Hi ho lads, Raul here, you friendly derelict speculator and humble farmer. Been plugging away—toiling in the fields to produce corn and punkins all whilst hustling these opening bells on the NASDAQ. In other words, living my best life.

Most of you don’t know this but your dear pal raul is really very beautiful. I brush my long dark locks of hair ten minutes in each direction to produce a shining mane. Then I oil my knees so they also give off a nice shine. My Sephora habit is more expensive than your :::insert drug addiction here::: habit.

The only drugs I’ve been doing these days are COFFEE. HOOTCH. And diesel fumes. Few understand that a drug is not just a white powder or some pill dispensed by the HALF BLOOD POPES of the world. Drugs are all around you friend. Smog is a drug. Loud music is a drug. The key is properly defining the word “drug.”

Coffee and diesel make life feel a bit more like a campaign. When I fire that heckin’ old diesel truck up and it lurches to life, my aura is filled with a sweet fume that makes me feel like some kind of american with a mission. A soldier perhaps.

Mushrooms don’t do this. Mushrooms make me feel like a wolf who can converse with the wind. Non-duality. All One Or None, comrade.

America is a high-strung nation of psychopaths addicted to stimulants and diesel fumes and my fear is that I’m becoming more American every time I fire up that diesel. I want to grow fat in the belly region and complain about mysterious lower back pain, all while ignoring the huge sack of tissue I’ve ringed around my hips. I want to grow corn, lots of it. I want to grow the numbers on the screen associated with the value of my person to infinity.

Heading into August I have a bearish signal coming out of IndexModel. Good old Rose Colored Sunglasses. Rose Colored Sunglasses tells a story of rose index prices hiding the ugly reality of the constituents. The constituents are sick. Sick from all the diesel fumes and caffeine and belly fat. The constituents are about to make their disease felt far and wide—at least that is what IndexModel is saying heading into next week.

I have crossed signals. There appears to have been some maintenance inside Stocklabs which has resulted in new signals appearing on the mother algo. Which is fine. When signals cross we lean on that which we can control. For me, IndexModel is in my control. I am the captain.

You’d be wise to find your own machinery in this crazy world of global finance. There are too many fucking enemies lobbing attacks at your ship from 6pm Sunday to 4:30pm Friday to be merely a loyal subject to the crown. Take the reigns buck-o or be mowed down by the psychopaths at Citadel.

One last note—who the fuck would own $HOOD when you can own @Jack’s $SQ?

Who is better leader? Long-haired, weak muscled eastern european or long-goatee stoic bitcoin maxi?

Okay for now. Bullish for the next 24 hours or so, then BEARISH.

Raul Santos, August 1st 2021

One more thing. The accountant in me takes great satisfaction in a month ending and beginning so very nice and clean like this. Okay see you in the morning.

Here is 349th edition of Strategy Session. Enjoy:

I. Executive Summary

Raul’s bias score 3.28, medium bull*. Expect a bit of upward price action early in the week. By as early as late Monday look for the auction to reverse lower. Selling pressure persists into second half of week. Then look for non-farm payroll data Friday morning to accelerate the selling into the weekend.

*Rose Colored Sunglasses [RCS] bearish bias triggered, see Section IV

II. RECAP OF THE ACTION

Mellow Monday with chop and upward drift. Hard trend down Tuesday that found late-day buyers. Choppy inside of Tuesday for the rest of the week. Russell bullish divergent during second half of week.

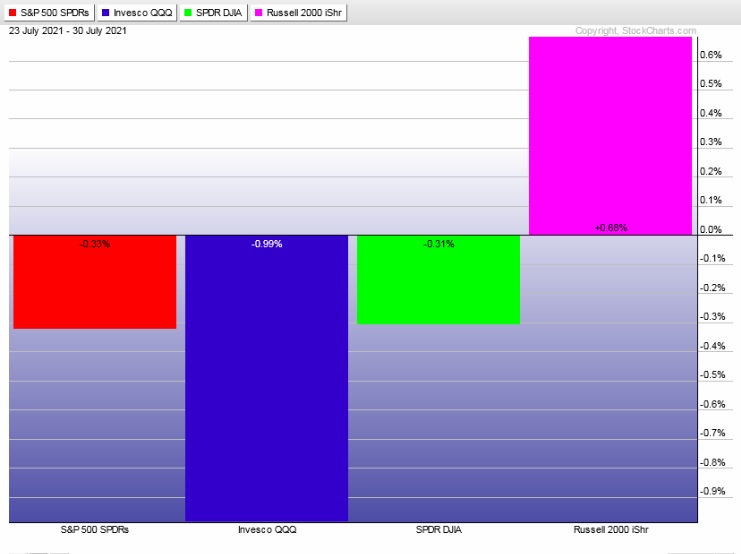

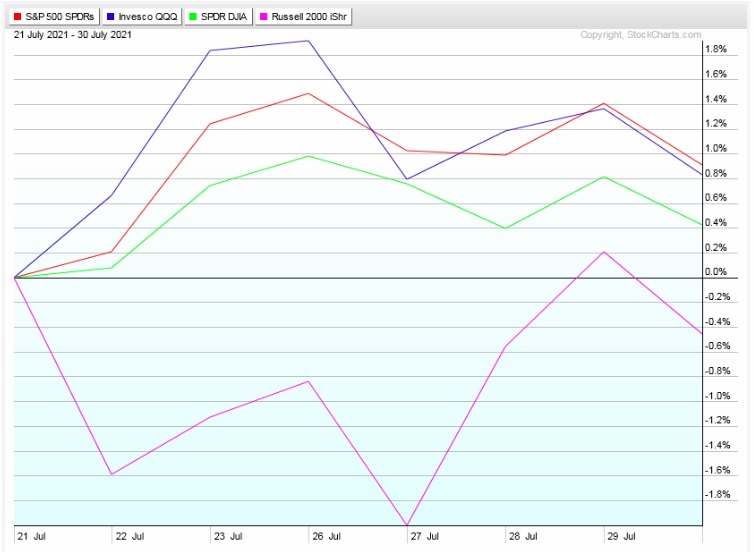

The last week performance of each major index is shown below:

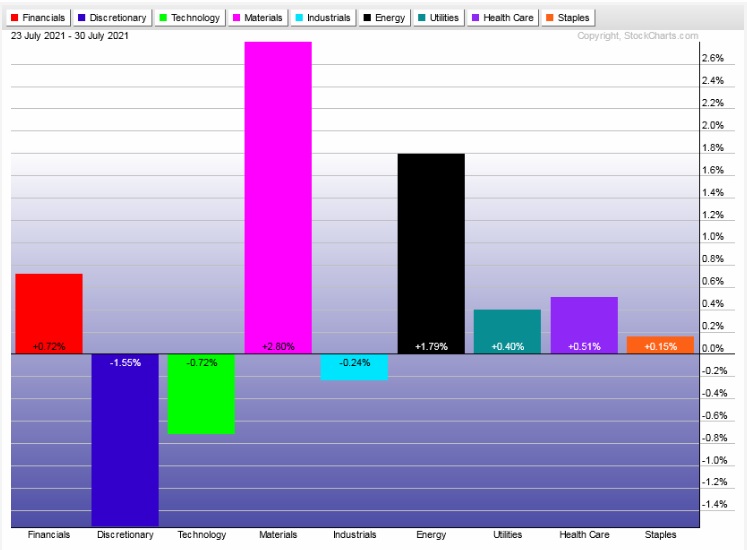

Rotational Report:

Key Tech and Discretionary sectors down. Materials leading.

slightly bearish

For the week, the performance of each sector can be seen below:

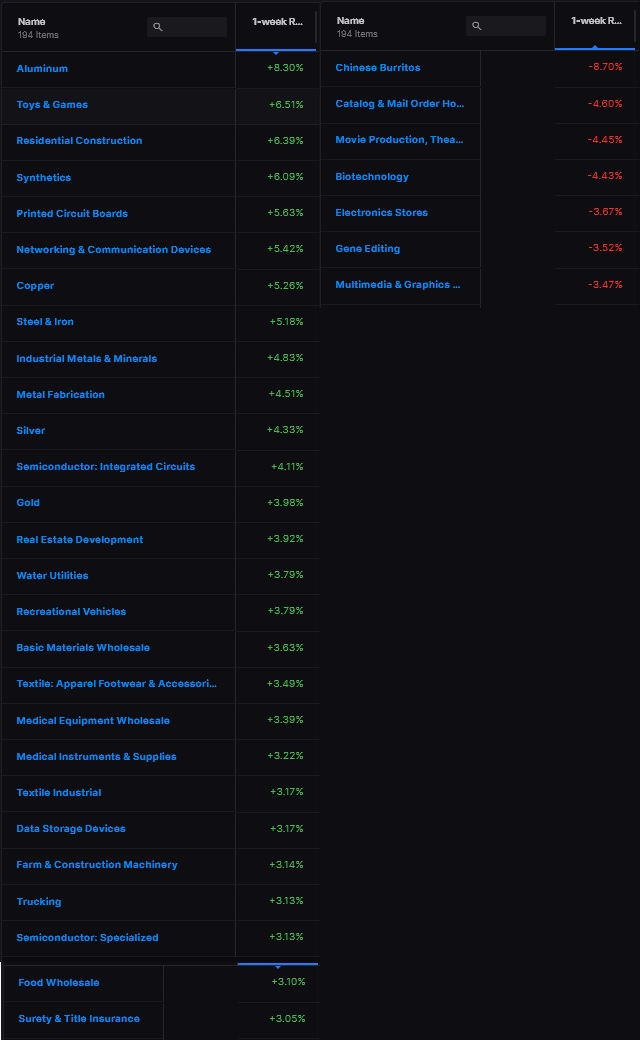

Concentrated Money Flows:

Ledger skewed slightly to the positive side but not enough to negate the major selling seen three weeks back.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

Algo maintenance

The mother algo inside Stocklabs appears to be under construction. There are suddenly 3-month overbought signals back on July 9th and 10th which effectively negate the July 21st signal I was using to carry a half position until August 4th.

When factors beyond my control arise there is nothing I can do but accept them. What is within my control is IndexModel and IndexModel is bearish heading into August. I will formulate a strategy for the week based on this.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Expect a bit of upward price action early in the week. By as early as late Monday look for the auction to reverse lower. Selling pressure persists into second half of week. Then look for non-farm payroll data Friday morning to accelerate the selling into the weekend.

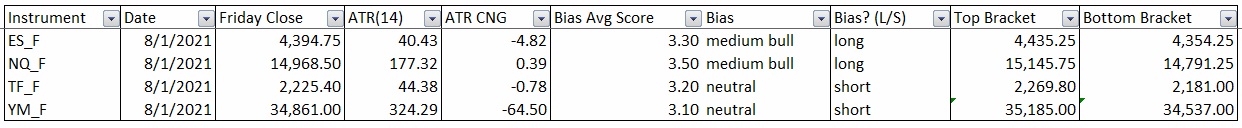

Bias Book:

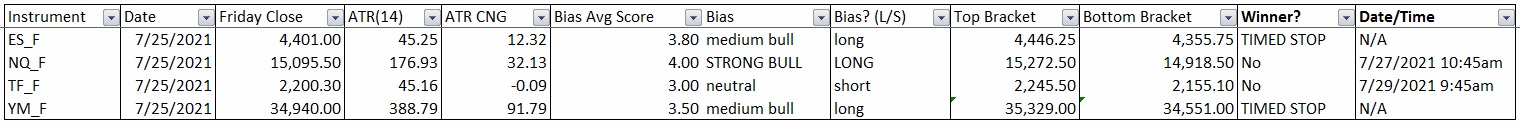

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

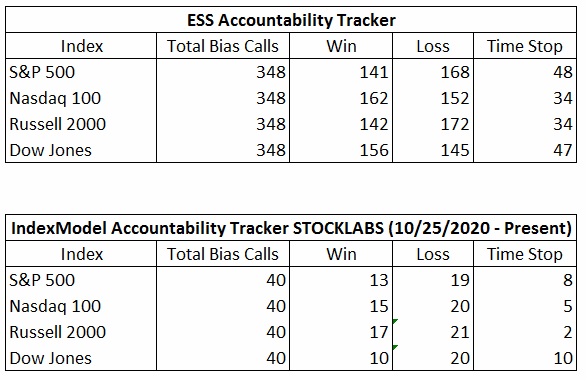

Bias Book Performance [11/17/2014-Present]:

Continue to key off semiconductors

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports have a discovery down look going on.

See below:

Semiconductors are attempting to go discovery up. This context makes it difficult to have bearish conviction on the overall market. While this week’s forecast calls for selling, we can use the PHLX to help us decide whether or not to initiate a swing short. If this index is pushing to news highs, we will back away from the shorts. However, if this breakout fails, we will gain conviction in short selling.

See below:

V. INDEX MODEL

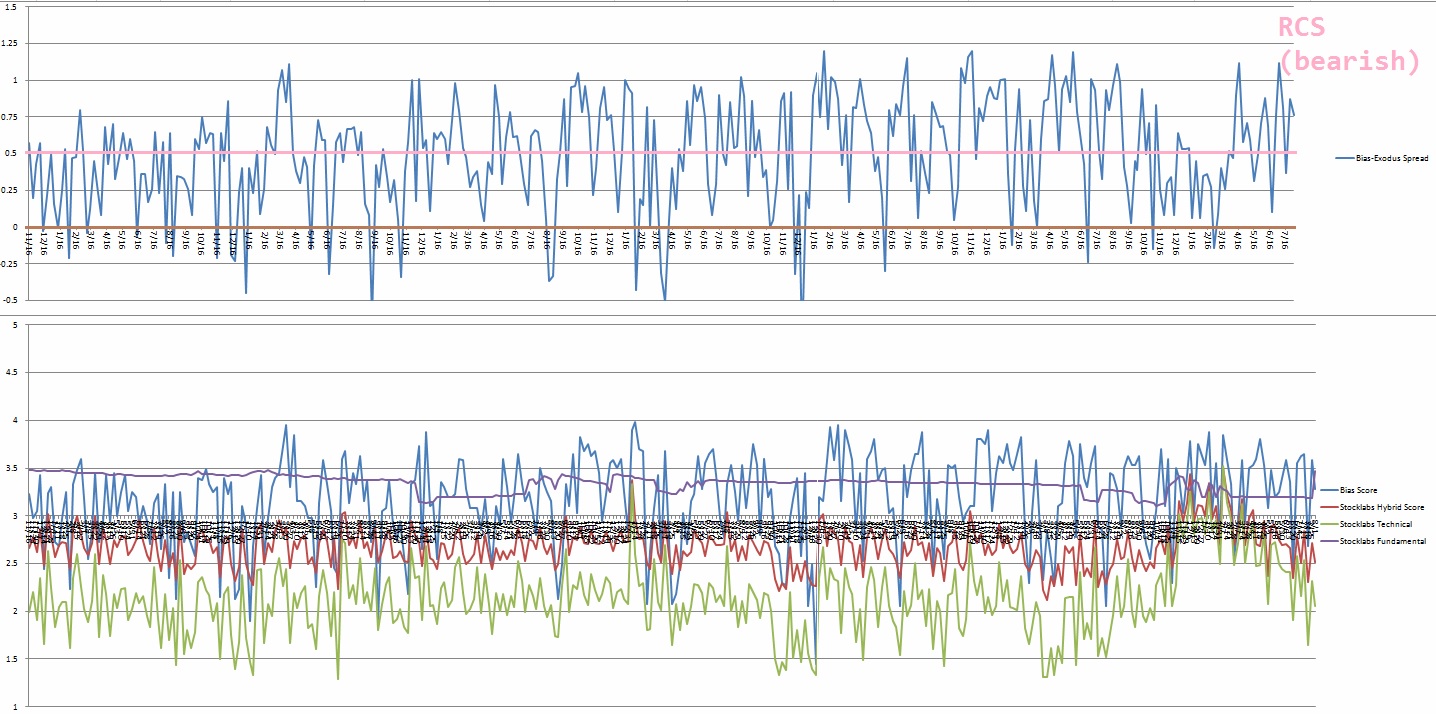

Bias model is Rose Colored Sunglasses BEARISH after being extreme Rose Colored Sunglasses bullish last week after being neutral two weeks back after being extreme rose colored sunglasses bullish for the three weeks prior to that. Bias model was neutral six weeks back after being extreme Rose Colored Sunglasses bullish bias for the three consecutive weeks prior after being neutral for the two weeks prior to that after being e[RCS] bullish twelve weeks back and RCS bearish thirteen weeks prior.

We had a Bunker Buster twenty-two weeks ago.

Rose Colored Sunglasses is a bearish bias that calls for morning selling pressure and lower prices on the week.

Here is the current spread:

VI. Stocklabs Hybrid Oversold (12-month)

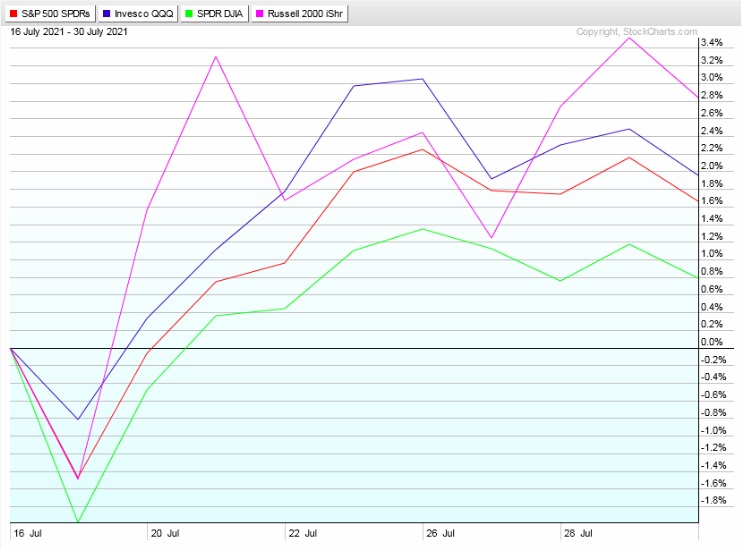

On Friday, July 16th the 12-month algo went technical oversold. This 10-day bullish cycle which runs through Friday, July 30th end-of-day. Here is the final performance of each major index:

VII. Stocklabs Hybrid Overbought (3-month)******

******THIS SIGNAL MAY BE A FALSE FLAG. UPDATES TO THE ALGO HAVE PRODUCED TWO OVERBOUGHT SIGNALS BACK ON JULY 9th AND 10th WHICH EFFECTIVELY NEGATE THE 21st SIGNAL*****

On Wednesday, July 21 the 3-month algo went technical overbought. This 10-day bullish cycle that runs through Wednesday, August 4th end-of-day. Here is the performance of each major index so far:

VIII. QUOTE OF THE WEEK:

“You will hear thunder and remember me, and think: “she wanted storms.”” – Anna Akhmatova

Trade simple, with full sensual awareness

If you enjoy the content at iBankCoin, please follow us on Twitter