all cowardice leaf eaters who lie in tall meadows waiting for better days. The group’s speculative fervor is something I never claim to have a firm handle on, but I can attest to my own. It is running hot. My book is juiced up like Arnold’s tits in 1986. Something had to be done.

Thus I juiced in the other direction, buying weekly calls in TZA, FTW, lol. Because I expect a very transient CORRECTION, you got it? I don’t need 10 stinking days of protection. I need one, tomorrow, because according to my god damned almanac, the apostles creed for all intents and purposes, there shall be shenanigans of the highest order tomorrow.

May said shenanigans take the form of an egregious gap-and-grind-up, rendering my protection dry and stale, and my juiced up book all the richer, amen. IF NOT, well at least I can pull a downside trick.

NEUTRAL EXTREME DOWN YESTERDAY, NETURAL EXTREME UP TODAY, CRAZY OUT THERE! Keep your wits, focus on what you can control-your risk, your mind, your plan.

Kiss kiss

Comments »Neutral Neutral Not So Crucial?

Neutral days are some of the most potent market profile prints out there. They suggest jostling for position by the other timeframe. They extend both sides of the initial balance, suggesting the bigger, institutional money is not only active at the start of the day, but also intraday. They are watching the tape and adjusting.

There are a few things working against today’s rally:

- Internals are showing risk flow, yes, but large caps are lagging more than we have seen in several days

- A poor low on the /NQ

- Neutral prints in the /ES and /TF

- Tomorrow is the Thursday before OPEX WEEK

OPEX has a way of sniffing out the piker money and brutally boning it with the proverbial “African Spear”. With that in mind, and a crew of edgy call options all huddled around me, I bought a weekly TZA call, lol.

Fade today, down tomorrow, flush out the turds.

Comments »Negotiating The Other Side of Balance

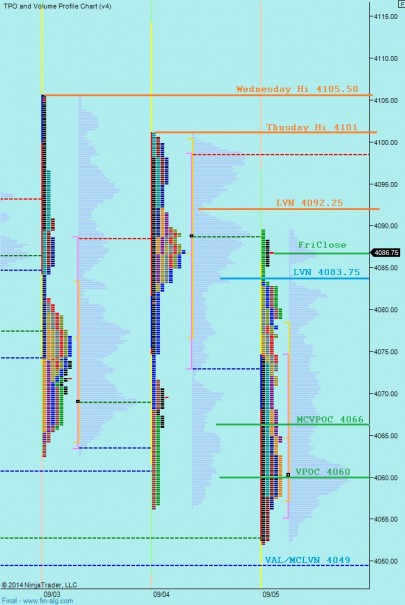

Nasdaq futures are flat overnight after printing a very wide and fast range yesterday. The spike in volatility yesterday coincided with the Apple product release. As the event introduced new technologies, the price of AAPL stock was radically swinging, moving the Nasdaq alongside it. The economic calendar is quiet for today’s session, however there are a few pieces of context to keep in mind.

First, tomorrow is the Thursday before OPEX, a day often reserved for shenanigans. Second, China released their CPI and PPI data after hours tonight which might impact any Chinese holdings currently housed in your book.

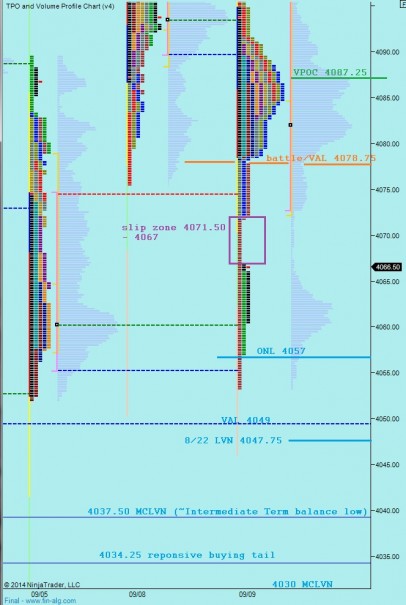

Turning our attention to the auction, we can see the intermediate term still hangs in balance. The fast action was enough to raise a few eyebrows, especially how we rejected fresh swing highs, but we do remain in balance overall on this timeframe. This balance is best seen using a volume profile which encompasses the last 13 sessions. I have built this profile and noted the key price levels below:

Yesterday I made several comments about 4080. The reason was how price was behaving at this level. Sellers made three aggressive pushes at 4080 which were absorbed by a buyer, presumably the same responsive buyer who existed on Monday in this territory. The problem was, like any aggressive attack on a territory, it jeopardized the structure in that area. Said in market profile terminology, by mid morning we had a very blunt “poor low” which was susceptible to breakage. It eventually did break, we found a sharp responsive buy to new multi-year swing highs, at this point going neutral (expecting the fade back to the mean), before finally giving way to heavy sell flow for a proper mean revision on the intermediate term time frame. On the net, yesterday was seller controlled and we printed a neutral extreme profile. This makes hypothesizing very simple today.

I have noted the key price levels I will be observing today on the following market profile chart:

Comments »Remain Calm

My discussing heretofore must be brief as I was swept into the hype that was the Apple event and now only have a few minutes before traversing across town to my local torture purveyor, the dental surgeon. It is difficult to have a clear read on today’s session right now without seeing the close. Nasdaq went neutral print when we made new swing highs, found a strong responsive seller, and as I type we are working lower, likely to test the MCVPOC at 4066 [update: done]. The difficult read comes from not knowing where this will close.

A close on the lows would be the first neutral extreme print to go out on the lows since I started tracking day-types in June. This type of close would carry strong directional conviction likely to carry through to tomorrow and result in testing the other edge of intermediate term balance (see prior post). The fresh risk I initiated in WYNN is being dismantled, and my options book is buoyed simply from having WB in its cadre. WFM is dead money even after three dedicated shout outs at the Apple event. How? How after being such a big part of such a big event!? The price action today is as fast as we have seen even including Fed days.

The issue as I see it, is whether this is a singular data point or some major shift in sentiment. It appears they have chosen today to put the bulls’ heels to the proverbial coals. Indeed, a fine day to have to report to the dentist, because it is forcing me to eat a sandwich while this noisy day plays out.

Comments »

Premarket Context Report

Nasdaq futures were up modestly this morning before giving up the gains as we rolled into 8am. There are no economic events which align with this selling. Instead it appears to simply be some early sell flow. As we approach US cash open the Nasdaq futures are flat on a compressed 16.5 point range of trade.

Buyers pressed away from Friday’s range early yesterday morning before finding responsive selling back inside the range. At this point expectation was for a move back to the micro composite volume point of control at 4066 but instead we found buyers who rejected the idea. These buyers took us back up above the daily midpoint in the afternoon. Overall price and value migrated up relative to Friday.

This is occurring inside intermediate term balance. As this balance matures, now going on our 13th session, expectation of a break increases. As we head into Tuesday’s trade, we are priced in the upper tail of balance. If buyers are not strong to initiate trade away from this area, then we are likely to go explore the lower boundaries of balance in short order. I have highlighted the intermediate term balance below:

With that in mind, I have noted the key price levels I will be observing on the following market profile chart:

Comments »

Well That Was Interesting

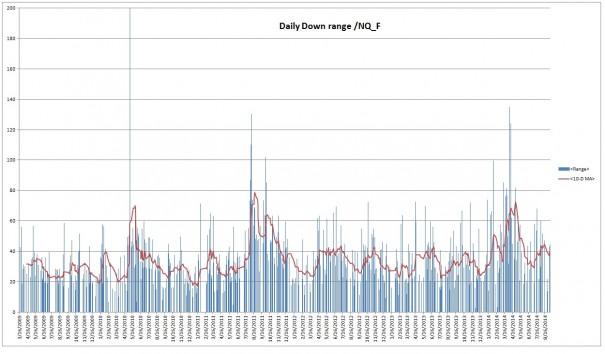

Day-by-day, when you become emerged into a product and methodology, you begin to better understand “where” you are intraday. One of my favorite developments as a trader has been understanding what the market tells me when my hypothesis is wrong. For example, today I had an afternoon hypothesis we could trader lower and target the MCVPOC at 4066. When the selling wave rolled through at lunch, I was expecting the second wave to push us lower than it did. This made sense with my recent range study because it would have produced a 39 point down day for the Nasdaq. That would be in line with the average down days according to the study.

When instead I saw a sharp responsive buy, eight and a quarter points wide (not normal), my trader antennas picked up on a change. The afternoon hypo was negated and the other side became clear. At this point I placed risk in CRM, GOOGL, and DANG. I nailed the intraday move, citing a contra play back to the VPOC, which eventually shifted down to price right around closing prices. My intraday eye is becoming sharp as I prepare to reenter the futures realm.

Something else happened, though.

Perhaps eating an entire chicken for lunch was excessive, for when I attempted my 3pm “power nap” to 3:30pm, I overslept and missed the closing bell. Now I have a bit more risk than I really wanted (eek). My plan was to cut something to make way for this fresh batch of risk. All I managed to close was FEYE weekly calls which might not have even been the right move. I have a bit too much weekly risk already, and it is Monday. May the warm breeze of late summer drift us just a touch higher to allow a rotation out of shorter duration and into longer duration, amen.

To top it all off, I have to go under the knife after market close tomorrow, very routine dental procedure, but a bug in my head nonetheless. Needless to say, I will have some interesting decisions to make tomorrow morning.

So what is working? My long term investments are treating me exactly how I expected they would. I think people are waking up to the huge lead Go Pro has in the wearable market. You would be short sighted to consider them merely a “camera-on-a-stick”. If they can use their momentum properly, then they should continue to outpace any competition in the tiny HD-video arena. With panache I might add. I stand by my $72.00 profit target which is calculated using the valuation Apple gave to Beats during the buyout. Twitter added a “buy” button to tweets apparently and now we are headed for new all-time highs. Now, next year, or five years, I will own Twitter until the fabric of electronic society radically changes. LO is sort of dead after the merger news but whatever, money is parked and earning a coupon. Today might have been the day to add to XON, but I want a bit more information before adding.

Everything else is subject to liquidation. I am like a cat on a hot tin roof up here frying eggs. The timing is everything.

Comments »Starting The Week in Balance

Nasdaq futures are down just a touch premarket on an orderly session of price balance with a slightly below normal amount of volume transacting during the session. We are set to hear Consumer Credit at 3pm today but have an otherwise quiet economic docket for the week. UK GPD comes out Tuesday morning, China CPI late Wednesday, a Monthly Budget Statement at 2pm Thursday, and Retail sales and U. of M. Confidence numbers on Friday.

Long term, the Nasdaq continues to be bullish after printing an outside candle on the weekly chart. The outside candle is often referred to as an “outside reversal” and in this case a “bearish engulfing” pattern. The quirk to last week’s candle is the long wicks on both sides, especially the bottom. This suggests a strong response to lower prices was able to press us well off the weekly lows. The gap zone left behind 14 years ago is living up to the expectations of gap zones by providing fast trading action. Overall, the market continues to sustain trade above the gap and we have to bear in mind how much energy was expended by the dip buyers and whether we see buyers initiating more risk this week:

Intermediate term we are fairly neutral at the moment. This can be seen best on the following volume profile which encompasses eleven session of trade:

I have noted the short term price levels I will be observing using the market profile chart below:

Comments »Sunday Morning Stat Mash

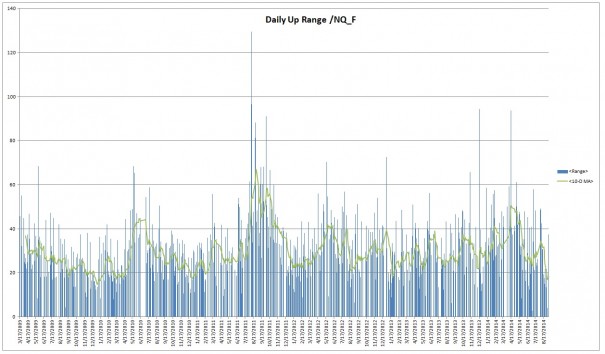

Today we are looking at the range statistics of the Nasdaq regular trading session. Although Nasdaq futures trade around the clock on globex, our focus is primarily to trade the index when the equities underlying its value are also active. Thus, this range analysis is conducted using the trading hours from 9:30-16:15 eastern time. This data was pulled from the IQ feed servers and compiled using about five years of trade (3/16/2009 start date).

The data has been split into two categories, up days and down days. This information is helpful when preparing your hypothesis on the day because you have a sense of what price levels are relevant and actionable, and which ones are beyond the average reach of the marketplace.

Some notable stats include:

- Average down day range: 35 points

- Average up day range: 29 points

- 2014 Average down day range: 45.5 points

- 2014 Average up day range: 32.5 points

Usually I will use a histogram to calculate a “normal” range, considering about 68% of occurrences as normal and anything else an outlier. What appears to more relevant in this instance is to look at the data over time to see how ranges are trending. I applied a 10-day moving average to the daily up and down ranges. The average daily up range is at about a 5-year low at just under 20 points. The average daily down range is just less than 40 points. Thus recent trading has provided about double the daily range when trading lower than higher. See below:

Comments »Three Dog Nights

Yes, sure, there is something of a correction going on in the equity markets. Some of my entries last week and into this week seem early. P is in the toilet. WB flashed its zoobies at me only to rabbit punch me. FireEye is not ripping, clearly it is broken. KNDI has not been so dandy.

The market has accelerated and the tone made a notable shift in pitch and vibration to start September. There are lots of moving parts right now, macro waves rippling across the financial complex like the stroke of a monarch’s wings. There are experts who will tell you their prediction and I respect a few of them.

My job is to understand the auction today and how it might affect about the next three days. My looking glass is a bit foggy beyond that horizon. However, one can be dangerous in such a limited duration if they pick their battles wisely.

I do belive I have some of the finest candidates should a flood of money decidedly turn risk on.

A few stocks who might have offered hints this week were WYNN and PCLN. These longer term consolidations in risk assets pressed lower. If they continue to entice sell flow, it could mark a shift in risk appetite. Also watch GOOGL. It is flirting with swing highs, lingering well, and “should” make a new swing high. A failure to do so would be unlikely and odd.

On the topic of unlikely and odd, we are 45 minutes away from printing the elusive “neutral extreme” on the Nasdaq. Such a structure suggests strong directional conviction. Bears need to show up ASAP. Thus, as we close out the week, with two red candles on our charts and three hard nights of trade, perhaps you could envision a new high and how it might change your perception of this market?

I am taking my final swing at SINA, via the September calls. This might not resolve soon enough, or it will, and the derelict will come to the town square with a fresh tunic ready to party. I am in some NBG too.

In the meantime, Go Pro seems to be the hottest wearable since Beats. I am in no hurry with this one, a good slow idea for a young gent.

Comments »