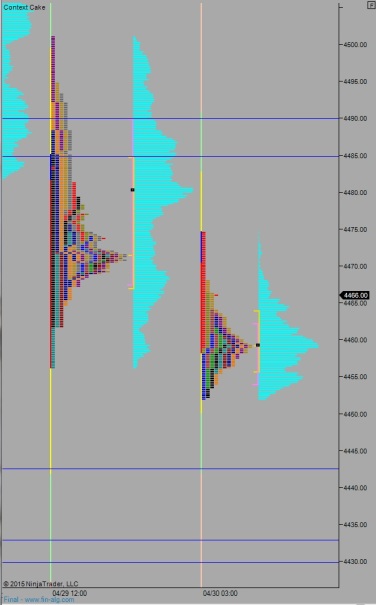

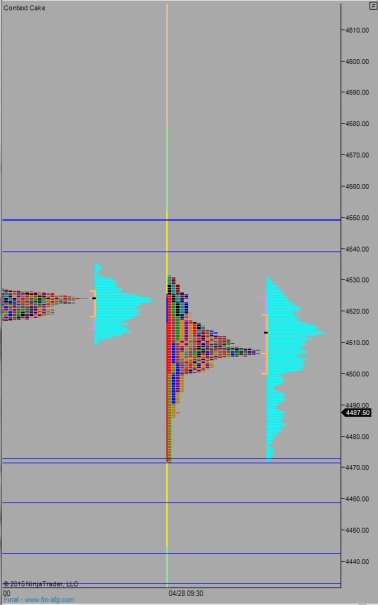

Nasdaq futures are set to gap up as we head into a fresh week. Volume is running normal and range is elevated a bit above normal, but overall it was an orderly auction. Price managed to push down into the upper quad of Friday’s range before finding buyers who worked up into last Wednesday’s value.

Heading into today the economic calendar is quiet. At 10am month-over-month Factory Orders are out, a medium impact number. However, most of the weight will be on Friday’s Non-Farm Payroll data, with Wednesday’s ADP employment change and Thursday’s Initial/Continuing jobless claims serving as appetizers.

Last week the Nasdaq managed to make a new contract high on Monday before rolling over and spending most of the week trading lower. It wasn’t until late Thursday afternoon that buyers emerged with enough conviction to entice initiative buyers onto the tape.

Heading into today, my primary expectation is for buyer to push a bit higher, but stall out around 4484.50-4490. I will look for sellers to close the overnight gap down to 4467.50. If buyers aren’t found here then continue lower to test below overnight low 4457. This could lead to an acceleration, especially if we trade below 4445.

Hypo 2 buyers push up through 4490 and grind higher to target 4517.

Hypo 3 we chop and build value between 4489 and 4457.

Comments »