Maximum fucking happenings this weekend as the world tries to figure out the next bank to fail. We know now the most woke bank in America did many things wrong, one of which was not having a risk officer for 8 months prior to Jan 2023. By that time, the die had been cast and SVB was well on its way towards perdition.

These things happen when confidence is lost. It can quite honestly happen to any bank. If people lose confidence they pull money out and if enough people do it at the same time — IT’S OVER.

A few bullet points until I give some ideas.

Joseph Gentile is batting 1000 in major bank blow ups — current Chief Admin Officer at SVB and was CFO at Lehman at time of its collapse pic.twitter.com/02YKtcvWGG

— The_Real_Fly (@The_Real_Fly) March 11, 2023

SVB POLITICAL DONATIONS LEAN HEAVILY DEMOCRAT pic.twitter.com/X7NNdVN4Ws

— The_Real_Fly (@The_Real_Fly) March 11, 2023

Don’t look now, but the 2 year Treasury is down almost 50 bp in two days. Last two times this happened: 2001 and 2008.

Uh oh.

— Jeffrey Gundlach (@TruthGundlach) March 10, 2023

HELLO $C pic.twitter.com/jL5Ja7NJ6u

— The_Real_Fly (@The_Real_Fly) March 11, 2023

On the issue of bailout — many prominent businessmen are coming out in favor of it. I am not surprised, since SVB is an integral part of the fucking VC scheme that has been perpetuating absurd valuations in Silicon Valley for decades and without that scheme running — the scum in DC would be woefully undercapitalized.

But let’s platy devil’s advocate here and pretend it’s a good idea to bail them out. Here is Bill Ackman’s long form tweet, which I will mildly edit to make it more readable, on the matter.

The gov’t has about 48 hours to fix a-soon-to-be-irreversible mistake. By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is — an unsecured illiquid claim on a failed bank. Absent @jpmorgan @citi or @BankofAmerica acquiring SVB before the open on Monday, a prospect I believe to be unlikely, or the gov’t guaranteeing all of SVB’s deposits, the giant sucking sound you will hear will be the withdrawal of substantially all uninsured deposits from all but the ‘systemically important banks’ (SIBs).

These funds will be transferred to the SIBs, US Treasury (UST) money market funds and short-term UST. There is already pressure to transfer cash to short-term UST and UST money market accounts due to the substantially higher yields available on risk-free UST vs. bank deposits. These withdrawals will drain liquidity from community, regional and other banks and begin the destruction of these important institutions. The increased demand for short-term UST will drive short rates lower complicating the @federalreserve’s efforts to raise rates to slow the economy.

Already thousands of the fastest growing, most innovative venture-backed companies in the U.S. will begin to fail to make payroll next week. Had the gov’t stepped in on Friday to guarantee SVB’s deposits (in exchange for penny warrants which would have wiped out the substantial majority of its equity value) this could have been avoided and SVB’s 40-year franchise value could have been preserved and transferred to a new owner in exchange for an equity injection. We would have been open to participating. This approach would have minimized the risk of any gov’t losses, and created the potential for substantial profits from the rescue. Instead, I think it is now unlikely any buyer will emerge to acquire the failed bank. The gov’t’s approach has guaranteed that more risk will be concentrated in the SIBs at the expense of other banks, which itself creates more systemic risk. For those who make the case that depositors be damned as it would create moral hazard to save them, consider the feasibility of a world where each depositor must do their own credit assessment of the bank they choose to bank with.

I am a pretty sophisticated financial analyst and I find most banks to be a black box despite the 1,000s of pages of

@SECGov filings available on each bank. SVB’s senior management made a basic mistake. They invested short-term deposits in longer-term, fixed-rate assets. Thereafter short-term rates went up and a bank run ensued. Senior management screwed up and they should lose their jobs.The @FDIC gov and OCC also screwed up.

It is their job to monitor our banking system for risk and SVB should have been high on their watch list with more than $200B of assets and $170B of deposits from business borrowers in effectively the same industry. The FDIC’s and OCC’s failure to do their jobs should not be allowed to cause the destruction of 1,000s of our nation’s highest potential and highest growth businesses (and the resulting losses of 10s of 1,000s of jobs for some of our most talented younger generation) while also permanently impairing our community and regional banks’ access to low-cost deposits. This administration is particularly opposed to concentrations of power. Ironically, its approach to SVB’s failure guarantees duopolistic banking risk concentration in a handful of SIBs.

My back-of-the envelope review of SVB’s balance sheet suggests that even in a liquidation, depositors should eventually get back about 98% of their deposits, but eventually is too long when you have payroll to meet next week. So even without assigning any franchise value to SVB, the cost of a gov’t guarantee of SVB deposits would be minimal. On the other hand, the unintended consequences of the gov’t’s failure to guarantee SVB deposits are vast and profound and need to be considered and addressed before Monday.

Otherwise, watch out below.

My take on how we got here:

TIMELINE OF EVENTS

Markets rewarded post 2008 credit crisis via ZIRP and QE

2020 COVID scare shuts down entire economy. No problem — more QE and this time direct payments to everyone as compensation for staying at home

That works out and the market is rewarded.

The $5 trillion in free money coupled with shutting down of economy causes supply chain issues.

The scarcity of goods and increases of asset prices and minimum wage causes runaway inflation.

They blamed Putin for this.

The Fed is forced to fight inflation since traditionally fucking with the cost of food topples governments.

The sharp increase in rates slows the economy and causes job cuts at vulnerable companies.

Persistent inflation, thanks to non stop govt spending (hello Ukraine) forces Fed to remain hawkish in the face of slowing economy.

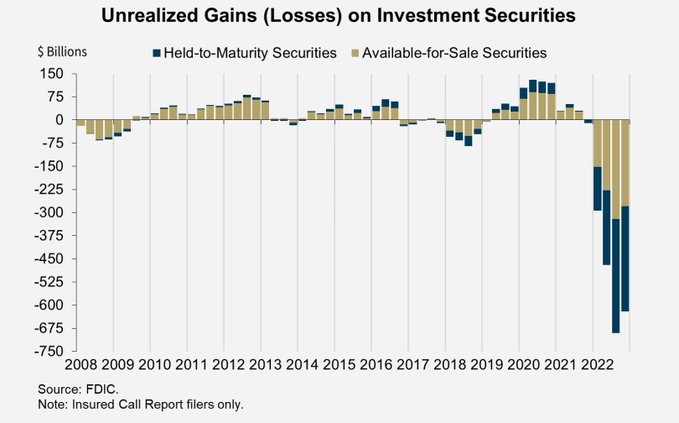

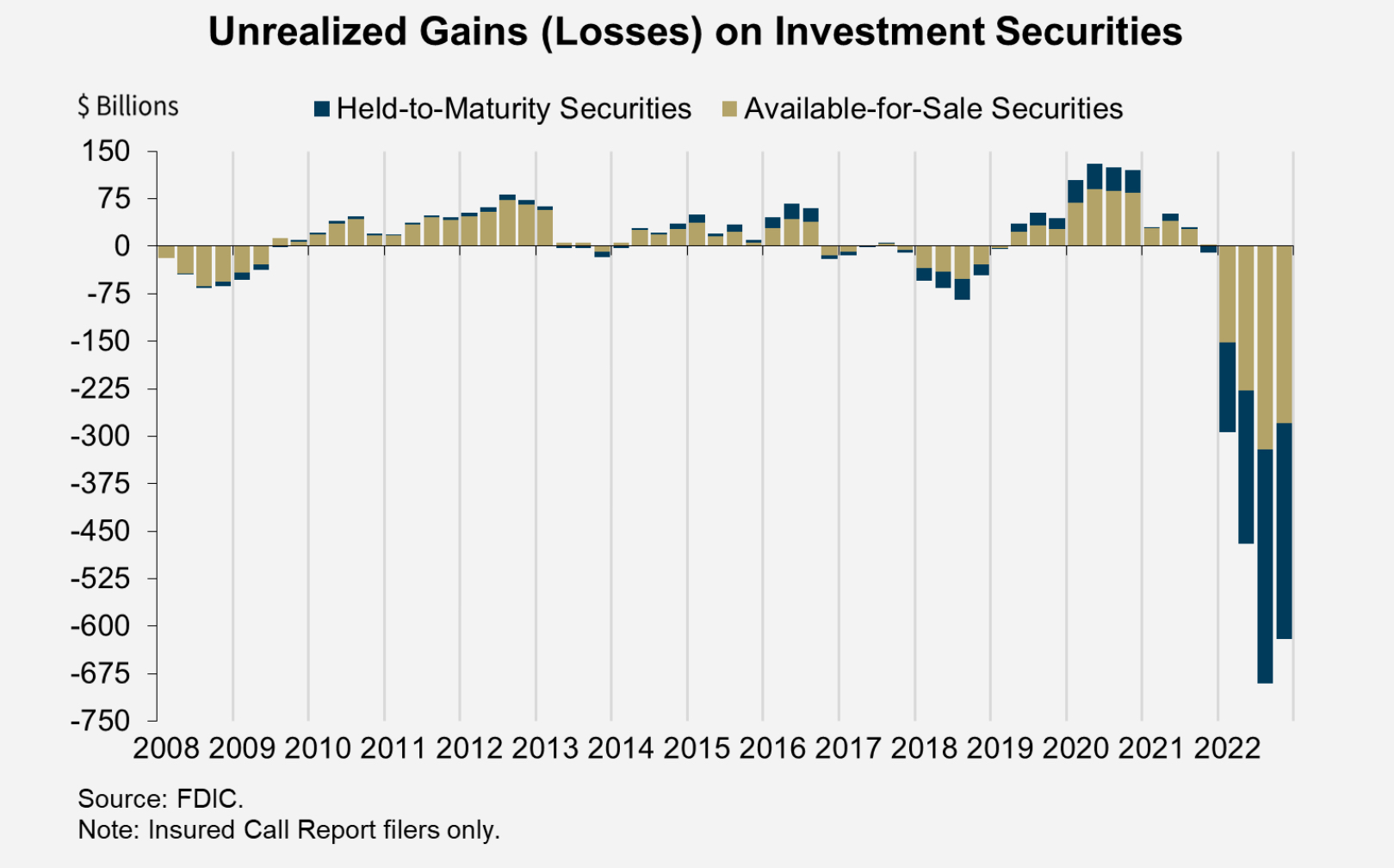

Since 2008, corporations have stored money in treasuries. Since last yr, rates have gone up from 0 to over 5%, sending the price of those bonds spiraling lower.

Now those corporations are sitting on mammoth losses — all thanks to the credit crisis of 2008 and COVID era policies of free money and plant closures.

We are here now.

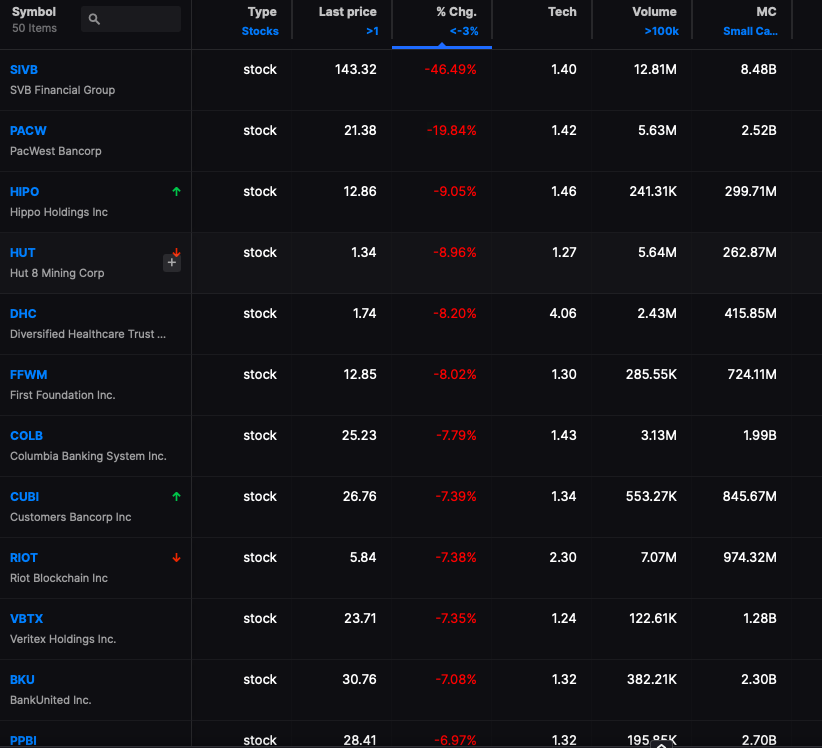

The big question everyone is asking is — who is next?

For starters let’s look at some of the companies who have big deposits at SVB. Reminder: $200b in deposits and 98% of them uninsured.

1. Circle: $3.3 billion

2. Roku: $487 million (26% of cash) (ROKU)

3. BlockFi: $227 million

4. Roblox: $150 million (RBLX)

5. Ginkgo Bio: $74 million (DNA)

6. iRhythm: $55 million (IRTC)

7. Rocket Lab: $38 million (RKLB)

8. Sangamo Therapeutics: $34 million (SGMO)

9. Lending Club: $21 million (LC)

10. Payoneer: $20 million (PAYO)

11. Noventa $65 million (NVTA)

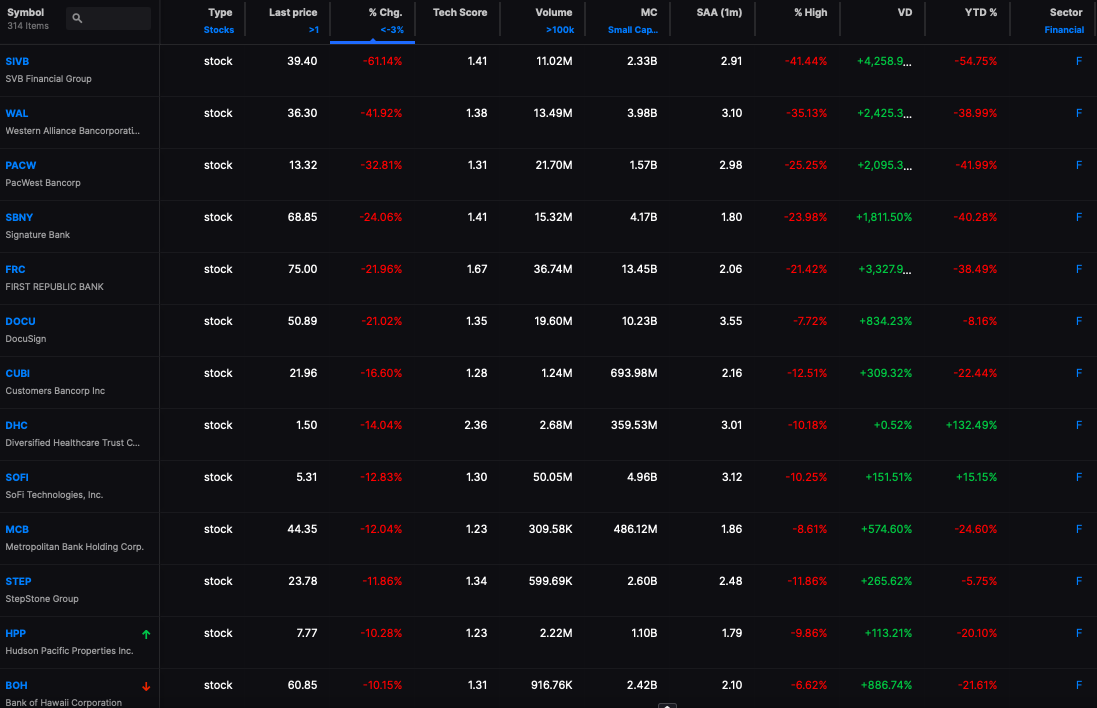

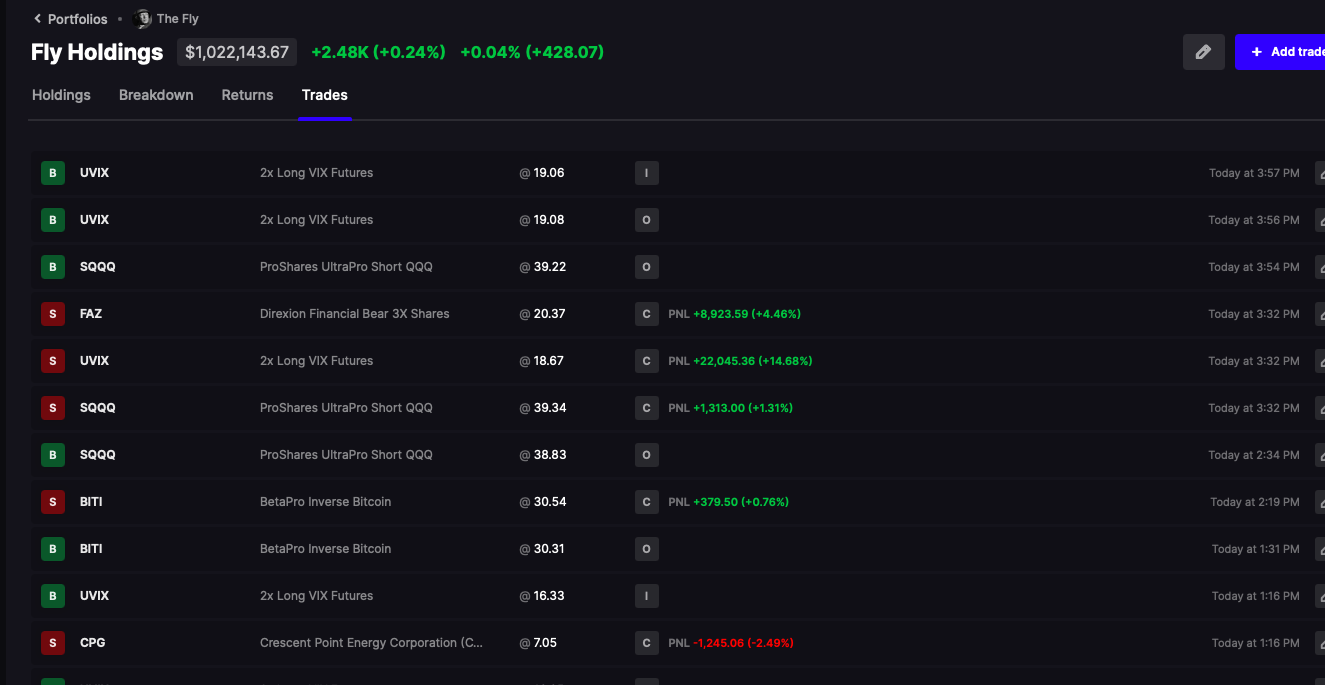

Here are the banks Wall Street is saying is in trouble now.

(1 WEEK RETURN)

PACW -55%

SBNY -39%

WAL -35%

FRC -34%

SCHW -25%

AX -21%

STEP -21%

ZION -18%

LNC -18%

PNFP -18%

APO -18%

SOFI -18%

WBS -18%

OZK -17%

BKU -17%

LOB -17%

COLB -17%

BHF -17%

EWBC -17%

NTB -16%

FITB -16%

CFG -16%

SNV -16%

TFC -16%

ALLY -16%

CMA -15%

For anyone who traded the 2008 crisis, you’re having dejavu now looking at the list above. All we need to make the list match perfectly is C and AIG to enter the fray, and perhaps see the autos fail too.

The issue at hand here is interest rates and the losses the banks have as a DIRECT RESULT of Fed hiking. We aren’t even game planning an economic malady yet. This is bank stress due to rates, not a poor economy. If these fucking banks start to get hit with delinquencies — it is 100% over — game.set.match.

Here are the banks with the lowest FDIC protection as a percentage of accounts less than $250k.

ALMOST ALL OF $SVIB’s CASH DEPOSITS ARE UNINSURED — HIGH NET WORTH ACCOUNTS

ALL EYES ON $SBNY pic.twitter.com/dO5qbuHk9j

— The_Real_Fly (@The_Real_Fly) March 10, 2023

Should we bail them out? If you enjoy this version of capitalism yes. If we do not bail them out — many other banks will fail. Look at the plight of CHARLES FUCKING SCHWAB — dealing with an issue called “CASH SORTING” which is basically a run on the bank due to people transferring out of Schwab money markets in favor of higher yielding ones.

HEY — they wanted to give us free trades.

Since Biden is in office, a person who voted for every bailout he has ever seen, we are likely to get some form of government intervention before the market opens on Monday. If not, to quote a once great man “watch out below.”

Comments »