My latest trading stratagem in a nut shell.

Since December I implemented a new trading strategy to force myself into a 100% long position at all times — mostly because I was and still am too bearish. It was designed to protect myself against myself. I can’t help but to feel certain ways — but I can certainly do something about it and behave in a logical way to further my position.

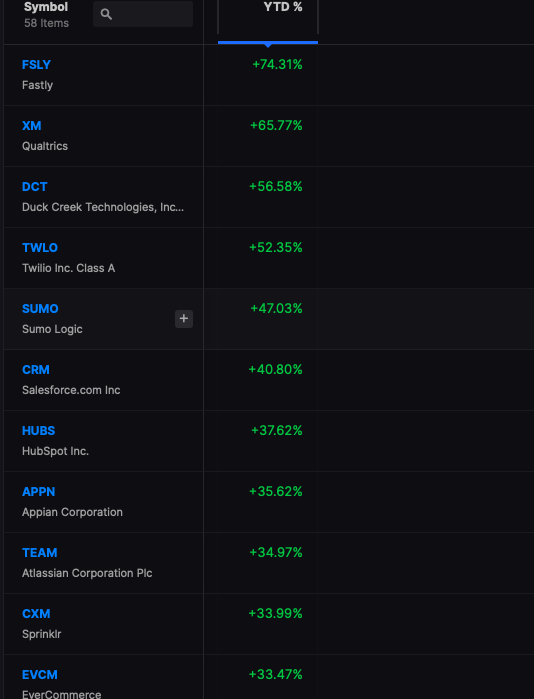

The 100% long picks are all picked using my growth quant method, which employs a sundry of fundamental factors — all but assuring that picks are solid companies but also growing revenues and all have very good free cash flow. The last thing I wanted was a portfolio filled with AFRMs. I was emboldened by this method after seeing the quant produce a 7% return last year — which was terrific all things considered.

After my longs are picked for the week (every Monday), my only job is to either hedge to prevent losses or boost returns via day and/or swing trading using margin. And that’s it.

The results:

Much of the +29.5% YTD returns are due to my additional trading. My monthly quant account is +6.7% YTD, which is more in line with markets. My outperformance is due to the fact that on bad days I am often heavily hedged and my timing has been good. Another reason is when markets are very good — I employ the volume tools inside Stocklabs to find me runners and have been very fortunate to find them using very specific methods.

All of the screens are inside the platform — but the basic tenets I use are as follows.

Find stocks within 2% of session highs. Mean reversion is fine — but I’d rather squeeze 2% out of a runner at session highs than catch a falling knife in the hopes the current trend will reverse.

Find stocks with volume breakouts. My volume delta tools analyzes the volume of all stocks pro-rated on a minute scale using a 30day average. If there is a volume spike in the making, I will know about it right away. The big runners are always paired with volume breakouts.

Do not concern yourself with fundamentals when trading intraday or overnight.

Gravitate towards liquid stocks — volume of at least 500,000 shares per day. If it’s late in the session and I want a pop, I look for stocks with 2m+.

If you cannot find any ideas — you might want to buy an inverse ETF to hedge. Often times when ideas are scarce — it is because the market is topping out. When in doubt, sell short.

Keep track of intraday QQQ chart using a 5m scale all day every day and look for breakups and downs. Do not sell short into massive down candles and do not go long into massive melt ups. Often times after big candles, you will see a little mean reversion.

Keep losses and gains tight at 1-2%, sometimes even smaller. The point of using margin is not to be greedy — but to boost returns on existing positions.

There are times when I will ignore a 1-2% loss in a hedge, providing I already have nice gains for the session and intend to average down.

Position sizes start at 5%. Double sized position is 10% etc. I rarely buy stocks at more than 5% — but will double or triple it for a day trading — but on rare occasions. Often times when needing to average down, I will reduce my adds to 2.5% positions in an attempt to stagger my buys as it trades lower in the hopes of a major upside candle to get me out. When a bad trade all of a sudden turns close to break even — I sell and count my blessings. I am not interested in making money in it only to get out alive.

Position sizing and stopping out of losses are the most important things when trading. Anyone can pick good stocks — but many fall prey to greed and ego — which causes them to blow up.

One final note: If long 100% growth stocks, I’ve found the only way to truly hedge into a net short position is to have 40% of assets margined into an inverse ETF. There are many inverses to choose from. I would suggest gravitating towards the most liquid and correlated to the market — which happens to be SQQQ, SOXS or TZA. The best one, in my opinion, is SQQQ. If you want to target a class of stocks specifically, you can buy FNGD, DRV, FAZ, LABD — but just know there will be times when they do not correlate well with markets and you might end up with a hedge that not only didn’t hedge but added to your losses.

Comments »