NASDAQ futures are coming into the final Thursday in July gap down after an overnight session featuring elevated range and volume. Price was balanced overnight, balancing along the Wednesday midpoint. At 8:30am jobless claims came out more than expected and GDP lower than expected. As we approach cash open price is hovering along the top-side of the Wednesday midpoint.

Also on the economic calendar today we have pending home sales at 10am, by 4- and 8-week T-bill auctions at 11:30am and a 7-year note auction at 1pm.

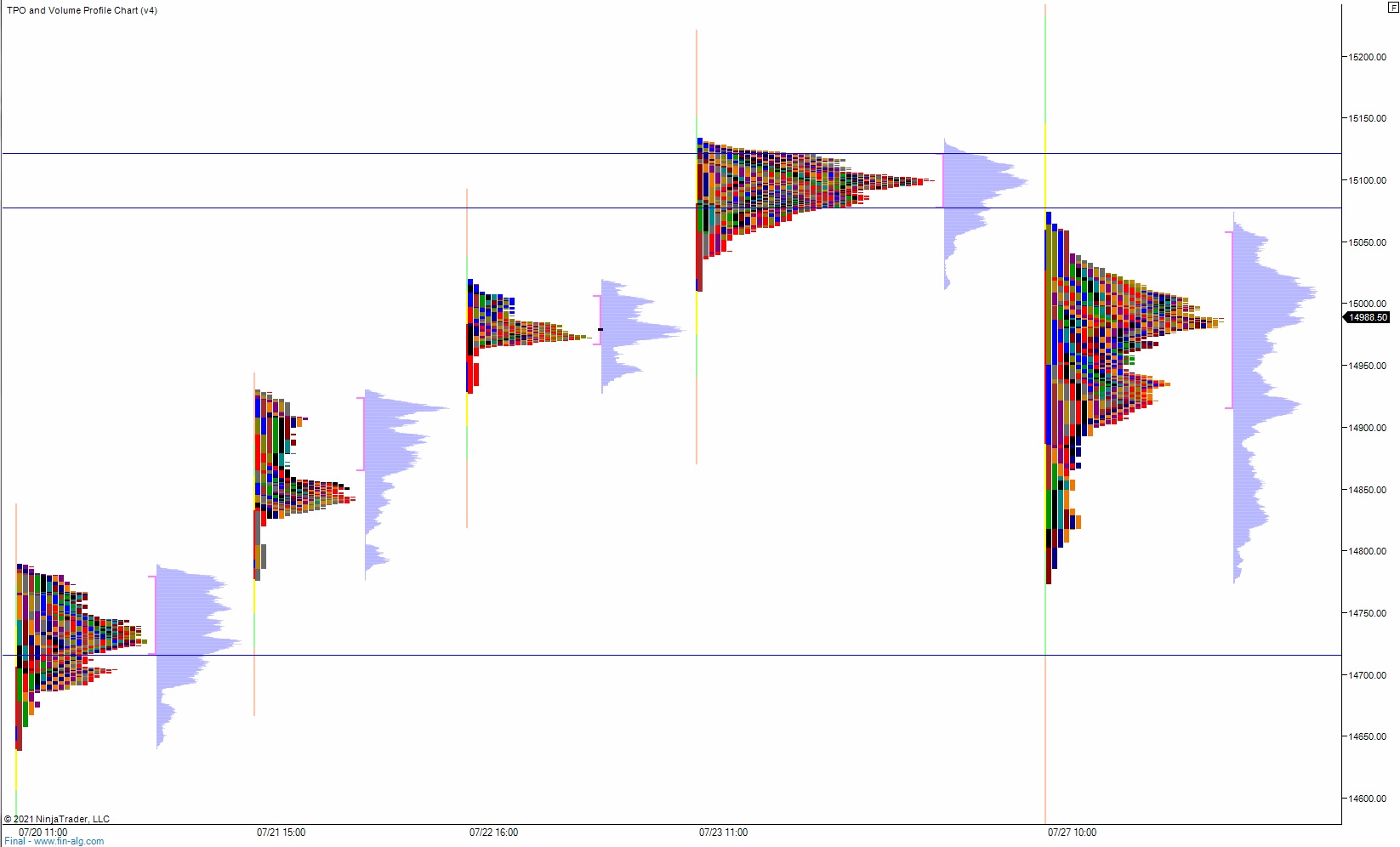

Yesterday we printed a normal variation up. The day began with a gap up in-range. Sellers quickly resolved the overnight gap with an open-drive-down. Sellers closed the gap with that drive before the auction sharply reversed higher. Buyers worked price up into the upper quadrant of Tuesday range and made an early range extension up before we checked back to the midpoint. There was a battle at the midpoint before sellers eventually reclaimed it for a bit. Again we saw a sharp buying response, forming an excess low. We rallied back through the mid and ended the session bouncing along the top of it.

Inside day, normal variation up.

Heading into today my primary expectation is for sellers to make a move on the open again. Pressing down through overnight low 14,944.50 and tagging 14,918.50 before two way trade ensues.

Hypo 2 buyers work into overnight inventory and close the gap up to 14,995.75 setting up a run through overnight high 15,024.75 before two way trade ensues.

Hypo 3 stronger buyers trade up to 15,077.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: