Nasdaq futures are down a bit overnight, currently trading near the lows of yesterday’s range. The economic calendar was quiet mostly during the globex session, with the main release being UK CPI stats. However, the real news over the pond comes Thursday when Scotland is set to vote on whether to continue as part of the United Kingdom. The outcome of this election could send waves through the macro world as the Pound reacts. Also on Thursday we have the BABA IPO. But before all of that excitement we will hear from the Fed tomorrow afternoon who will be setting their QE pace followed by a Janet Yellen press conference. Thus the market will have much new information to price in later this week.

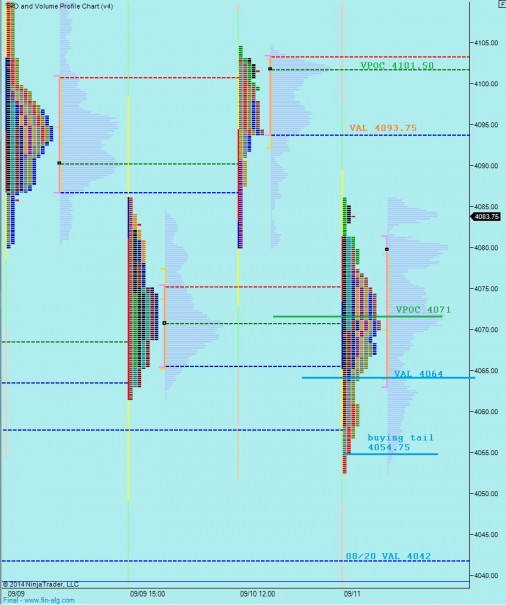

Taking a quick look at the long term timeframe, we can see the trend on the Nasdaq composite is still up. We can also see the fast behavior occurring in this gap zone from 14-years ago. We are having a proper auction of these prices, both ways, to determine which side of the gap we belong on. See below:

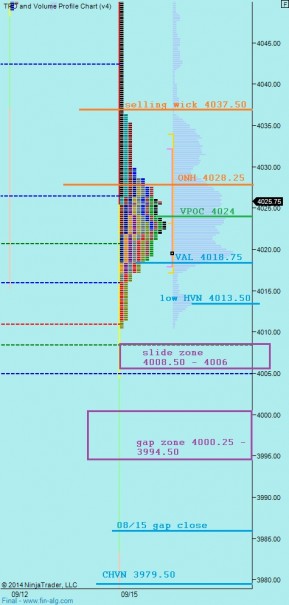

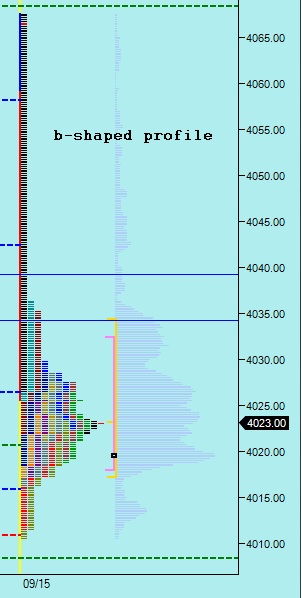

Determining what data to pull into your intermediate term composite is a matter of knowing what you want to see as far as detail. Premarket yesterday we switched the start date to 08/25 which revealed the imbalance present in our upper balance. Now I have pulled more data into the intermediate term composite to give the tail end a bit more detail for reference. By doing so, we have some clear levels of interest to keep in mind as the day progresses. Note also the lack of structure just below. If we are not done finding buyers today, then there is scant volume structure to slow prices down until about 3980. See below:

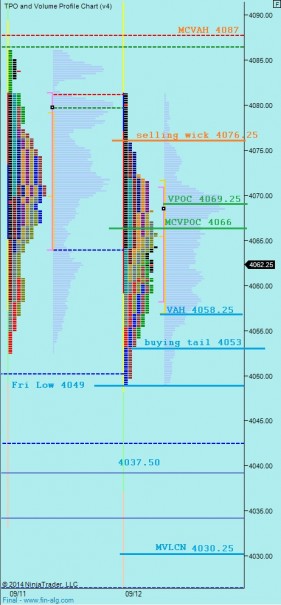

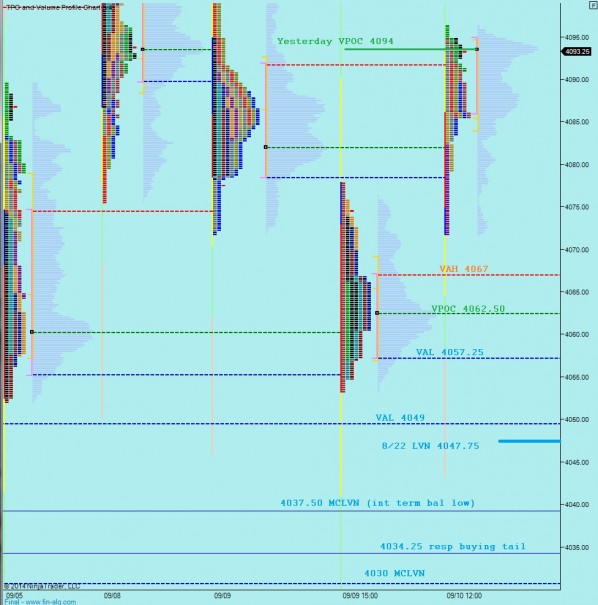

I have noted the short term levels I will be keying from today on the following market profile chart:

Comments »