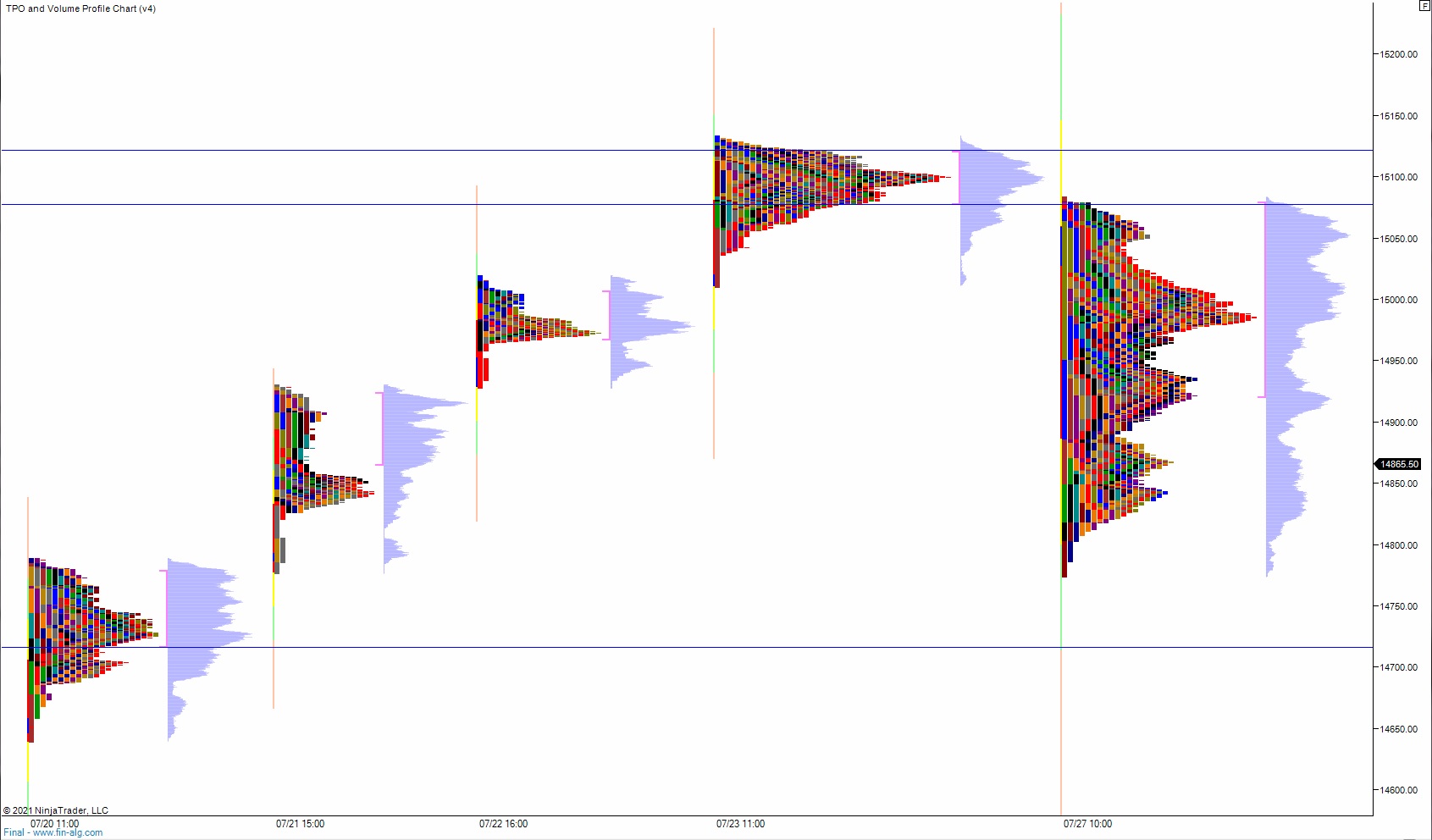

NASDAQ futures are coming into the final trading day of July gap down after an overnight session featuring extreme range and volume. Most of the action came shortly after the bell thursday when Amazon earnings were great, but their outlook came in below expectations. This sent AMZN shares lower and the NASDAQ along with it. The selling continued until about 9pm New York and saw price trade down near (but not exceed) the weekly low. Since then price has balanced along the lower quadrant of Tuesday’s range and as we approach cash open price is hovering in the lower half of the Tuesday range.

On the economic calendar today we have consumer sentiment at 10am.

Yesterday we printed a neutral extreme down. It was a pretty mundane normal variation up for much of the day, starting with a gap down that was quickly resolved with an open-drive up. Buyers made an early range extension up but the auction immediately stalled and then spent the rest of the day marking time by flagging along the highs. Then during settlement price drove lower pushing us into a neutral print.

Heading into today my primary expectation is for buyers to work into the overnight inventory, effectively erasing the Amazon earnings reaction by rallying up to 15,000.

Hypo 2 sellers hold price below 14,918.50 setting up a move down through overnight low 14,811. Look for buyers down at 14,800 and for two way trade to ensue.

Hypo 3 gap-and-go lower, liquidate down to 14,716.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: